KYC-Chain Management App Documentation

1. Getting Started

1.1 About KYC-Chain:

KYC-Chain is a managed workflow solution that helps financial service providers perform KYC in a simple way. The KYC-Chain application makes the KYC process effortless by providing secure, compliant data sharing.

Why is KYC important?

The purpose of KYC is to protect your business from being used by criminal elements for money laundering or other illegal activities. Complementary procedures also enable you to better understand your customers and your financial dealings.

How does KYC-Chain help?

KYC-Chain is built around the actual legal framework regarding identity and customer data on a global scale.

KYC-Chain provides a secure platform for sharing suitable data and/or documents to satisfy compliance requirements for KYC onboarding or refresh without compromising the privacy of owners while preserving the integrity of the data.

1.2 Setting up the KYC-Chain app:

What inputs are required from you to set up the KYC-Chain application?

The first step when setting up your KYC-Chain app is for our team to personalize it for your company and project. In order to do that, you will receive a list of requirements with all necessary details for this customization. Some of the information required is:

Company (and project) details

- How would you like us to spell the name in the app and the url?

- Timeline and scale of your project

- Name and email address of the main point of contact from your company

Setup details

- E-mail address of the team members that will use the app

- Your terms and conditions

- Preferred method for sending emails from our app: Email sending is enabled as soon as your official email address and domain are verified by our system.

- Preferred storage location for your documents. We can integrate with AWS S3 or Google Cloud.

Customer communications

- The email communications sent through our app can be customized at your request. Once the app is configured, please test it and let us know if there are changes that you'd like made to the wording in an email subject or body.

Styling

- Your logo (preferably a png image) and favicon can be used in the app

- Link to your style guide or listing of your brand hex codes that you would like us to use in the emails to customers.

API documentation:

You can access our API documentation via the following link: https://apidocs.kyc-chain.com/#/ Please create a ticket to get the login credentials.

Helpdesk support details:

Throughout the entire process, our KYC-Chain team is ready to help you. If you have any questions or suggestions you are welcome to contact us by email at help@kyc-chain.com.

1.3 Use of the guide:

It is important to note that all the information contained in this guide is private and intended for the sole purpose of training users of the KYC-Chain application.

Without the explicit written permission of KYC-Chain, it is prohibited to copy in whole, or in part, any of the content on this guide and any other linked document property of KYC-Chain ltd.

KYC-Chain does not provide legal advice and suggests that your business consults the proper legal counsel prior to establishing specific KYC requirements for your project and jurisdiction.

In no event shall KYC-Chain be liable for the misuse of the application or the information provided in this guide resulting in any incident or unlawful action.

2. User roles & responsibilities:

In the KYC-Chain app, there are two different roles which define the permissions and responsibilities of each user: Manager and Applicant.

2.1 Manager: Management User:

Primary Roles:

- Reviews all KYC applications assigned to them

- Responsible for checking sanctions screening results

- Screens answers and documents provided by the user

- Approves or rejects KYC applications

2.2 Applicant: KYC Applicant:

Primary Role: Participates in the KYC process, answering the questions and uploading the documents established in each specific KYC template.

3. Using the KYC-Chain application:

The KYC-Chain app allows managers to set up KYC verification processes that applicants can easily complete by navigating the application. Each project can be customized depending on the specific needs and documentation required. KYC-Chain also facilitates any necessary follow-up for each process, and the approval, rejection or cancellation of an application.

In this section, you can find an overview of all the main features available. For details on how to carry out specific procedures, go to our "How to" and "FAQs" sections below.

Each application moves through different stages. Below you can find the KYC-Chain app's statuses, which show you updates and changes to KYC processes. If the applicant submitted the KYC process or the Manager was assigned to the process, you will see a new status.

| Status Name | Description |

|---|---|

| Approved | The KYC Process was approved |

| Rejected | The KYC Process was rejected |

| Cancelled | The KYC Process was cancelled |

| Customer Invited | The applicant has been invited to the KYC Process |

| Terms Accepted | The applicant has accepted the terms and conditions, beginning the KYC Process |

| Customer Processing Requirement | The applicant is providing values for the requirements in their KYC Process |

| Documentation Ready For Review | The applicant has completed and submitted the KYC application. The applicant can't modify their application |

| Additional Items Requested | A new requirement was added to the application, or an existing requirement was removed |

| Manager Assigned* | A manager has been assigned to the KYC Process. |

| Process Re-Opened* | The KYC Process has been re-opened. The current status is now the last non-ambiguous status from before the Process was closed. |

| Data Check and Sanctions Screening* | Our software has run the relevant external checks for this KYC Process, including Sanctions, AML, PEP, and others when applicable (eg. Company Registry, ID Document Verification, ID Data Verification). |

| Manager Filled Requirements* | A manager has filled/updated one or more requirements on behalf of the applicant. |

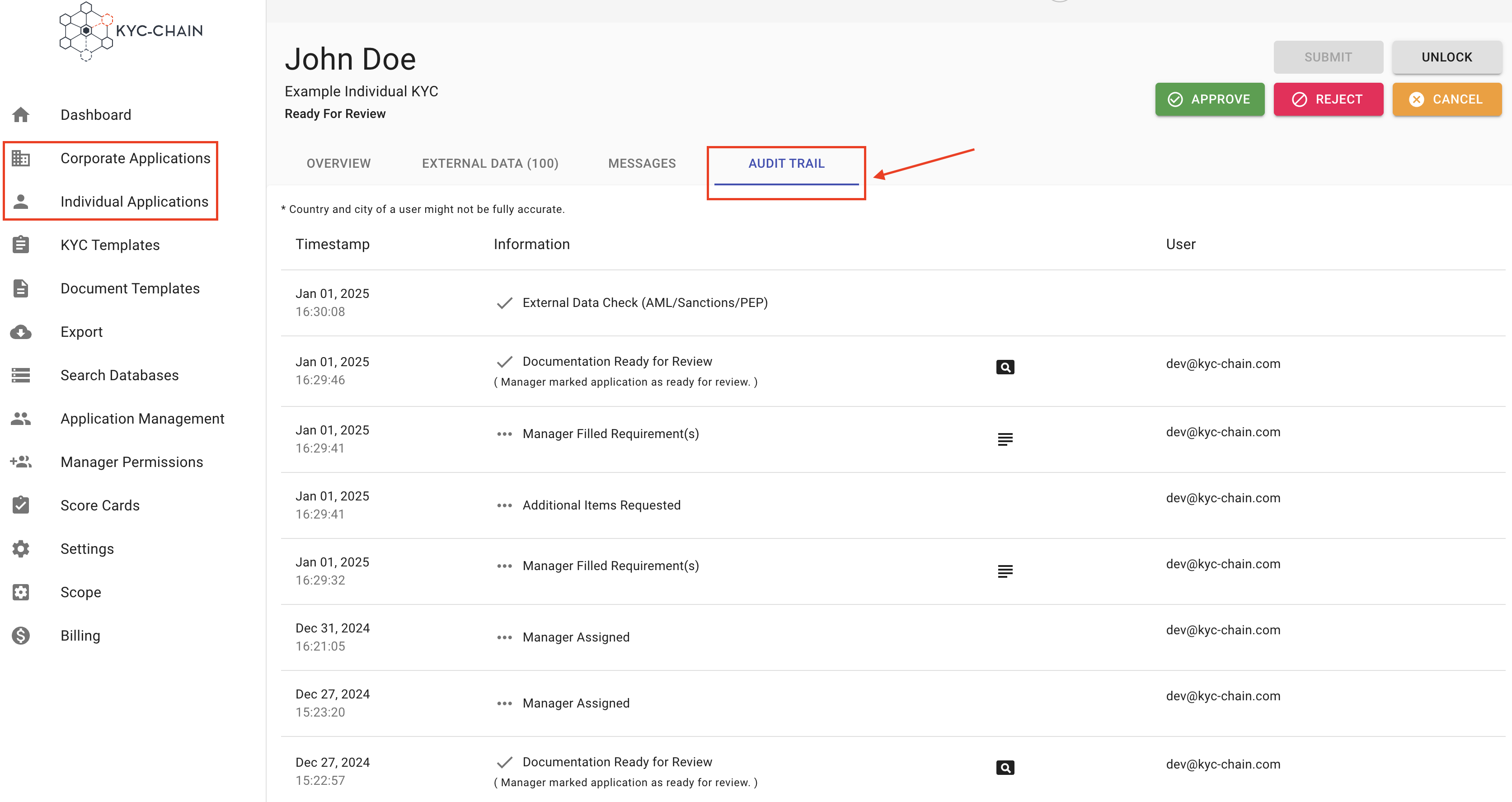

* Statuses with a * are considered "ambiguous" in our software because they could occur at multiple points throughout the application process. The "Current Status" property of a KYC Process will show the latest status which is not considered ambiguous (so as to avoid a scenario where the current status shows "manager assigned" when the more helpful indication would be "Documentation Ready For Review"). All status records can still be viewed in the order they occurred in the Audit Trail.

If you have any questions, contact your account manager or email us at help@kyc-chain.com.

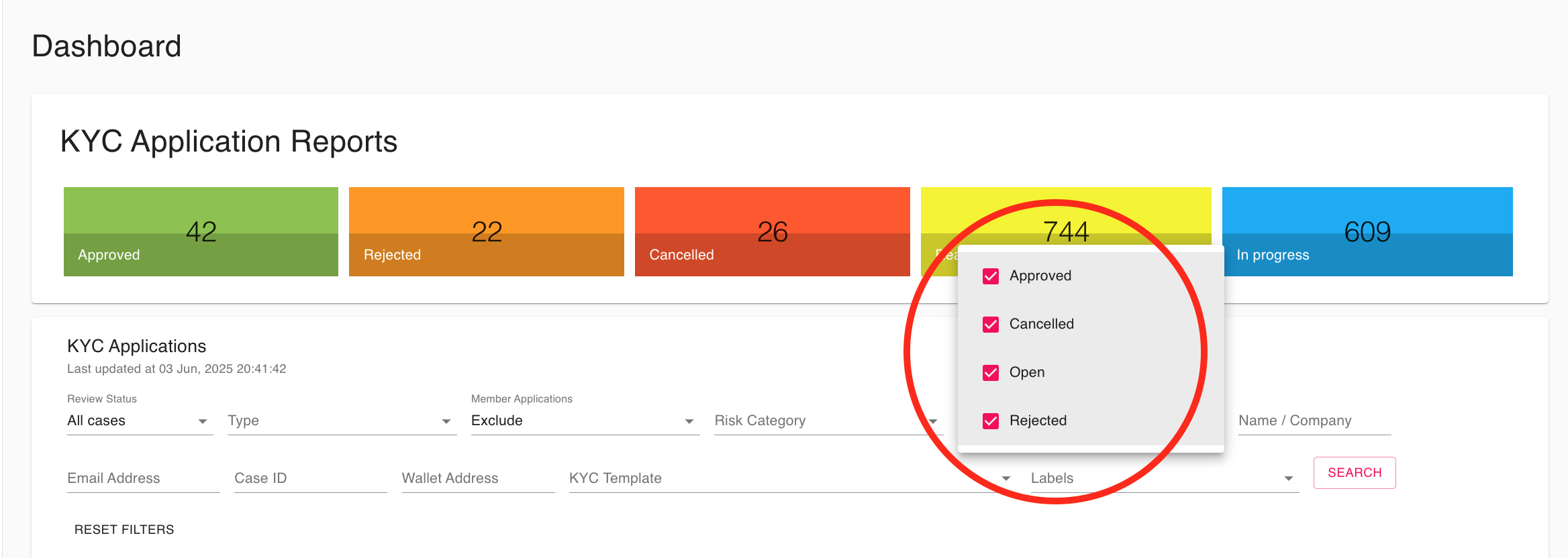

3.1 The Dashboard:

The Dashboard provides managers with an overview of all completed KYC Processes. The KYC Process Reports give the manager the number of approved, rejected, declined, cancelled, in progress and ready for review KYC processes at-a-glance.

The dashboard also offers a summary view of the Completed KYC Processes. Filtering options allow the manager to search all processes by type (individual/corporate), status (including any of the 4 closed statuses mentioned above), email address (with partial email matching), and crypto wallet address. Each manager's preferred filtering parameters are saved between sessions to allow you to pick-up where you left off.

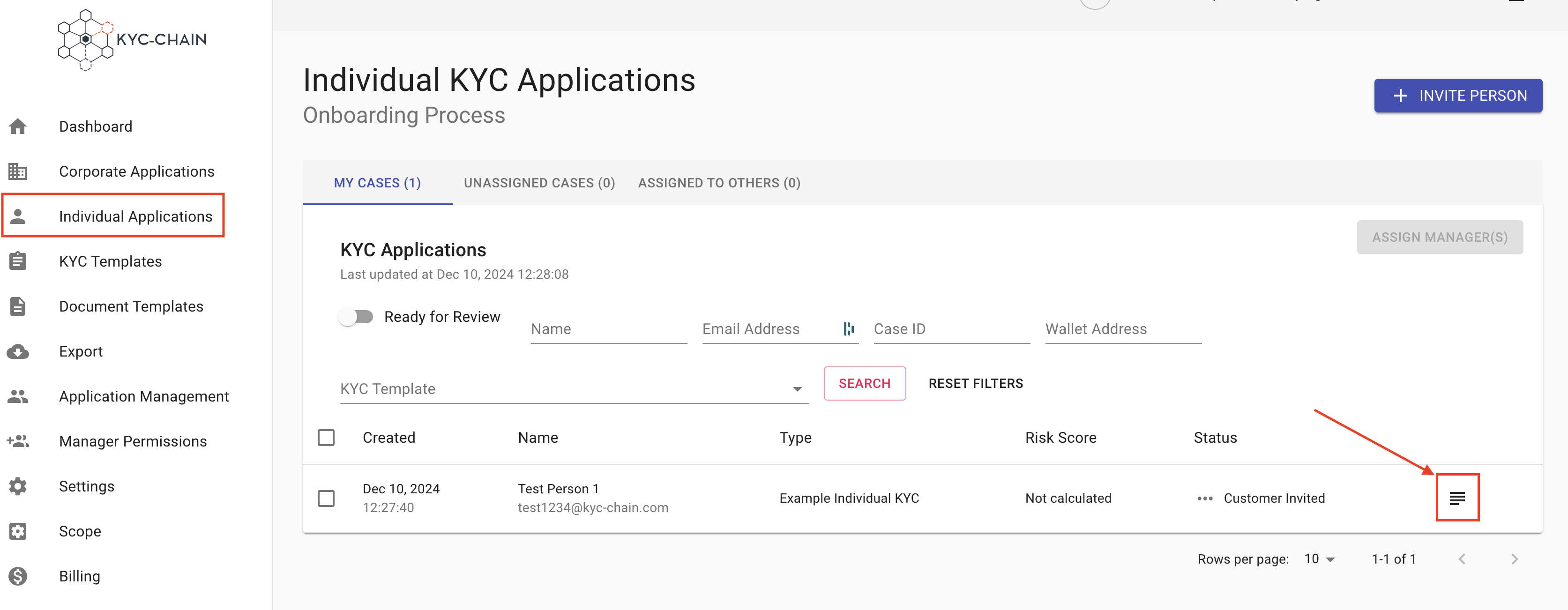

To access and view the full details of a case from this screen, simply click on the View & Modify button (text icon on the right side of the screen):

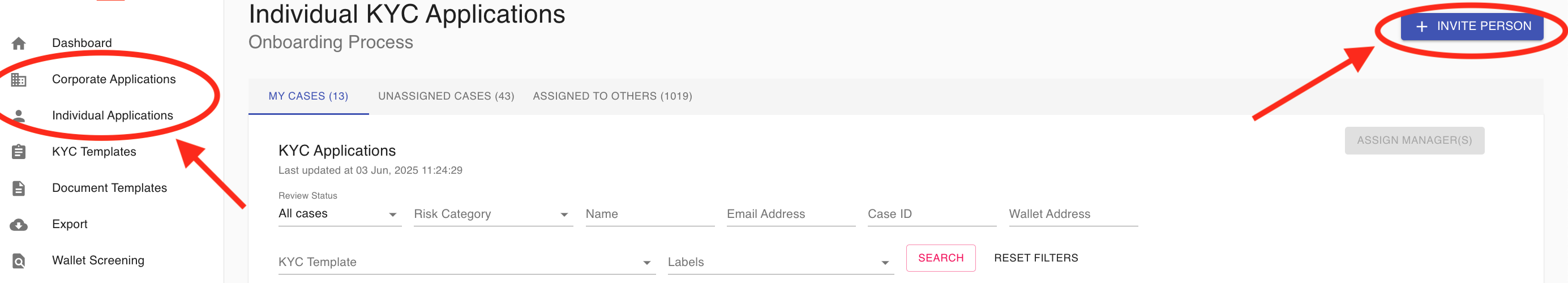

3.2 Processes: Individual and Corporate:

In the KYC-Chain app, the processes are organized into two different categories:

- Individual Processes: In this tab the manager can find and manage all the processes created for individuals.

- Corporate processes: Here the manager can handle from this tab the processes created for companies or organizations.

The Individual and Corporate Processes tabs list the "open" applications that have been initiated and are not yet in a fully closed state, meaning all applications shown in these tabs are either awaiting input from applicants, or awaiting a review from managers. Within the process pages, managers can assign, review, and change the status of KYC applications:

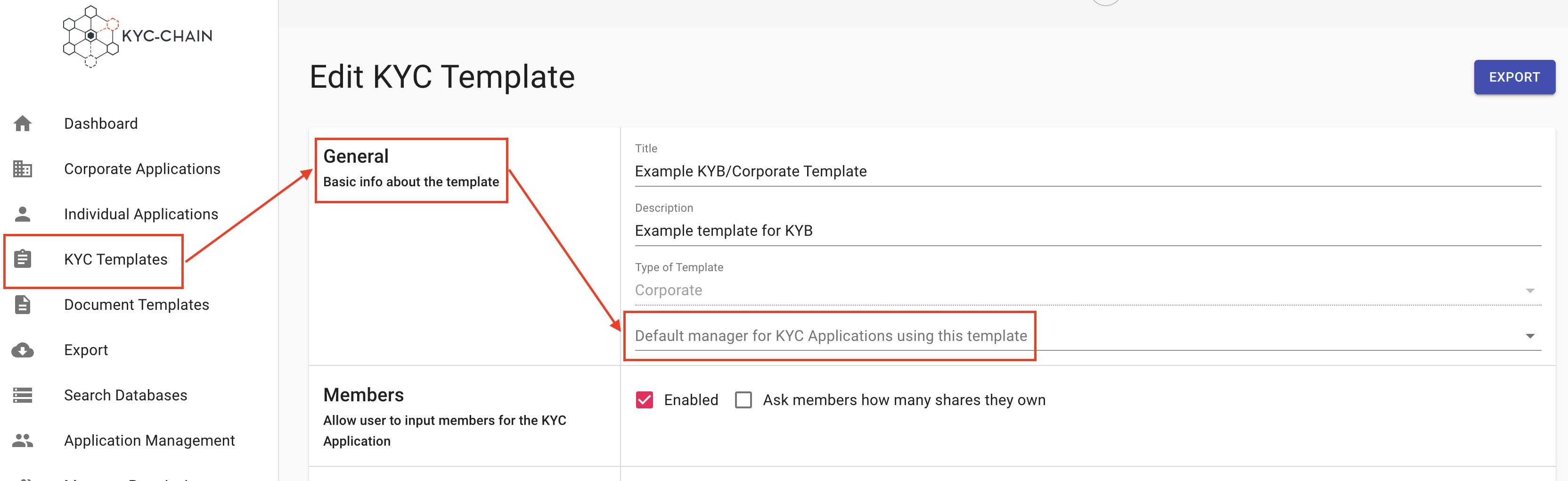

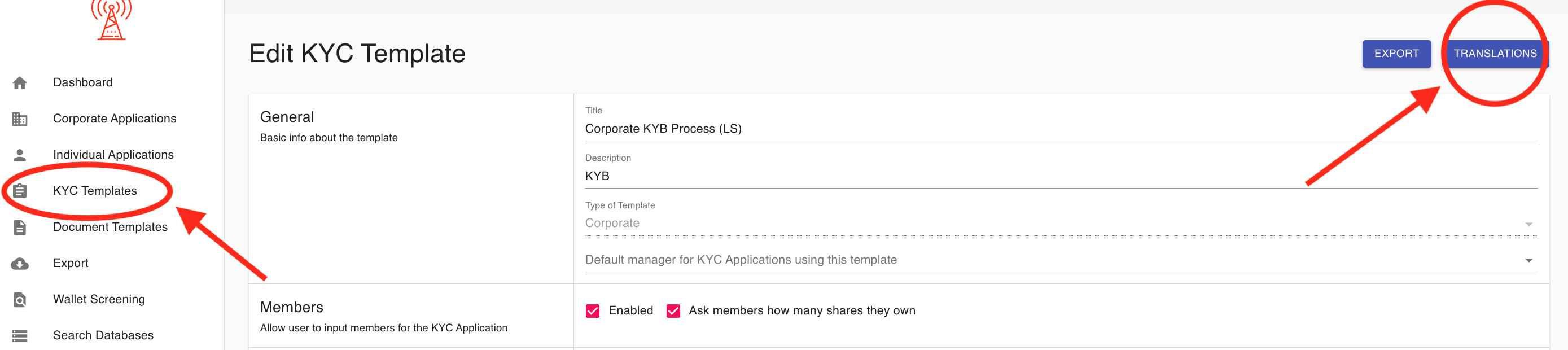

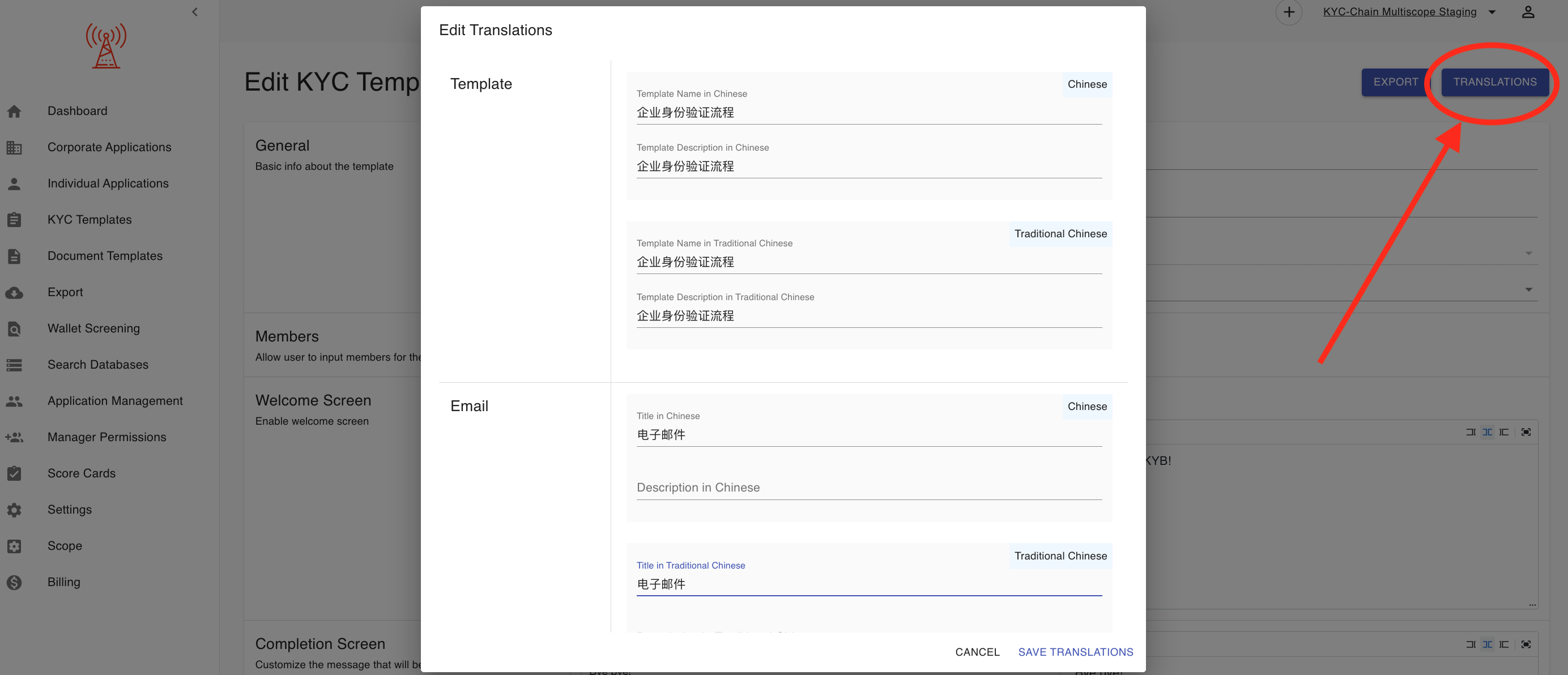

3.3 KYC Templates:

The KYC Templates section allows the Manager to customize the information required from the user for each process. Within the KYC Templates tab, Managers can create new KYC templates or edit existing templates. Some of the customizable options are:

- The template’s title and description

- The questions, documents, and forms

- Making certain requirements optional

- Changing the order of the requirements

- Assigning a default manager for each template

- Enable/Disabling certain options and features

3.4 Document Templates:

The Document Templates tab gives Managers the freedom to configure and customize key document templates according to their needs. Document templates can be added to KYC Templates in 1 of 2 places: as a Legal Document (Terms & Conditions), or as a Form.

Example: A Manager will customize the ‘Terms and Conditions’ document to be used in their onboarding flow. This document template can then be made active and added to one of more KYC Templates in the Legal Document field.

The document editor allows managers to add a signature box, date selector, check boxes and more.

3.5 Export KYC Data:

The Export tab gives Managers the ability to export user data in CSV format. They can either export a subset of specific users (approved individuals, for example) or the entire user list:

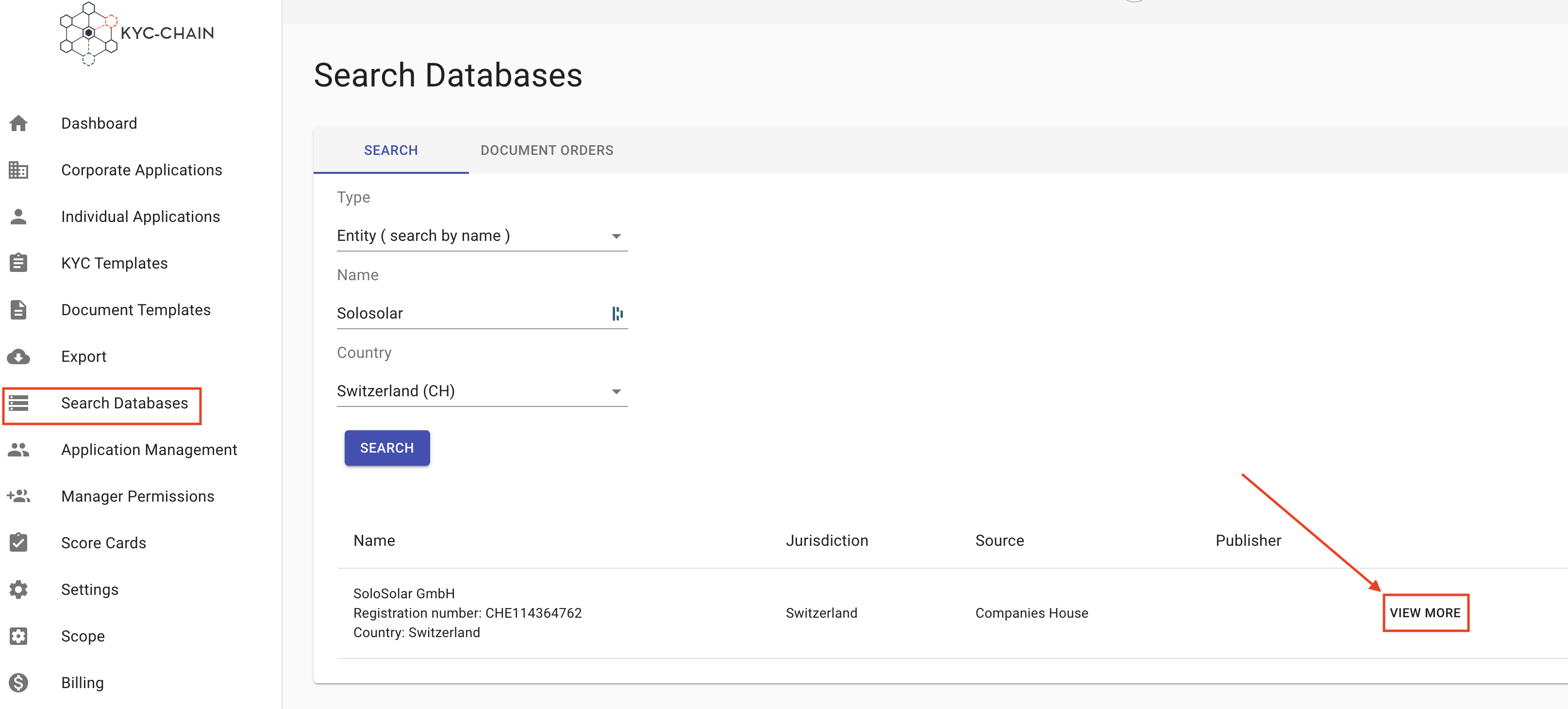

3.6 Search Databases:

The Search Databases tab gives managers the ability to run the following checks without first initiating and submitting a KYC process:

- Sanctions Screening

- Adverse Media

- Politically Exposed Persons (PEPs)

- Company Registry (the Jurisdiction is a required field)

First, the manager selects the type of search: Individual or Entity (corporate). Then they enter search parameters and click the Search button. To access and view full details for each match, click on the View More button:

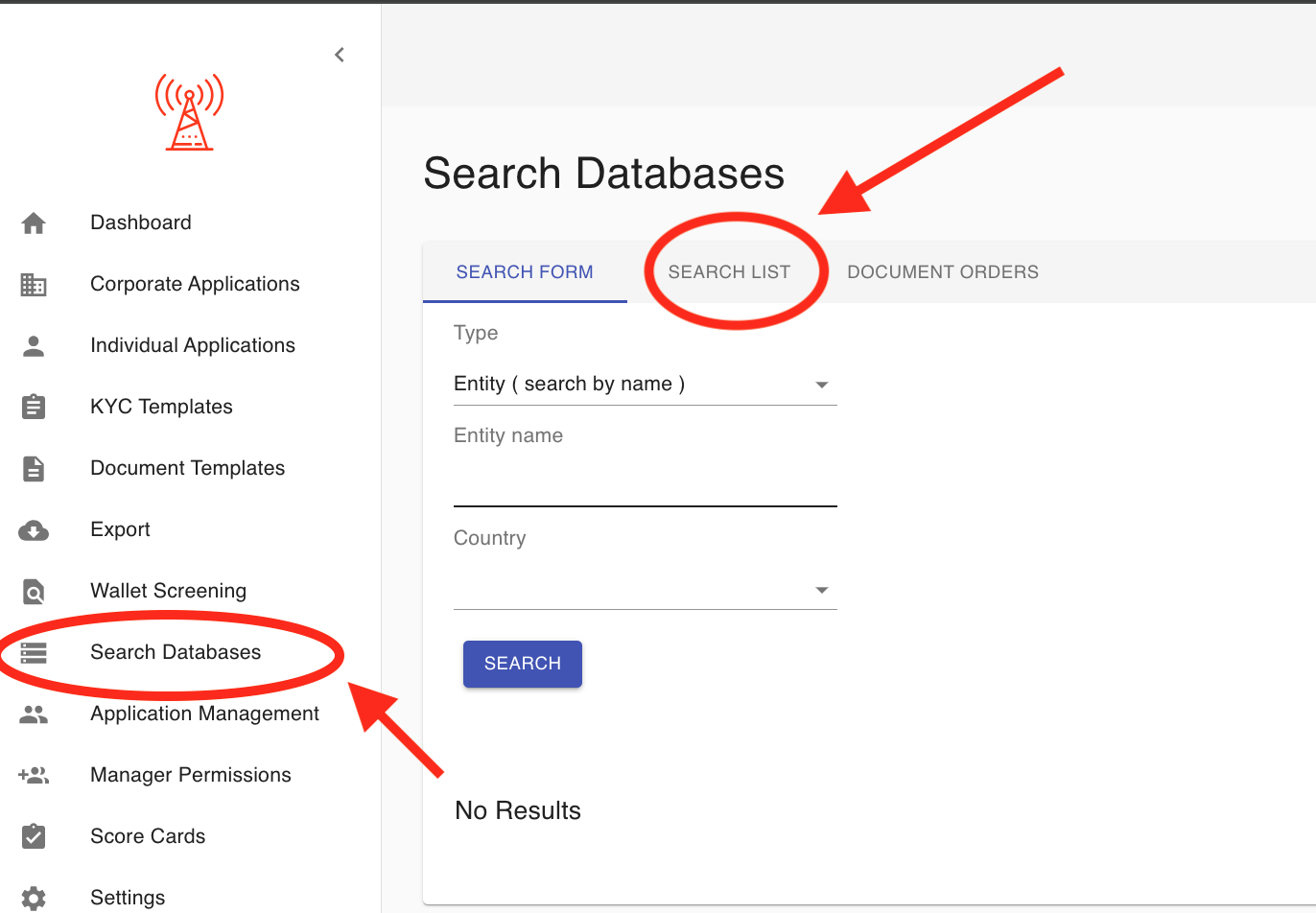

To access completed AML checks and their results:

- Click Search Databases in the left navigation menu

- Select the SEARCH LIST tab in the main window

- View a complete history of all previous AML checks and their results

This feature allows you to track and review all previously conducted AML screenings in one centralized location.

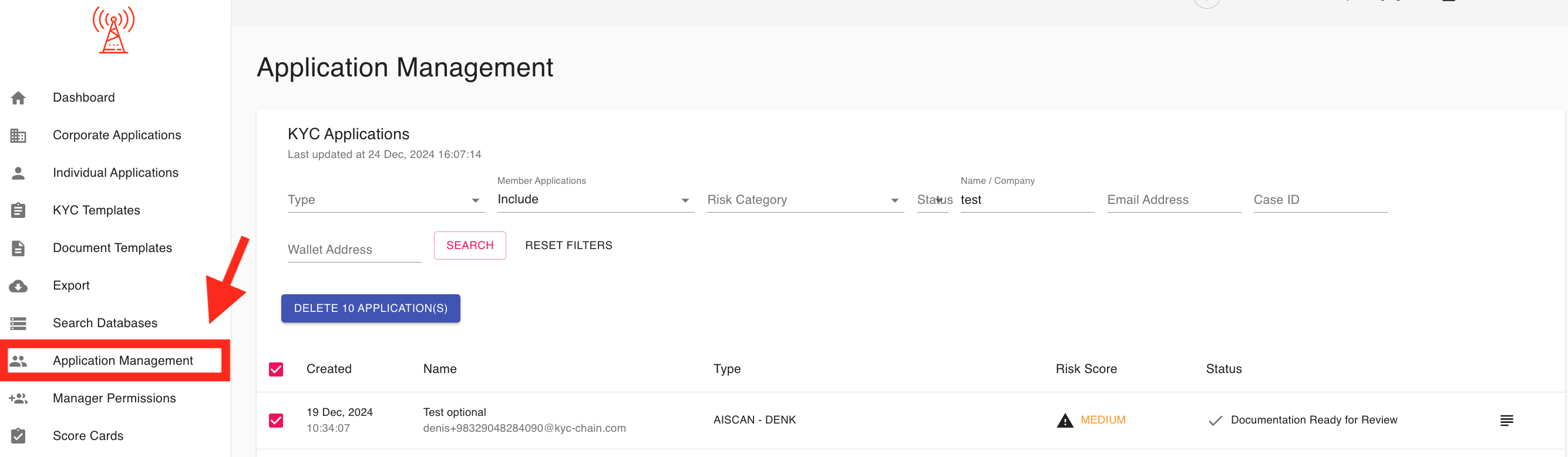

3.61 Application Management:

This tool allows managers to permanently delete applications including all data and files from the database.

1. Search and Filter Options:

- Allows administrators to locate applications quickly by applying filters such as type, wallet address, risk category, or status.

- Includes a search bar to find specific applications by name, email address, or case ID.

2. Application Selection:

- Administrators can use checkboxes to select one or multiple applications for deletion.

3. Bulk Deletion:

- A prominently displayed "Delete Applications" button allows for the removal of selected applications in a single action.

4. Application Details for Deletion:

- Displays essential information, such as applicant name, email address, risk score, and status, to help administrators make informed decisions before deleting applications.

This section is a key tool for maintaining an organized and efficient KYC application database by removing outdated or unnecessary entries.

IMPORTANT NOTE: Application's can't be restored after deletion

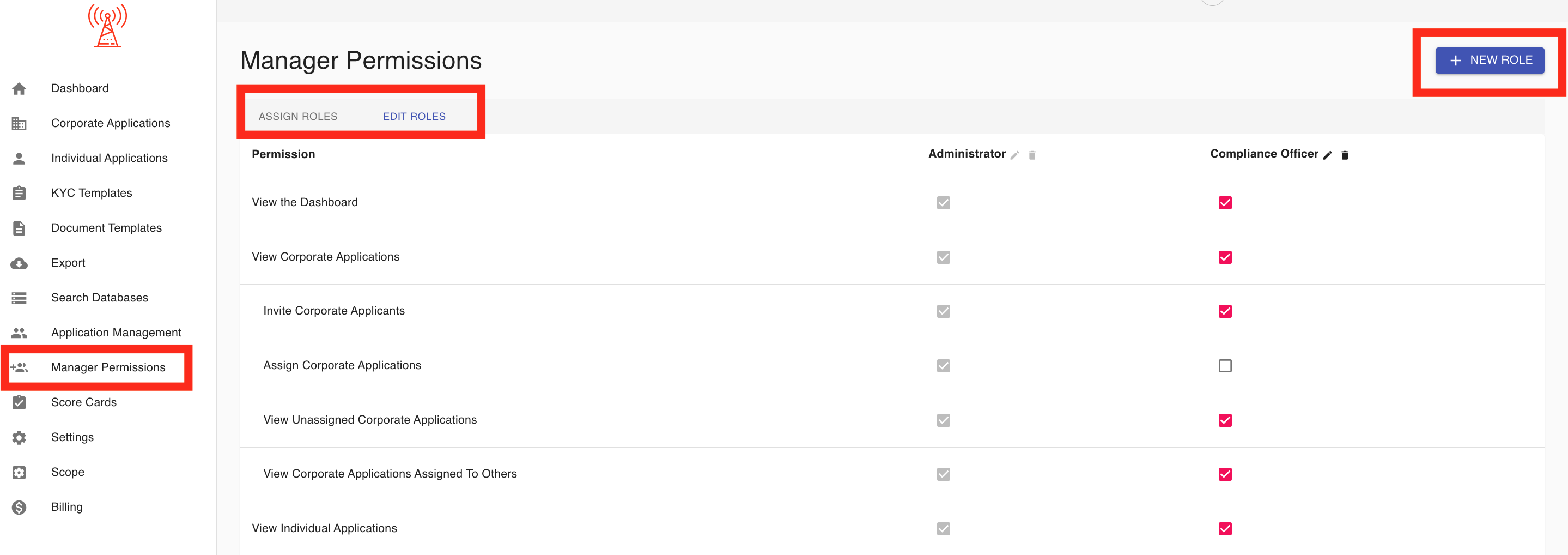

3.62 Manager Permissions:

The Manager Permissions section in the KYC management application provides a centralized interface for managing and customizing access levels for managers. Its key features include:

1. Assign Roles: Managers can be assigned specific roles, such as "Administrator," to define their level of access and authority within the platform. Each manager’s role is displayed alongside their email and name for easy identification.

2. Edit Roles and Permissions: Administrators can not only adjust or remove roles but also edit permissions specific to each role. This ensures a tailored access control system that aligns with organizational requirements.

3. Manage Active and Inactive Managers: A toggle option allows administrators to view and manage both active and inactive managers, providing flexibility in handling current and past users.

4. Add New Managers: The “+ New Manager” button facilitates the addition of new team members. Administrators can assign roles and set permissions for new users during the onboarding process.

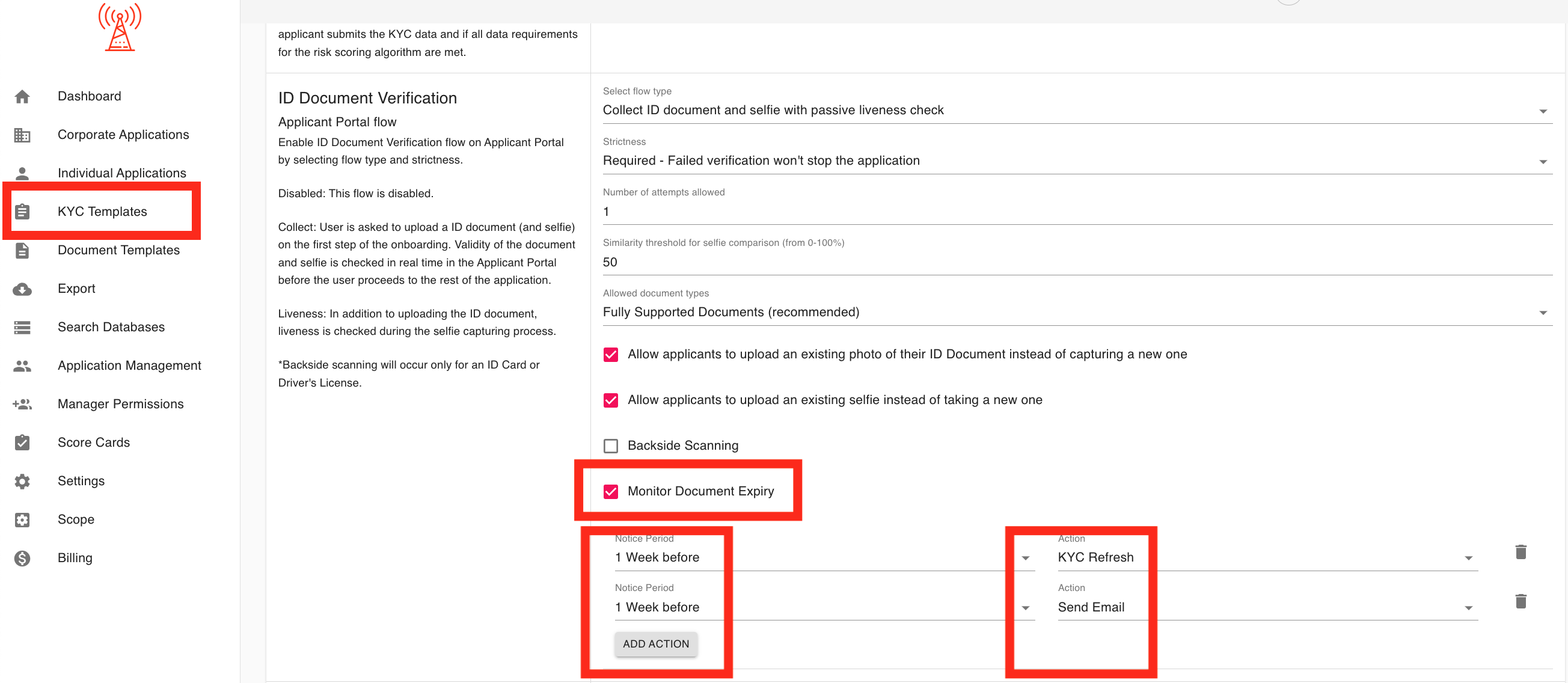

3.63 Document Expiry Monitoring:

The Document Monitoring Expiry feature tracks the expiration of customer ID documents and triggers actions based on a defined notice period. It helps ensure compliance by notifying both applicants and compliance managers before document expiration.

Key Features:

- Notice Period: Set a notice period (e.g., 7 days) before document expiration to trigger actions.

- Actions:

- KYC Refresh: Automatically reopens the approved application and requests the applicant by email to redo their KYC process.

- Email Notification: Sends an email to the manager about the impending document expiry.

How It Works: Go to the KYC Templates section, and open the template you want to customize. Set the notice period (e.g., 7 days) for expiry notifications. When the document is nearing expiration, a KYC refresh is triggered, and both the applicant and compliance manager are notified. The applicant receives a request to redo their KYC, and the compliance manager is alerted in advance.

This feature ensures timely updates and keeps your KYC data compliant and accurate.

3.7 Ongoing AML Monitoring:

When does ongoing AML monitoring begin for an application?

Ongoing AML monitoring does not begin immediately upon an application’s approval. Instead, the initial monitoring check is scheduled for a specific future date, and subsequent checks will then occur at configured intervals.

This feature helps managers keep AML results for their applicants up-to-date. The monitoring interval can be set for each risk category (Low, Medium, High) within the KYC Templates (Daily, Weekly, Monthly, Every 6 Months, or Annually).

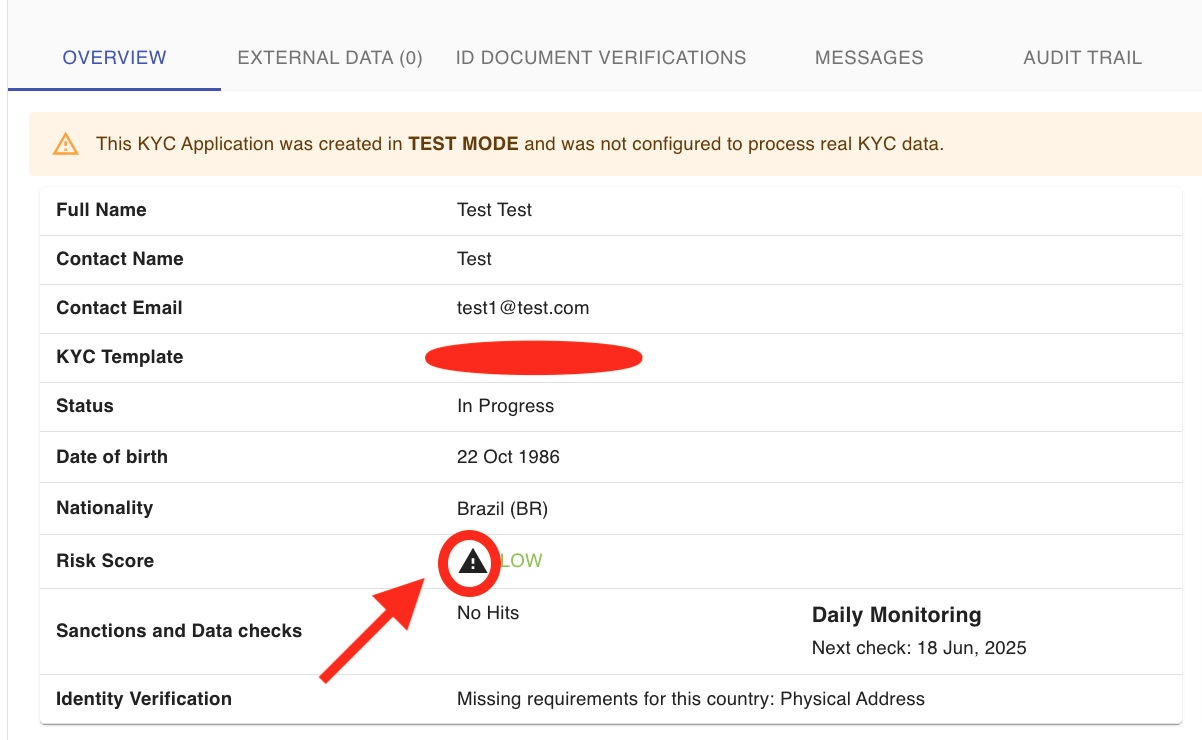

Important Notes: * Monitoring is only performed for applications that have a data check result. * Applications with ‘Cancelled’, ‘Rejected’, or ‘Ready for Review’ statuses are ignored. * Managers receive an email notification if any changes are detected in external databases for a monitored application. * The ‘Overview’ section of an application displays when the next AML check is scheduled.

Important Note: Cancelled, rejected, ready for review and any applications that don't have a data check result will be ignored.

To set this up:

- Go to KYC Templates

- Select and open a KYC Template

- Scroll down and find Ongoing Monitoring

- Select the interval for Low, Medium and/or High risk applications and click save.

The Overview section will also show when the next AML check is going to happen:

You can use the search filter option on the dashboard to display only applications with Monitoring Updates:

3.7.1 KYC Refresh:

The KYC (Know Your Customer) Refresh feature enables organizations to manage and maintain up-to-date customer records by setting a refresh frequency for each risk category. This feature ensures that customer information is periodically reviewed to comply with regulatory requirements and enhance security by refreshing data at appropriate intervals based on the risk profile.

Key Functionality:

- KYC Refresh Frequency Selection: The application allows users to set a refresh frequency for each customer category (e.g., low, medium, high risk). The refresh frequency is defined in months, enabling tailored intervals for different levels of risk.

- Customizable Intervals: For each risk category, users can specify a custom refresh period (in months) to ensure that high-risk customers are reviewed more frequently compared to lower-risk customers. This customization helps meet regulatory compliance and internal risk management requirements.

- Risk-Based Customization: The refresh intervals can be adjusted per customer risk category, allowing for more stringent monitoring of high-risk clients and reduced oversight for low-risk ones.

- Compliance and Monitoring: By setting appropriate refresh frequencies, organizations ensure they remain compliant with KYC regulations and can proactively manage potential risks by keeping customer data accurate and current.

3.71.1 Easy Fill:

The Easy Fill feature is a powerful tool designed to streamline the KYC process by enabling compliance officers to submit client data and documents on behalf of the applicant, ensuring a seamless and efficient workflow. With this feature, compliance officers can complete the entire application process without requiring any direct involvement from the applicant.

This feature is particularly useful for scenarios where applicants prefer not to complete the KYC process themselves but instead provide all necessary information and documents via email or other channels. The compliance officer can then input the applicant's details, upload supporting documents, and submit the application. Once submitted, all required checks are automatically triggered, allowing the KYC process to proceed smoothly.

The Easy Fill feature ensures flexibility and convenience, making it an ideal solution for clients who value a hands-off approach to KYC while maintaining full compliance with regulatory requirements. This functionality is designed to save time, reduce friction, and provide a professional experience for both applicants and compliance teams.

3.8 Settings:

In the Settings section, managers can set custom configurations for the KYC-Chain app and more:

Reminders:

KYCC can automatically send a reminder email to applicants who have an incomplete application that needs their attention:

In this section you can enable/disable this feature and configure how often the emails will be sent, as well as the maximum number of reminders to send to any one applicant. You can also choose to ignore old applications (even if they have not reached the reminders limit) so that enabling the feature doesn't necessarily result in emails going out to past applicants.

Note Templates:

Add frequently used rejection reasons to speed up the compliance workflow. Managers can save frequently used explanations here and then select them when rejecting a KYC application:

Email Management:

The Email Management section allows you to enable or disable email notifications for applicants and managers, customize the subject line, and send test emails to preview how they look.

Note: To update the actual email content, please contact our technical team.

Labels:

Labels are a powerful tool for categorizing applications within the Management app. For example, you can use labels to mark applications as HIGH RISK or LOW RISK, or for any other purpose—such as adding notes or flagging applications for later review.

When creating a label, you can assign a custom title and choose a color to help visually organize and differentiate your labels. To create and manage labels, simply go to the Settings section.

You can also search for applications by their labels, making it easy to organize and quickly locate specific cases:

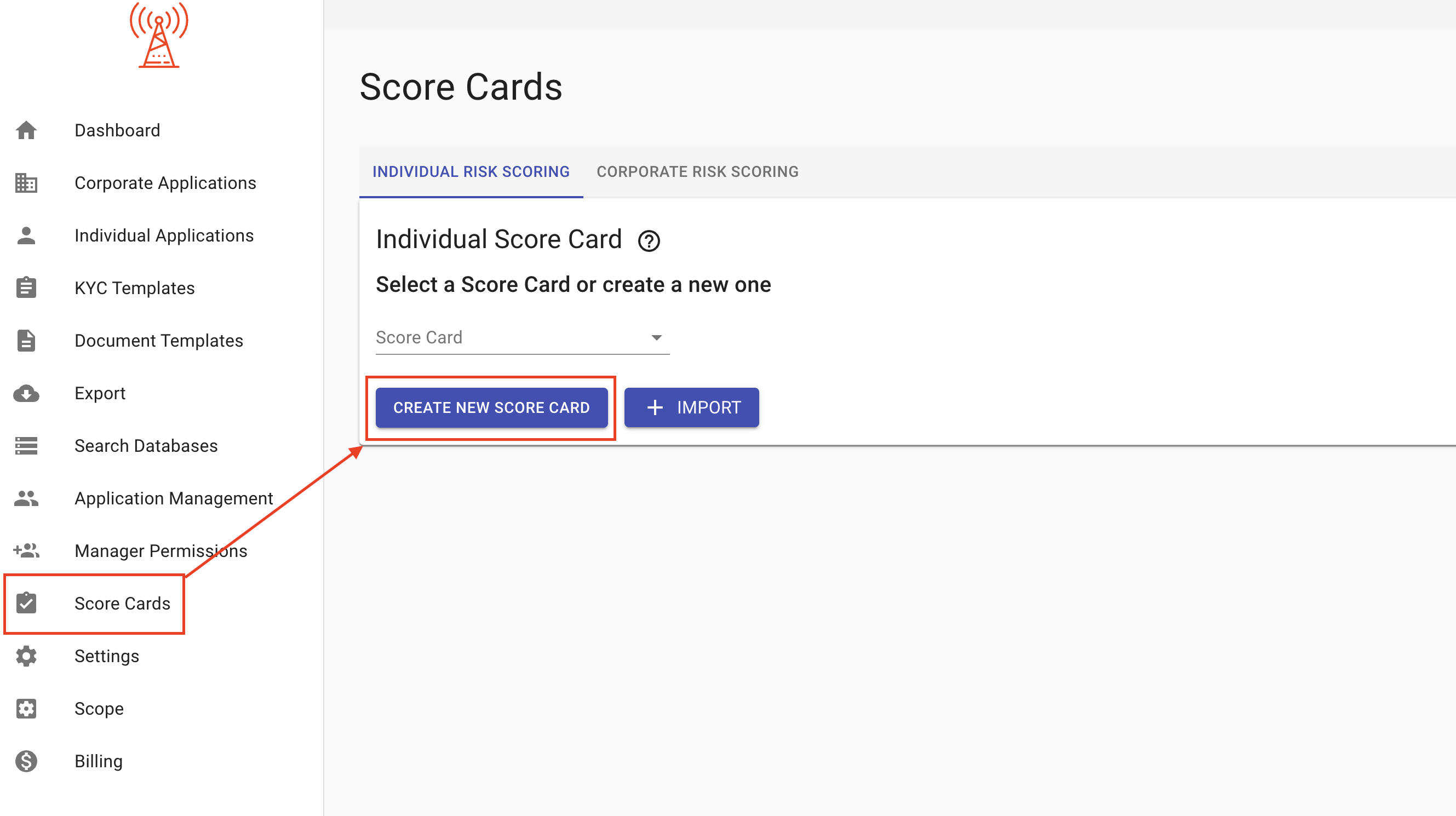

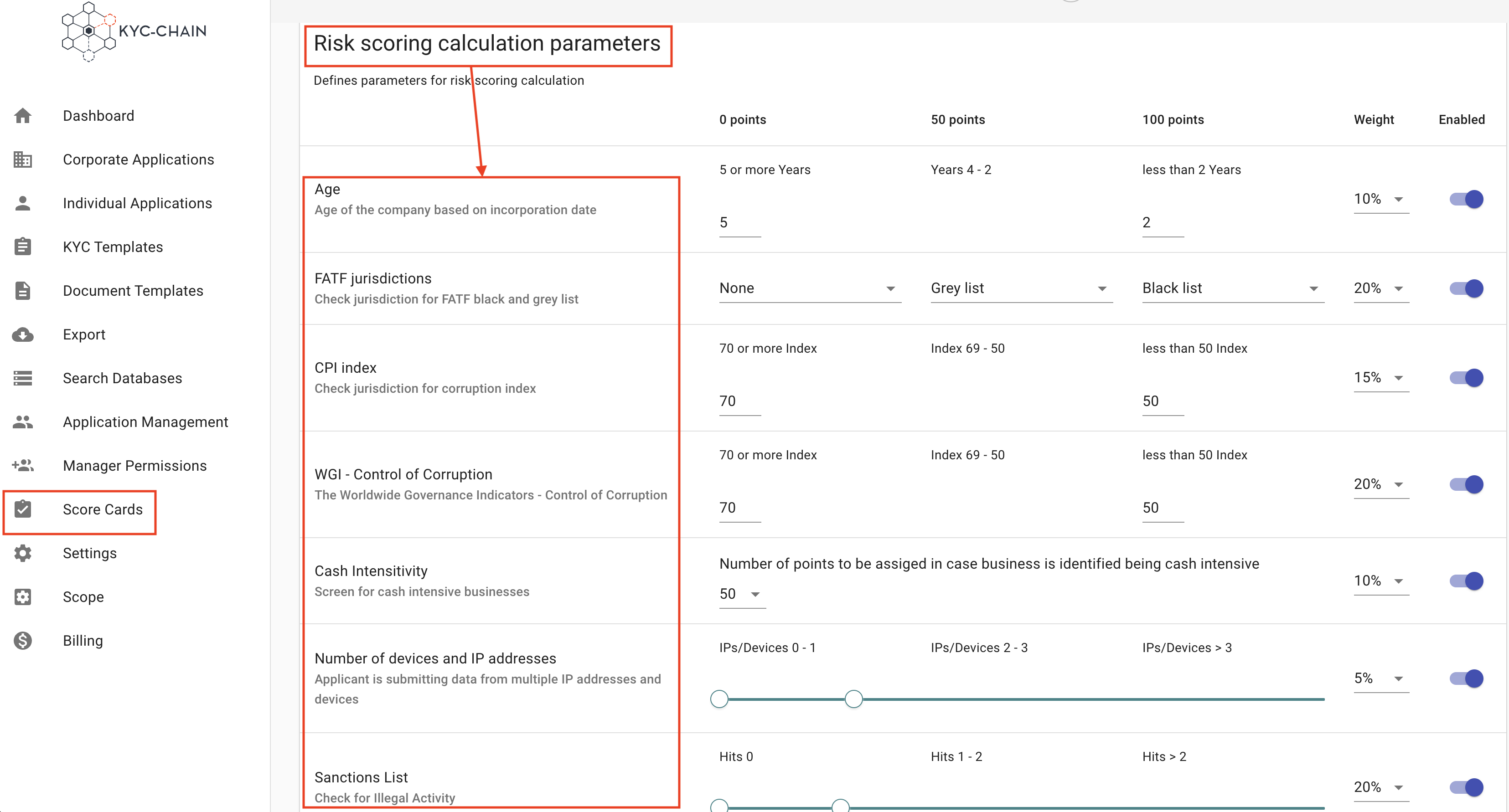

3.9 Risk Scoring:

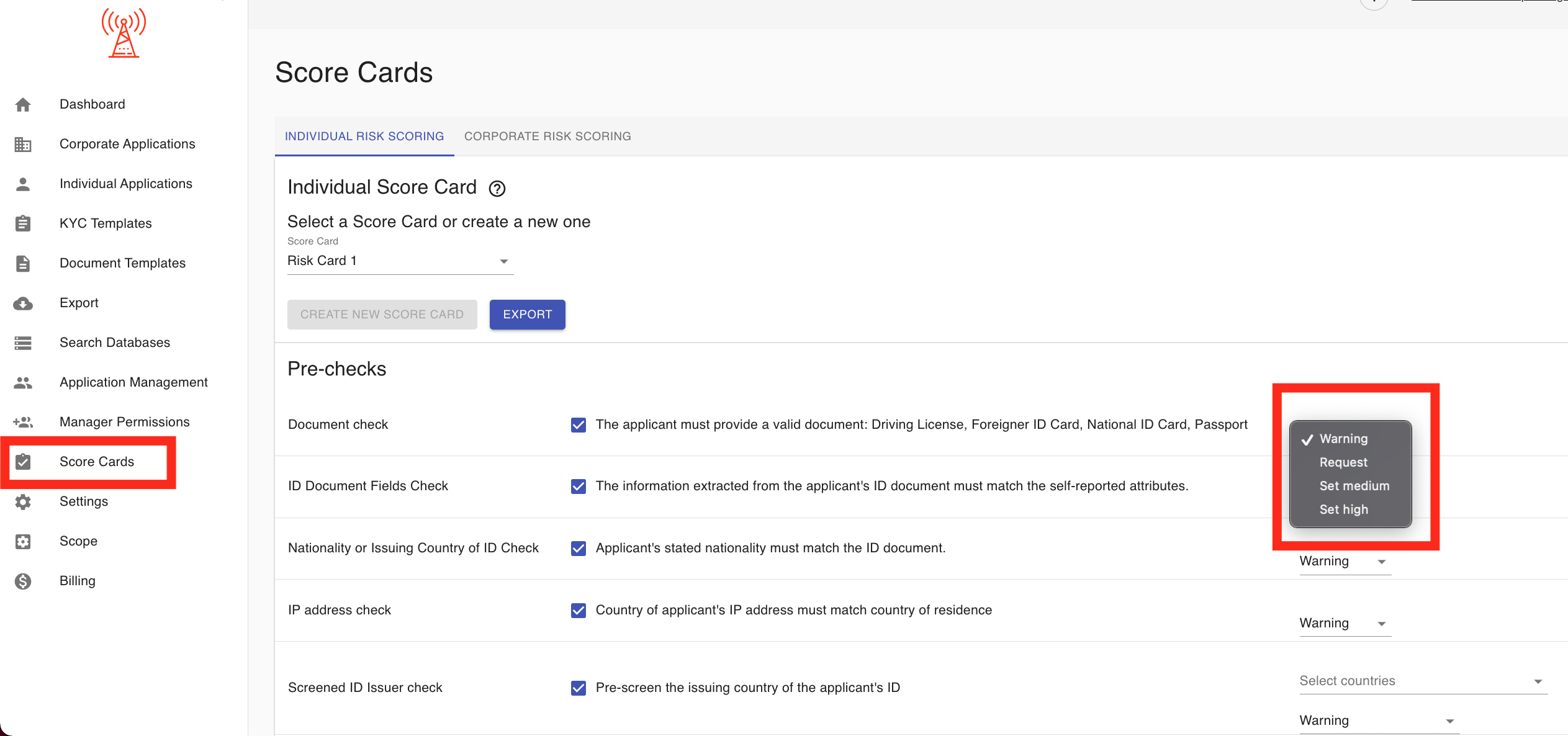

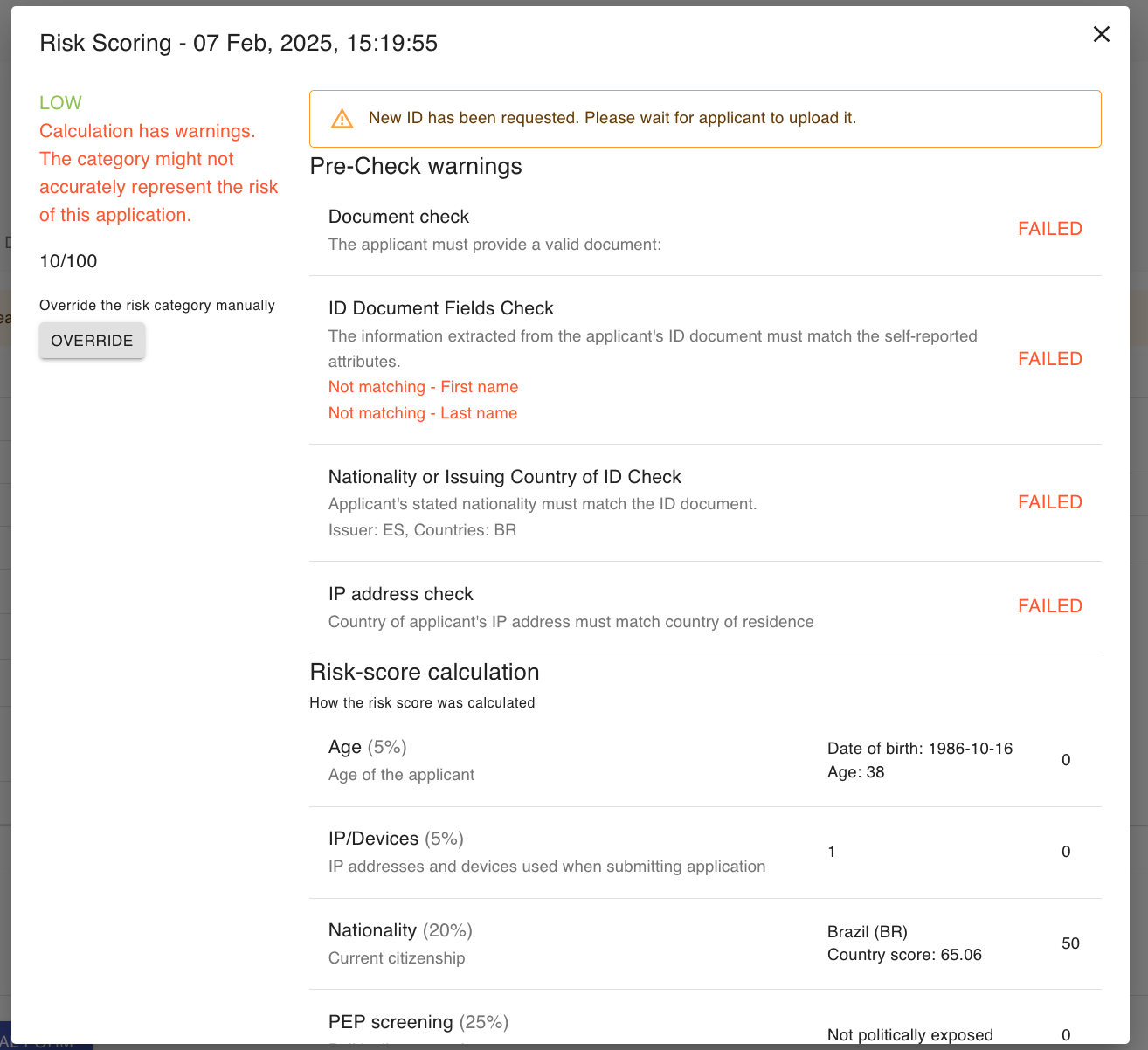

The Score Cards tab allows managers to configure multiple Risk Score Cards which each have customized parameters, and which can be assigned to KYC Templates so that KYC Processes using that template will automatically have their risk score calculated upon submission:

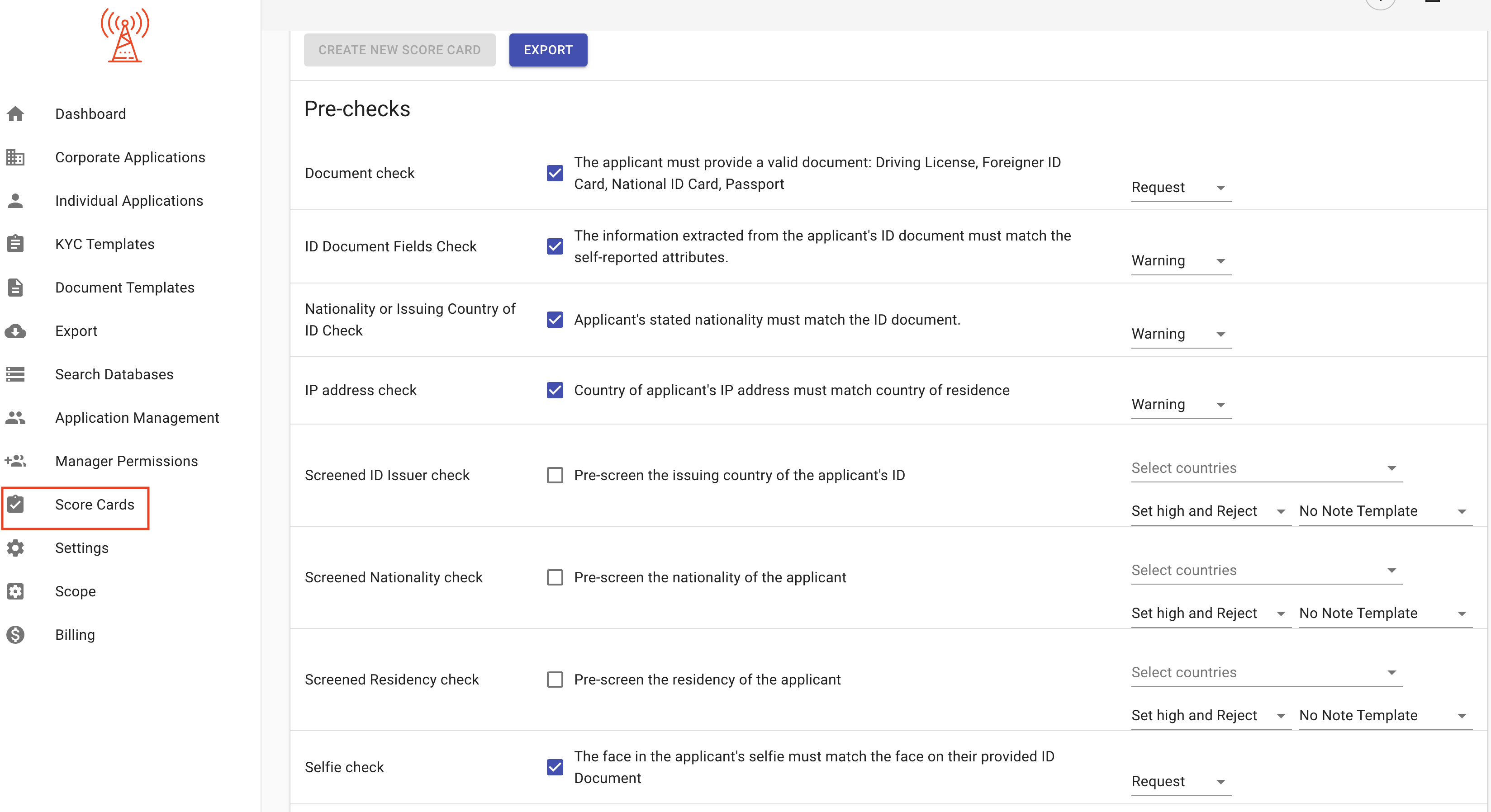

Pre-checks (Individual/Corporate Score Card)

Pre-checks can be individually enabled/disabled for any risk score card. Each pre-check parameter relates to a specific requirement in the KYC Template, and so that requirement must be present for the pre-check to function properly.

Types of Pre-checks:

Individual Score Card Pre-Checks:

- Document check: Will check if the ID document (passport, driving license or national ID card) is valid. This requires the manager to enable the 'IDScan Customer portal flow' on the KYC template.

- ID Document Fields check: Will check if the information extracted from the applicant's ID document matches the self-reported attributes.

- Nationality or Issuing Country of ID check: Will check if the applicant's stated nationality matches the ID document. The pre-check won't work if the Nationality attribute is not required on the KYC template.

- IP address check: Will check if the applicant's IP address matches their stated country of residence.

- Screened ID Issuer check: Will pre-screen the issuing country of the applicant's ID against a configurable list.

- Screened Nationality check: Will pre-screen the nationality of the applicant against a configurable list. The pre-check won't work if the Nationality attribute is not required on the KYC template.

- Screened Residency check: Will pre-screen applicant's country of residence, pre-check won't work if the Country of residence attribute is not required on the KYC template.

- Selfie check Requires the Passport attribute with the "selfie" property enabled.

Managers can also configure the action that's taken if a pre-check fails.

- Warning: Issue a warning and continue the risk score calculation. The warning will not change the risk score, but will display alongside the risk score when reviewing an application.

- Set Medium: Automatically set the score for the relevant parameter to Medium.

- Set High: Automatically set the score for the relevant parameter to High.

- Request: Automatically trigger a request for the client to resubmit or update any failed or incomplete requirements.

- Set Medium/High and Reject: Set the risk score accordingly and automatically reject the application.

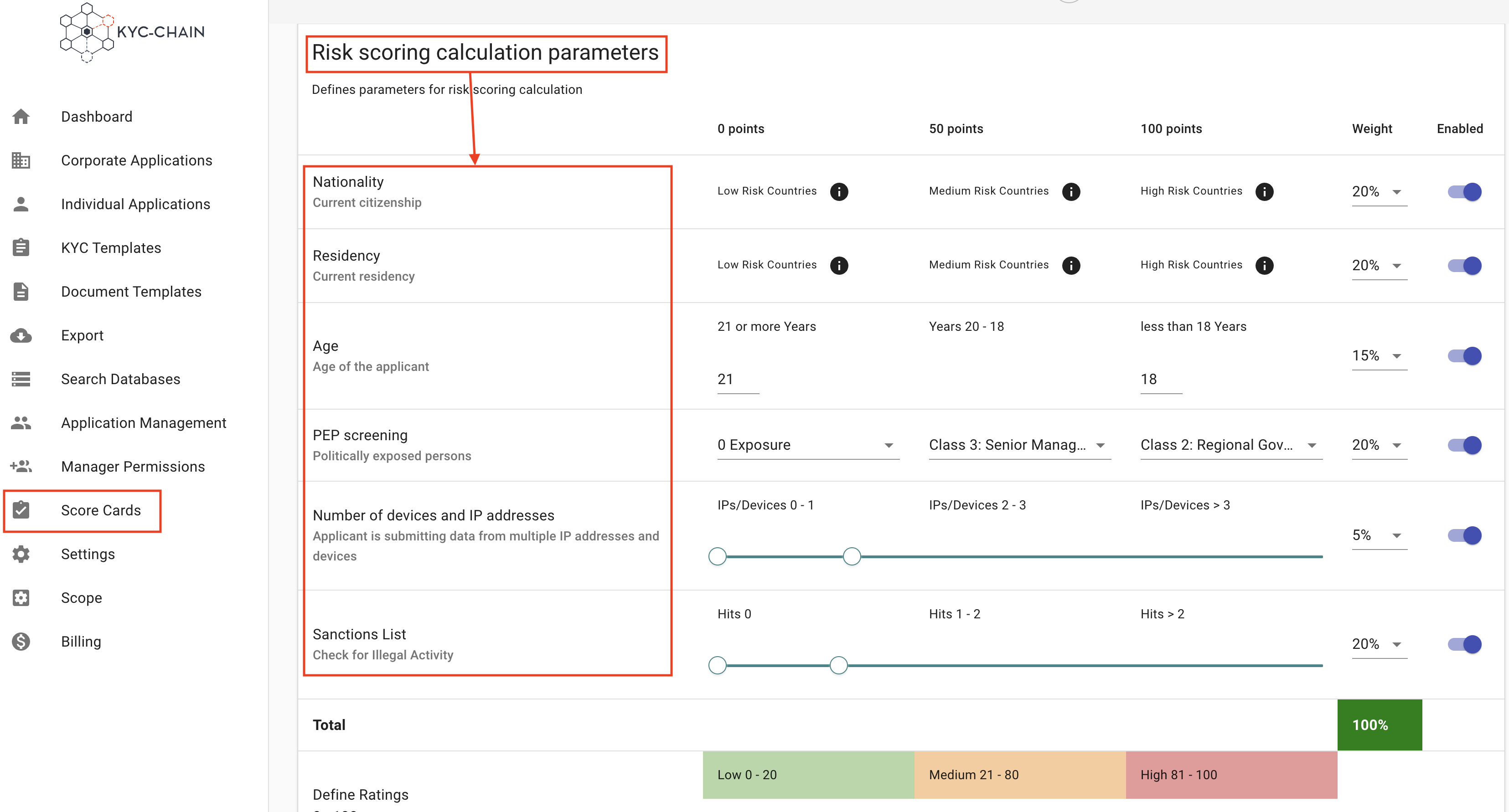

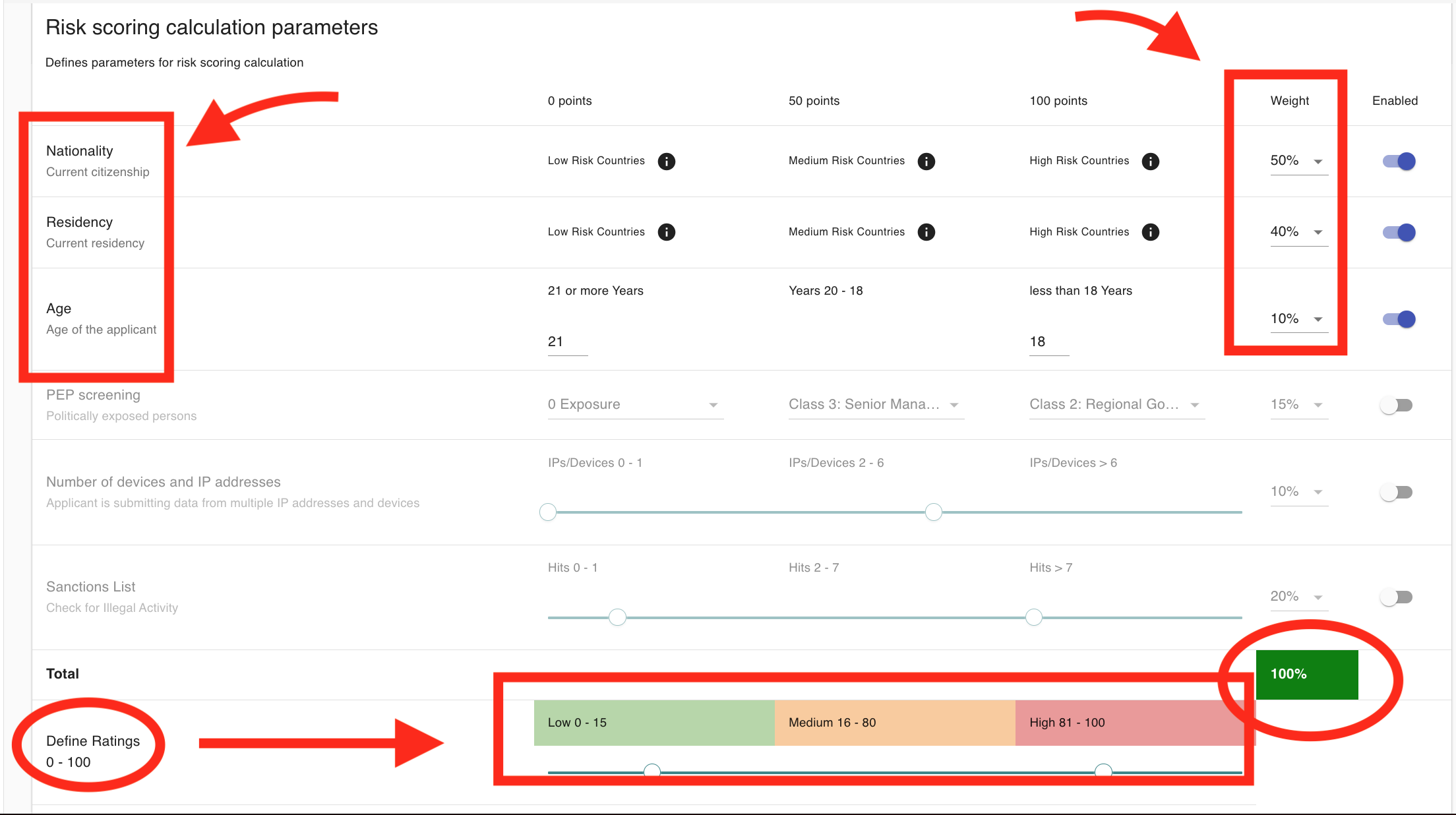

Individual Risk Scoring Parameters: Parameters can be individually enabled or disabled, and their weights can be adjusted so that the sum of all active parameter weights is 100%.

The current Individual Risk Score parameters are as follows:

- Nationality: The nationality entered by the applicant is scored based on the pre-set list of country risk scores. The nationality attribute must be required in the KYC Process.

- Residency: The country of residence entered by the applicant is scored based on the pre-set list of country risk scores. The Country of Residency attribute must be required in the KYC Process.

- Age: The applicant's age is determined using the Date of Birth attribute and the score is applied based on the parameters configured by the manager. The Date of Birth attribute must be required in the KYC Process.

- PEP Screening: The most severe class of confirmed PEP (Politically Exposed Persons) exposure for the applicant is scored according to the configuration in the score card.

- Number of devices and IP addresses: Risk score depends on the number of IP address and devices detected by the system.

- Sanctions List: The number of confirmed sanctions hits for the applicant are placed on the scale configured by the manager and scored accordingly.

Explanation on how risk score is calculated:

Risk Levels and Points:

- Low Risk: 0 points (does not contribute to the overall score).

- Medium Risk: 50 points (partial contribution based on the weight).

- High Risk: 100 points (full contribution based on the weight).

Weighted Contribution:

Each factor has a weight percentage (e.g., 20% for Nationality, 50% for Residence and 10% for age).

The score for each factor is calculated like this:

Score Contribution = Points for Risk Level × Weight

Examples:

- High Risk (100 points):

- If the weight is 50%:

100 × 0.5 = 50

- If the weight is 50%:

- Medium Risk (50 points):

- If the weight is 40%:

40 × 0.2 = 40(Note: Original example had 40% weight, 0.2 multiplier, resulting in 8, which seems incorrect. Assuming it should be 20% weight for 40 value, or 40% weight giving 20. I'll use the example values as given but the math here is a bit off from the example's stated result of 40. For consistency with "50+40+0 = 90", I'll assume50 * 0.4 = 20, but the example says 40. I will keep the original text's calculation for now.) Self-correction: The original example text said "40 x 0.2 = 40" which is incorrect. It should be50 * 0.4 = 20if weight is 40%. Or if the contribution is 40, and points are 50, weight is 80%. The final sum (50+40+0=90) implies the contributions are 50, 40, 0. If Nationality High (100pts) * 0.2 = 20. If Residency Medium (50pts) * 0.X = Y. The example is confusing. I will re-state the calculation more clearly based on the principle.

- If the weight is 40%:

Example Calculation Revised for Clarity: Let's assume the following:

- Nationality: High Risk (100 points), Weight 20% -> Contribution =

100 * 0.20 = 20 - Residency: Medium Risk (50 points), Weight 20% -> Contribution =

50 * 0.20 = 10 - Age: Low Risk (0 points), Weight 5% -> Contribution =

0 * 0.05 = 0

Total Risk Score: 20 + 10 + 0 = 30

(The original image showed a total of 90/100, which implies different contributions. I will stick to the original text example for now, despite its mathematical inconsistency, to preserve the document's intent, but add a note.)

Original Example Text's Calculation: Nationality: High Risk, 20% weight → contributes 20 points. Residency: Medium Risk, 20% weight → contributes 10 points. Age: Low Risk, 5% weight → contributes 0 points. Total Risk Score: 50 + 40 + 0 = 90/100 (Developer Note: The example breakdown (20, 10, 0) does not sum to the example total (90). The image likely reflects the correct calculation logic which might differ from this textual example. Please refer to the image for precise calculation if there's a discrepancy.)

Risk Classification: After calculating the total score, the system maps it to predefined ranges:

- Low Risk: 0–39.

- Medium Risk: 40–69.

- High Risk: 70–100.

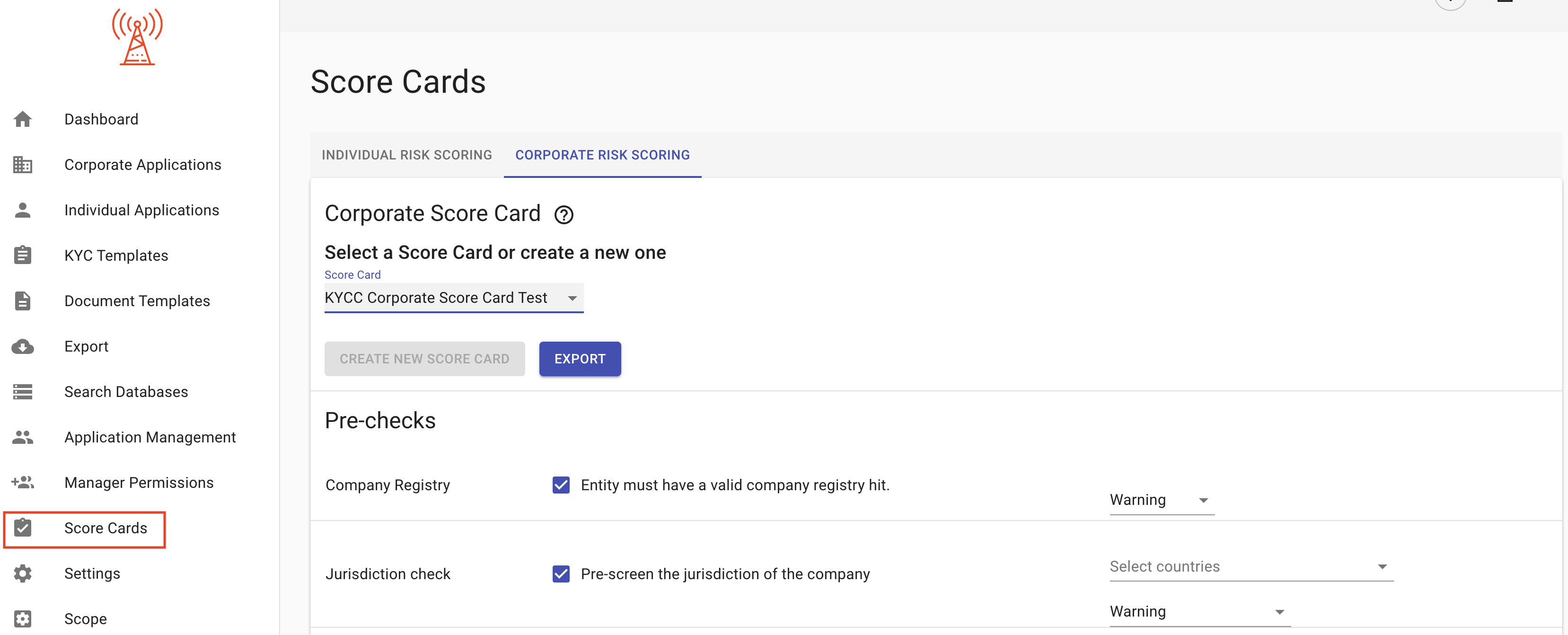

Corporate Score Card Pre-Checks:

- Company Registry check: Will check if the entity got at least 1 valid company registry hit.

- Jurisdiction check: Will pre-screen the jurisdiction of the company.

Managers can also configure the action that's taken if a pre-check fails.

- Warning: Issue a warning and continue the risk score calculation. The warning will not change the risk score, but will display alongside the risk score when reviewing an application.

- Set Medium: Automatically set the score for the relevant parameter to Medium.

- Set High: Automatically set the score for the relevant parameter to High.

- Request: Automatically trigger a request for the client to resubmit or update any failed or incomplete requirements.

- Set Medium/High and Reject: Set the risk score accordingly and automatically reject the application.

Corporate Risk Scoring Parameters:

- Age = The Company's age is determined using the "Date of Incorporation" attribute and the score is applied based on the parameters configured by the manager. The Date of Incorporation attribute must be enabled on the Individual or Corporate template.

- FATF jurisdictions = Checks jurisdiction for FATF (Financial Action Task Force) black and grey list, black list is HIGH risk, Grey list is MEDIUM risk.

- CPI index = Checks jurisdiction for corruption index, risk score calculation relies on the CPI (Corruption Perceptions Index) levels. Every jurisdiction receives its own score.

- WGI - Control of Corruption = Calculation of risk score relies on the WGI (Worldwide Governance Indicators)'s scores. Each jurisdiction receives its own score.

- Cash Intensivity = This parameter screens for cash intensive businesses and is determined using the ''business types'' attribute.

- Number of devices and IP addresses = Risk score depends on the number of ip address and devices detected by the system.

- Sanctions List: The number of confirmed sanctions hits for the entity are placed on the scale configured by the manager and scored accordingly.

Please note that the PEP and Sanctions parameters rely not only on the initial results of these screenings, but on the confirmed results. This means that if there are results in the "External Data" tab for an applicant, the manager will need to go through them and determine whether they are false positives, or if they do refer to the applicant themself. Only once a selection is made will the risk score calculate for that application.

Automatic Approvals: When enabled, this feature will automatically approve any applications which are given a Low risk score:

Risk scoring notification: When enabled, will send email notification to manager on risk-score calculations. You can also check the actual risk score and additional information related to risk score under Overview section:

3.10 Sybil Checks

- Sybil check 1 is calculated using a combination of the applicant's IP address, device name, first name, last name, date of birth and KYC template ID. It is performed after applicant submits the application before any data checks are done.

- Sybil check 2 is based on the applicant's passport code (or national ID number) and KYC template ID obtained from our OCR (Optical Character Recognition) data. In the case of passports the MRZ (Machine Readable Zone) line is used, and for national IDs either the document number or personal number along with country code is used. The second sybil check is performed as soon as ID Document Verification data is available.

Note: With sybil checks, the system will automatically cancel applications if it detects duplicate data. The Audit Trail will explain the cancellation and link to applications with similar data:

4. How to

4.1 How To Create and Configure KYC Templates:

Managers can create and customize as many KYC templates as they require for their workflows. Managers can request specific documents or ask KYC applicants questions tailored to their requirements. To do that, they can either create an entirely new template, or customize/duplicate an existing template.

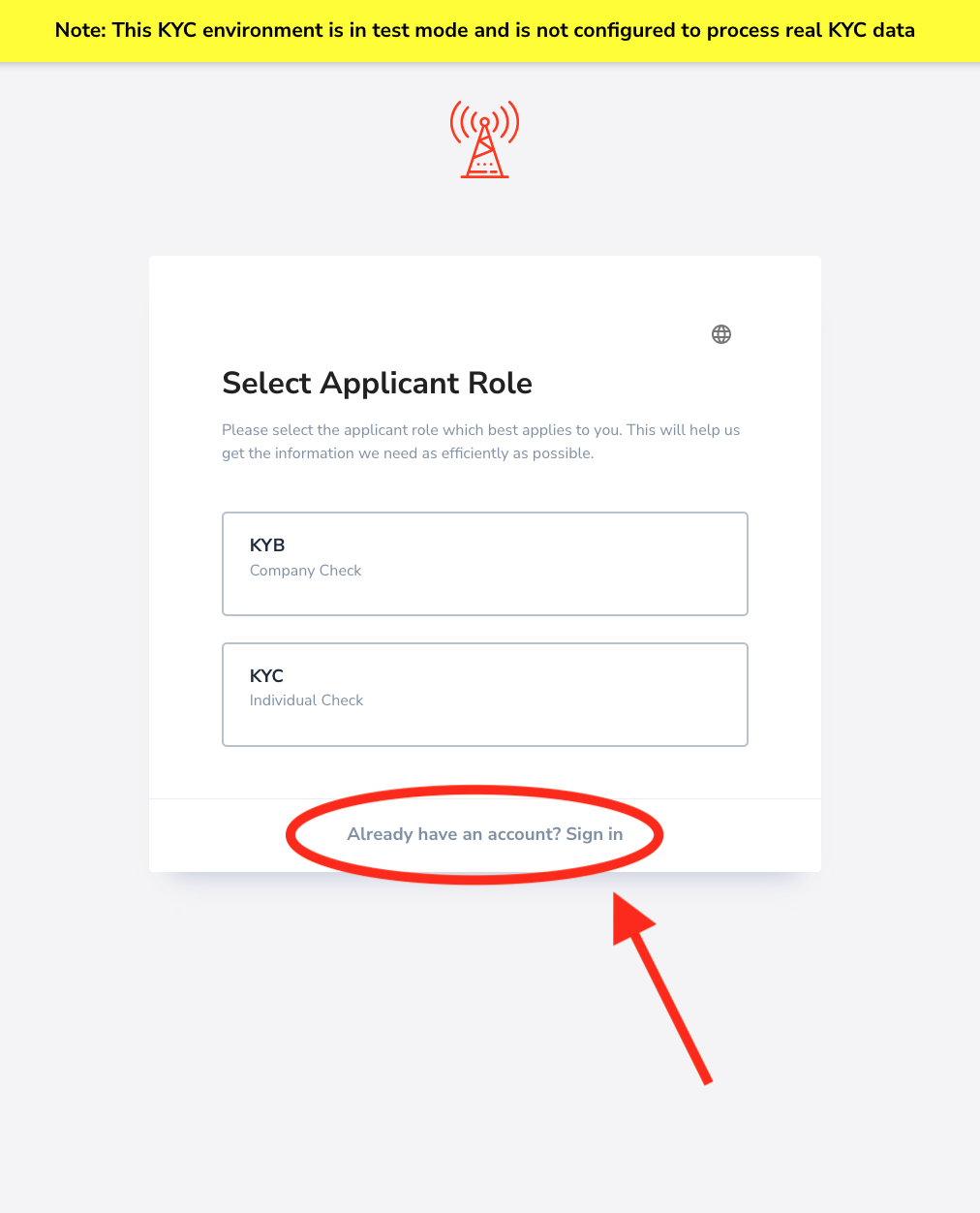

How can I get my invitation link resent?

If you have been invited to start the KYC process but the invitation link has expired or is not working, you can try signing in to the KYC portal directly. Alternatively, you can cancel the application and send a new invitation. Please refer to the following screenshots for guidance:

How can I pause my KYC-Chain subscription or service?

Please send an email to help@kyc-chain.com requesting to pause your service and include your project name. Our team will get back to you as soon as possible.

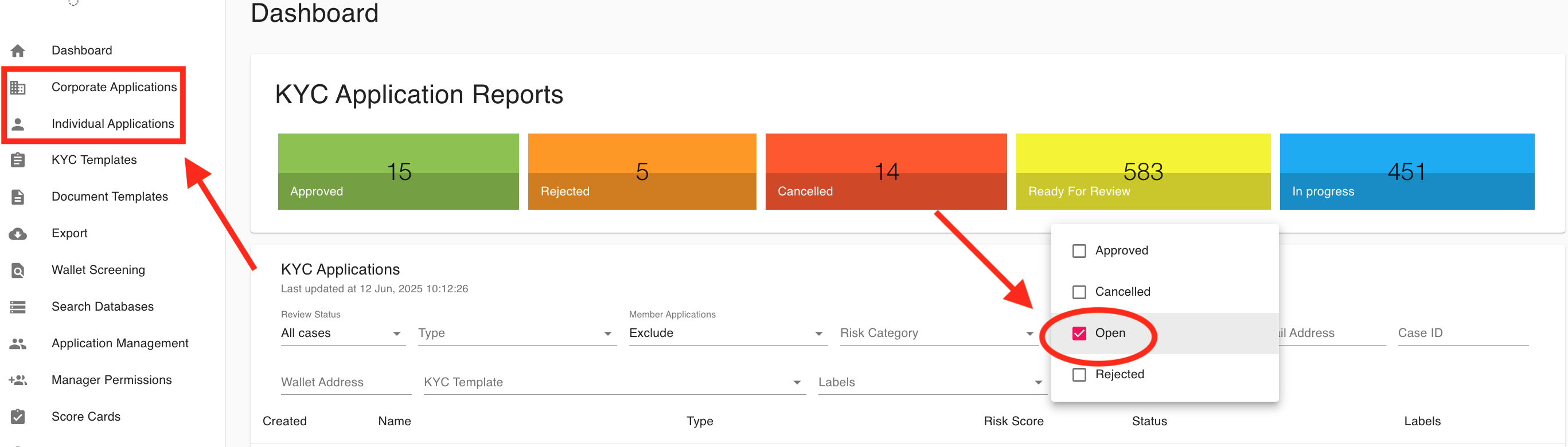

How can I use dashboard filters to view all open or pending applications?

To view all open or pending applications on the dashboard, use the filter options shown in the screenshot:

- Click on the filter dropdown menu (as highlighted in the red circle).

- In the dropdown, ensure that the "Open" option is checked. You may also want to check "In progress" if you consider those as pending.

- Uncheck other statuses such as "Approved," "Cancelled," and "Rejected" if you want to focus only on open or pending applications.

- The dashboard will then display only the applications with the selected statuses.

This allows you to quickly filter and review all applications that are currently open or awaiting further action.

How can data be retrieved from the cloud storage?

Data can be retirved using our API, for more informatin please consult our API documentation or open a ticket with out suport team for assistance.

How can 'N/A' or similar be allowed as an input for non-mandatory fields?

To accommodate 'N/A' inputs:

Configure the field to accept custom text input.

Add an explicit option (e.g., dropdown choice) labeled "Not Applicable" or "N/A" if predefined responses are preferred.

Applicants can then either:

-

Select the "N/A" option, or

-

Manually type "N/A" or similar into the field.

This ensures flexibility while maintaining data clarity.

How to configure manual approval or holding for KYC processes before charges?

To clarify, in KYC-Chain, charges for KYC checks are applied as soon as an application is submitted and checks are triggered—not only after approval. This means you are billed at the point when the verification process starts, regardless of whether the application is ultimately approved or not.

If your goal is to introduce manual approval or a holding step before any checks (and therefore charges) are triggered, please note that this is not the default behavior. The current workflow is designed so that all relevant checks (and corresponding charges) are initiated immediately upon submission. Manual review and approval can be configured for the decision-making process, but the billing will still occur at the time the checks are performed—not after approval.

How you can manage the workflow:

-

Disable Automatic Approvals: In your KYC Template or process settings, ensure that “Automatic Approval” is turned OFF. This will require manual review and approval of each application.

-

Manual Review Process: After the applicant submits their information, the application will remain in a “Pending” or “Review” status. A manager can then manually review documents, screening results, and risk assessments before a final decision is made.

-

Charges Still Apply on Submission: Please be aware that even with manual approval enabled, all verification checks—and their associated charges—will be triggered as soon as the application is submitted and processed by the system.

-

Custom Statuses and Notes: You can use custom statuses or internal notes to track applications that require special handling before final approval.

-

Permissions: Ensure that only authorized managers have the ability to approve or reject applications for compliance and oversight purposes.

Summary: While you can configure your workflow to require manual approval before an application is approved or finalized, charges for KYC checks are still applied immediately upon submission because that is when the checks are triggered in the system.

If you need to discuss alternative billing workflows or have specific requirements, please contact our support team for further assistance.

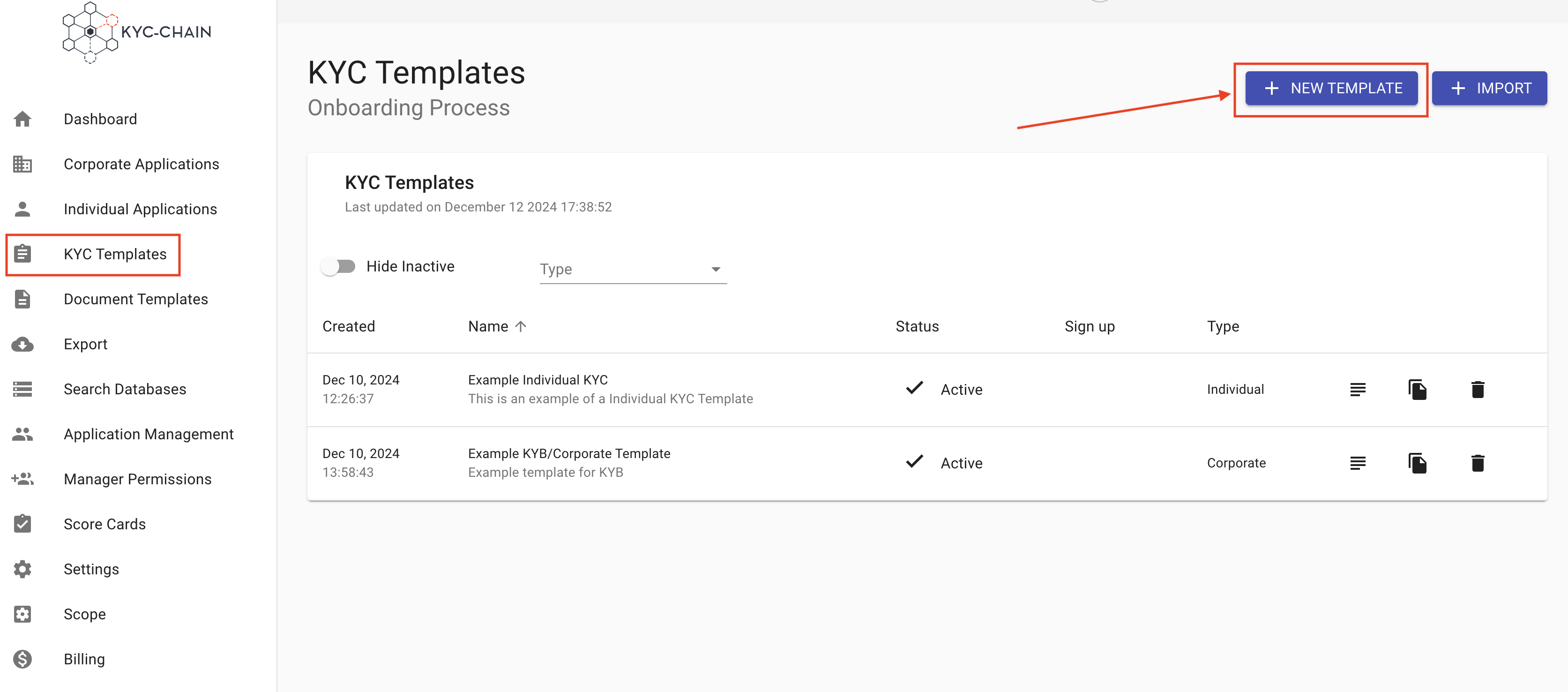

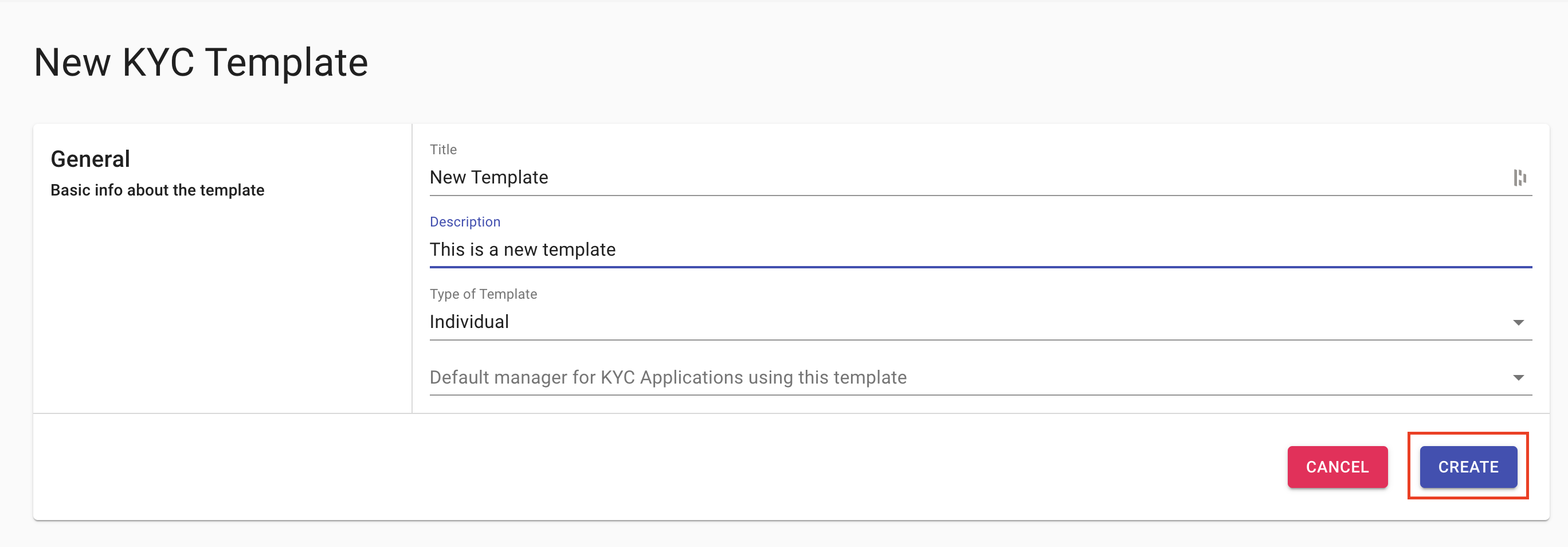

How to create a new template:

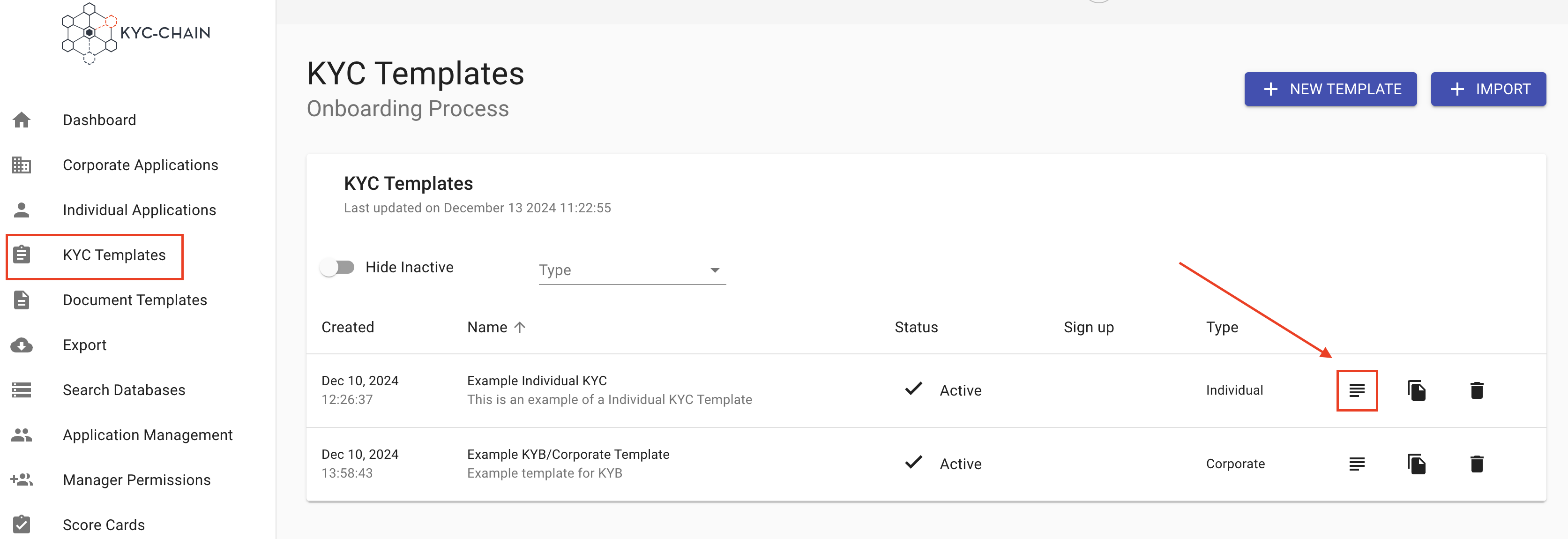

- Go to the KYC Templates tab (left-side menu)

- Click on New Template on the right side of the screen

- Fill out the initial fields and click "Create"

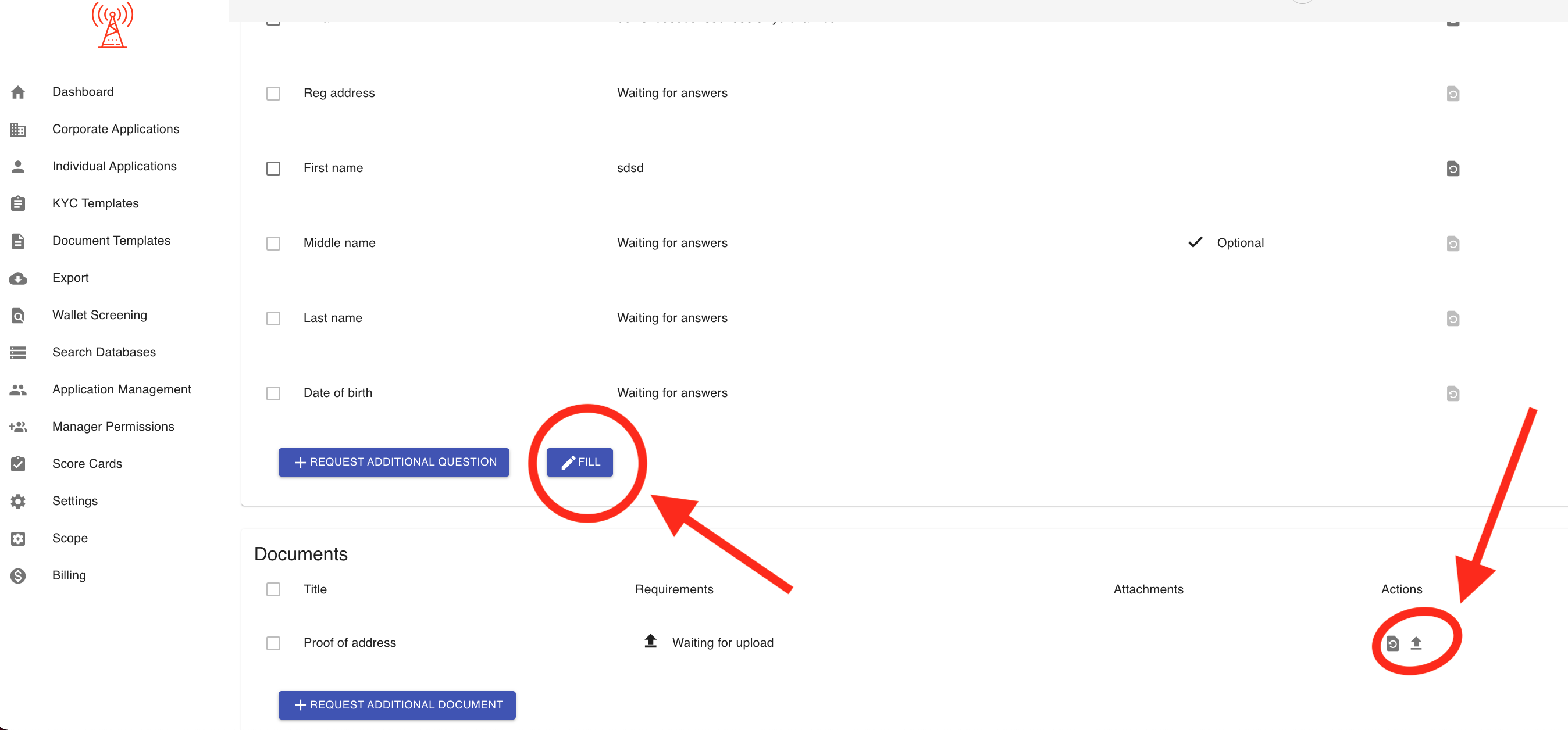

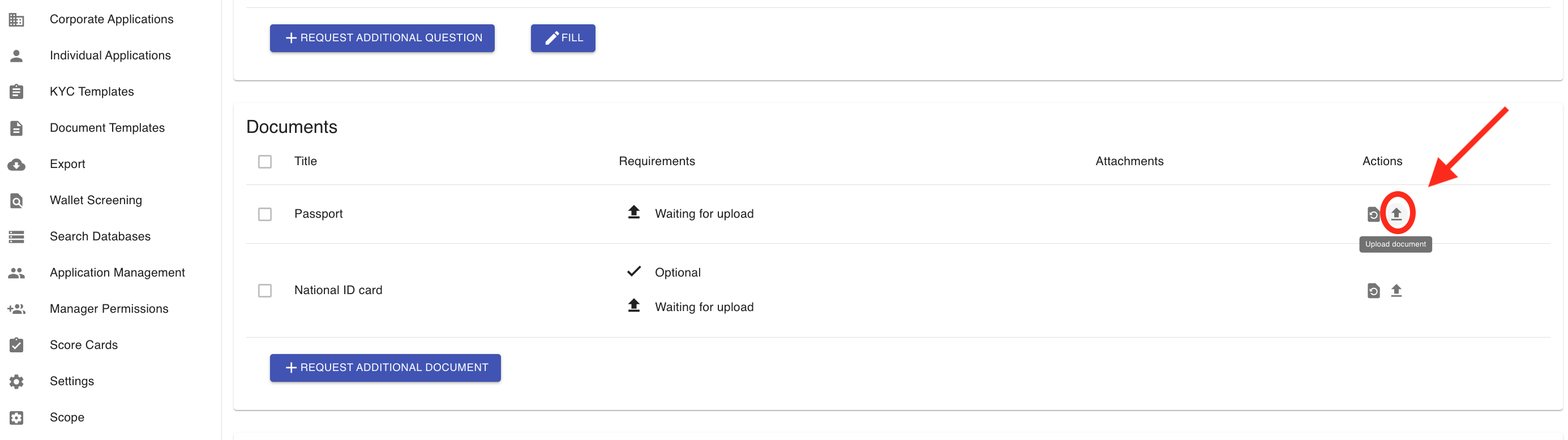

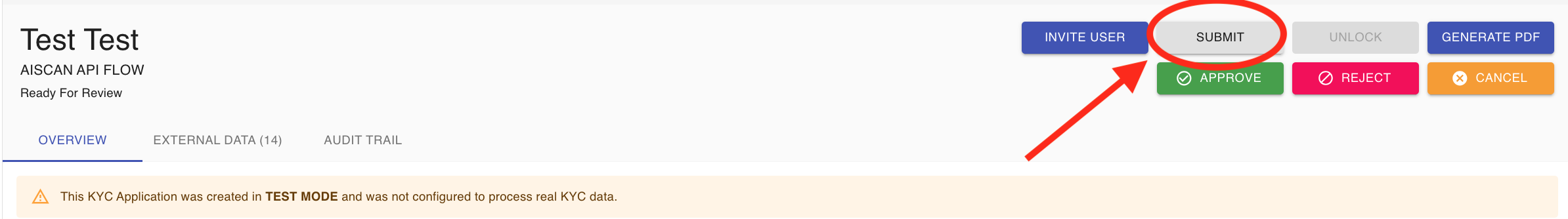

How to submit information and documents on behalf of applicant's using EasyFill:

The EasyFill feature makes updating application information simple and efficient. To use it, just click the FILL button highlighted in the screenshot. This will open an editing window where you can change or update any details, such as the name, date of birth, or other personal information.

You can also upload required documents by clicking the upload icon under the "Actions" column in the Documents section.

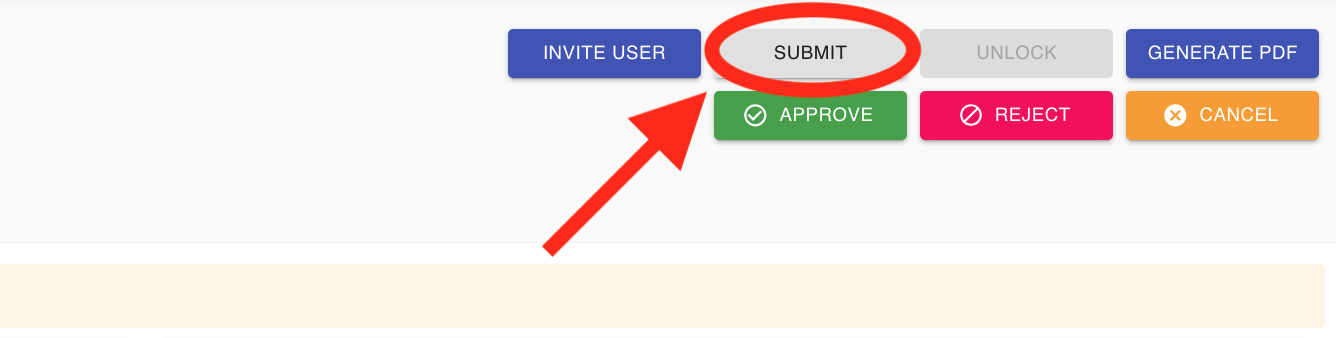

After you finish adjusting all the information and uploading any necessary files, be sure to click SUBMIT button in the top right corner. This step is important, as it allows the system to rerun all verification checks using the updated details.

How do I configure email sending from my custom domain in the KYC-Chain app?

The first step is to verify ownership of your domain. This is typically completed during client onboarding. If this step was not done, or if you would like to change the sending email address, please open a support ticket and provide the new email address or domain you wish to use for sending emails.

How to recall a sent message?

If your question concerns "External Notes," you can view all sent External Notes on the Overview page at the very bottom of an application. If your question is not about sent "External Notes" but other messages, please create a support ticket and provide details about which messages you are referring to so we can assist you more effectively.

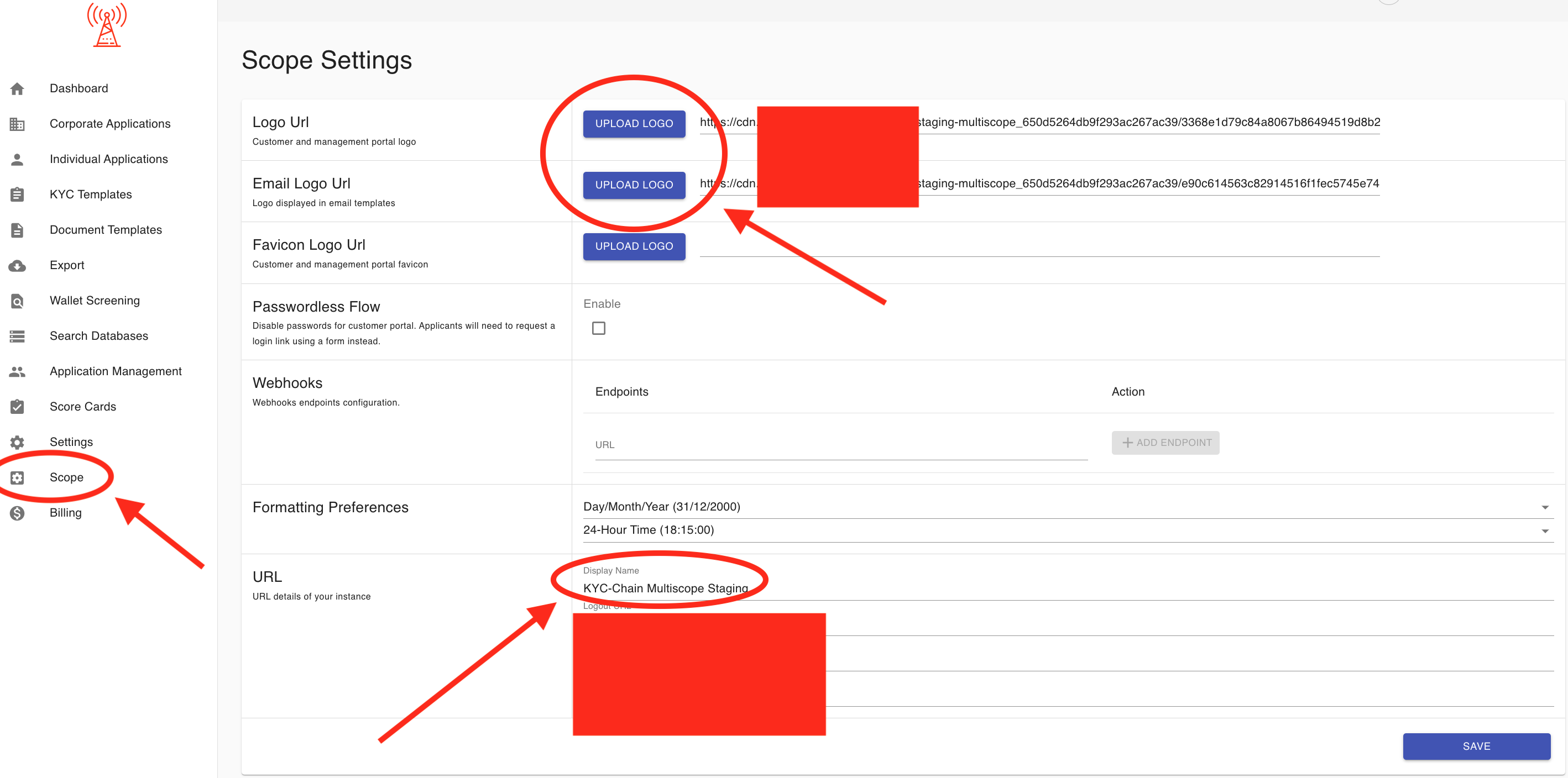

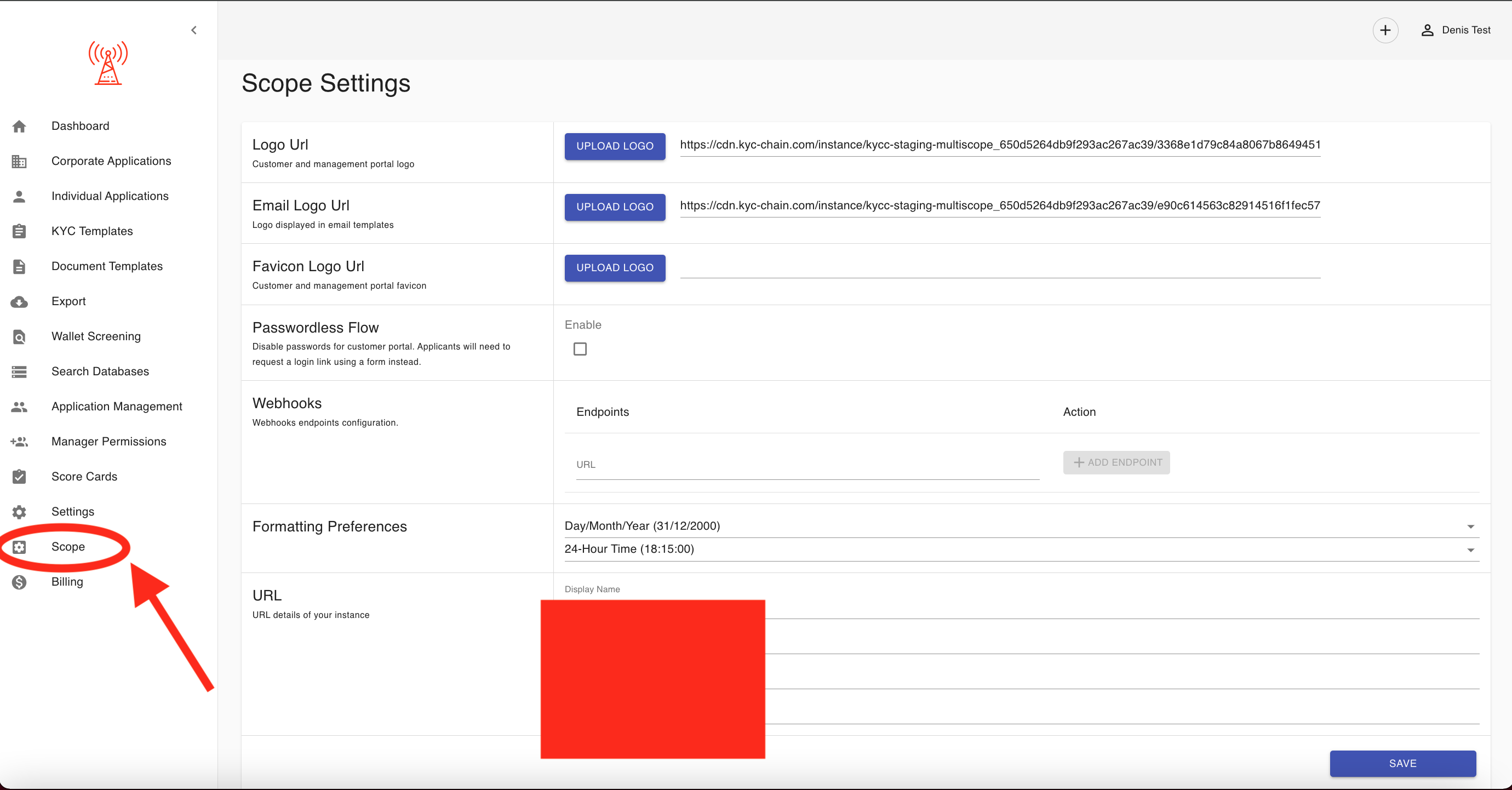

How do I update my organization's logo and name?

You can update your logo and organization name in the Scope Settings. Please refer to the screenshot for more information.

How can I obtain company registry information for British Virgin Islands (BVI) entities?

To request company registry information for a British Virgin Islands (BVI) entity, please open a support ticket and provide the following details: company name, legal entity type, company registration number, and date of incorporation. Our team will order all necessary documents on your behalf and notify you as soon as everything is ready. Please note that it may take a couple of days to obtain all the required documents.

How can I access the API documentation?

You can access our API documentation at the following link: https://apidocs.kyc-chain.com/#/. Please be sure to open a support ticket to request your login credentials.

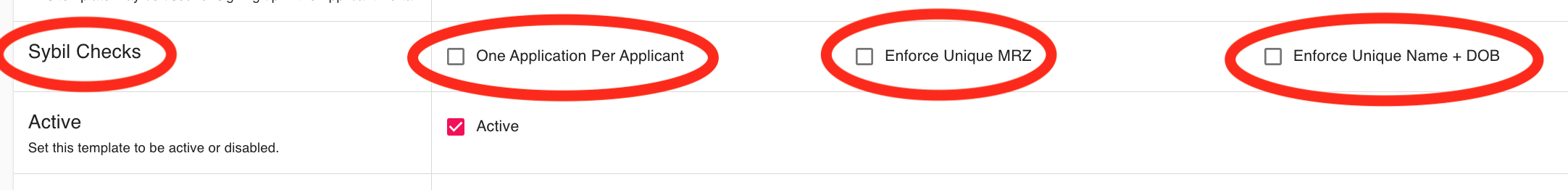

How to disable sybil checks?

To enable or disable Sybil Checks, simply open the KYC Template where you want to manage these checks, then check or uncheck the desired verification options (One Application Per Applicant, Enforce Unique MRZ, or Enforce Unique Name + DOB). Make sure the "Active" checkbox is selected for your changes to take effect, save changes:

How to customize an existing template?

- Go to the KYC templates tab (left-side main menu)

- Choose the template you would like to edit and click on the View & Modify button (magnifying glass icon on the right side of the template)

- Edit the desired fields, scroll down and click Save

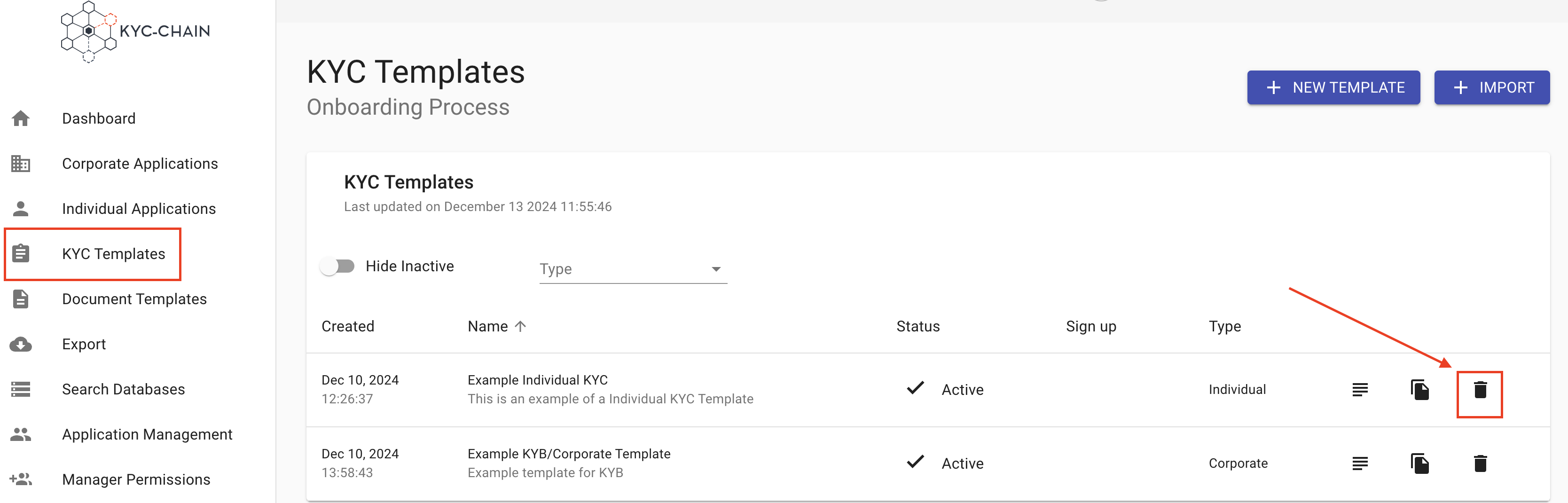

How to delete an existing template?

- Go to the KYC templates tab (left-side main menu)

- Choose the template you would like to delete and click on the Trash icon.

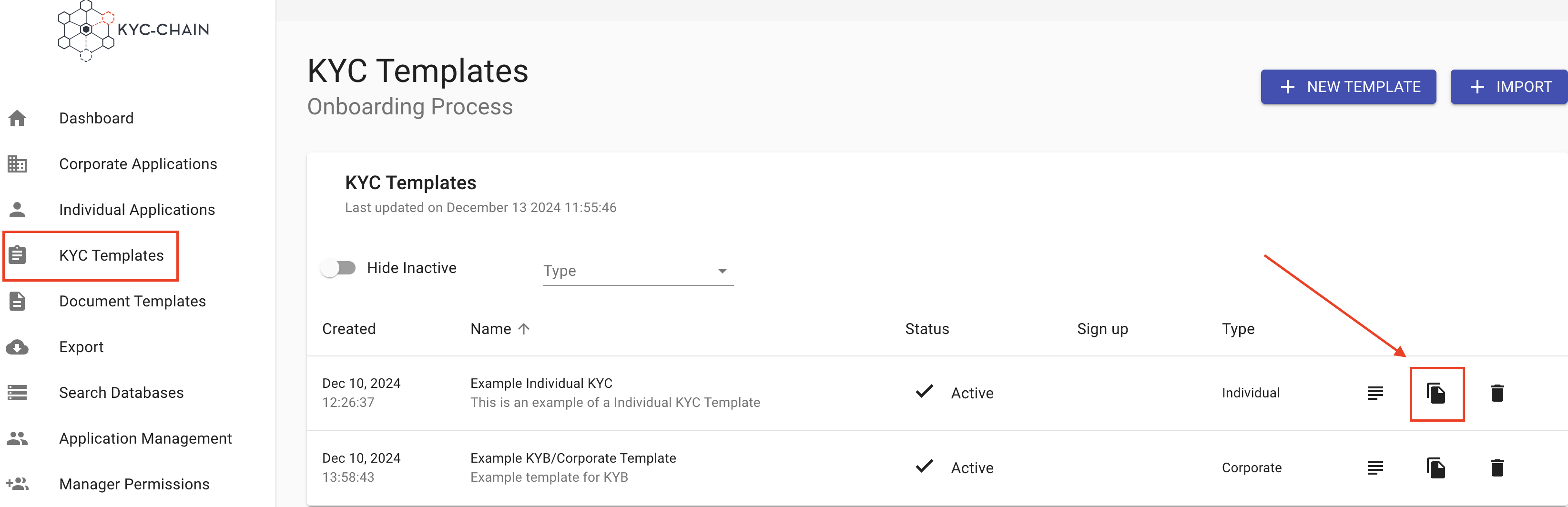

How to duplicate an existing template?

- Go to the KYC templates tab (left-side main menu)

- Choose the template you would like to duplicate and click on the Duplicate button (copy icon).

How to access the demo or sandbox environment?

When your KYC instance is deployed, it is set to demo mode by default, allowing you to begin running tests immediately. However, if you would like to perform real checks on actual data, please open a ticket to request that our team switch your instance to live mode. Please note that you will be charged for each real check completed.

If you need an additional sandbox environment separate from your live environment, please also open a ticket. Our support team will get back to you as soon as possible.

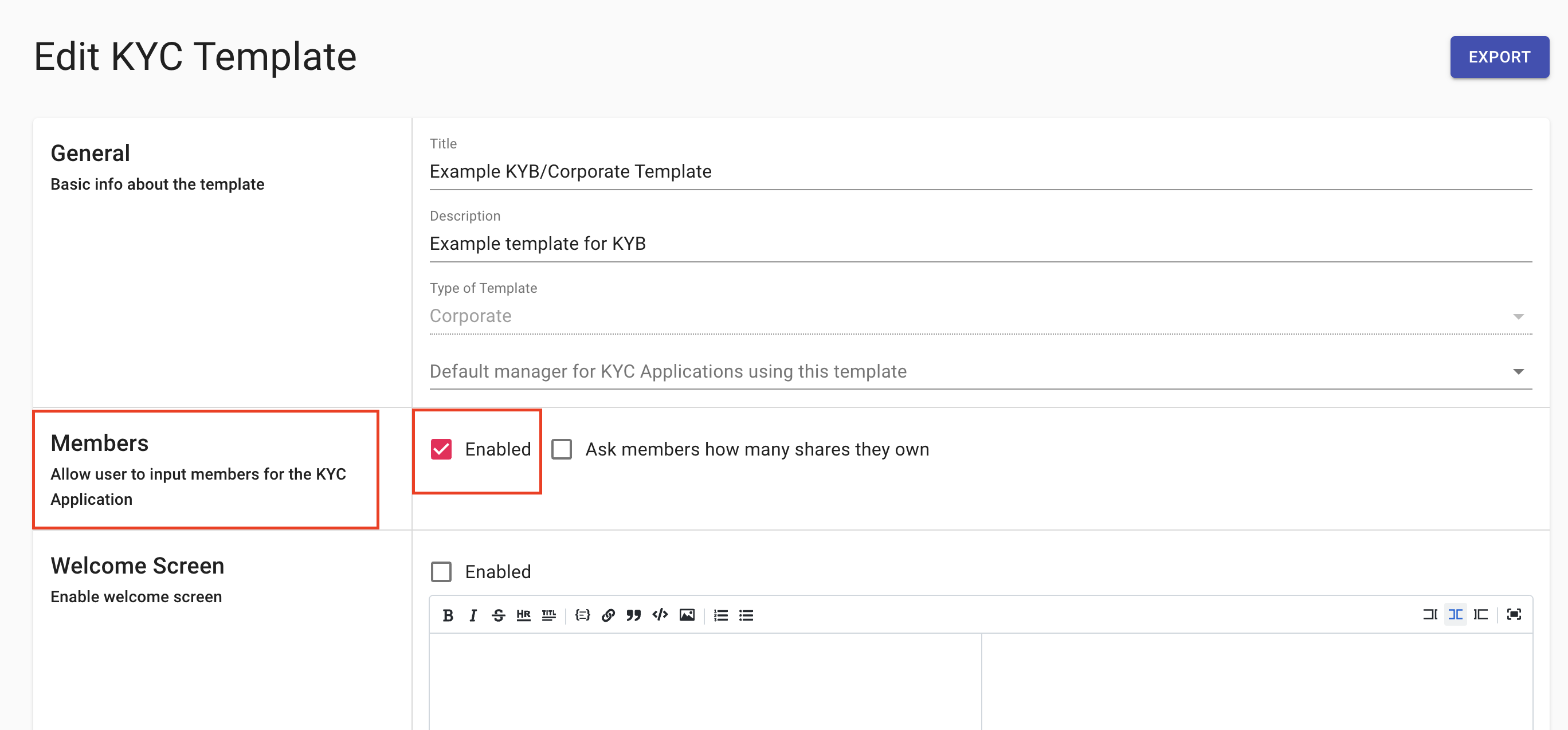

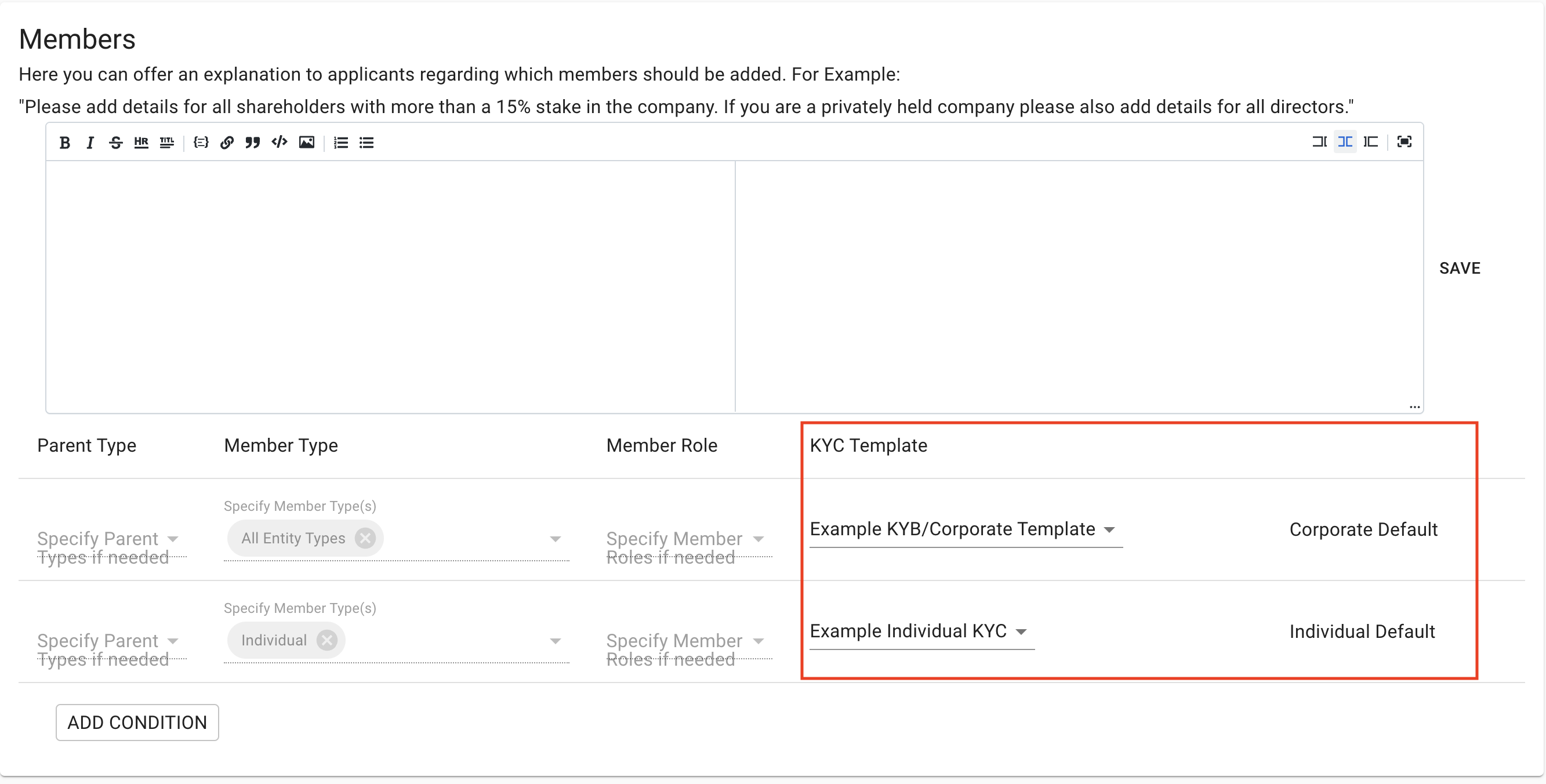

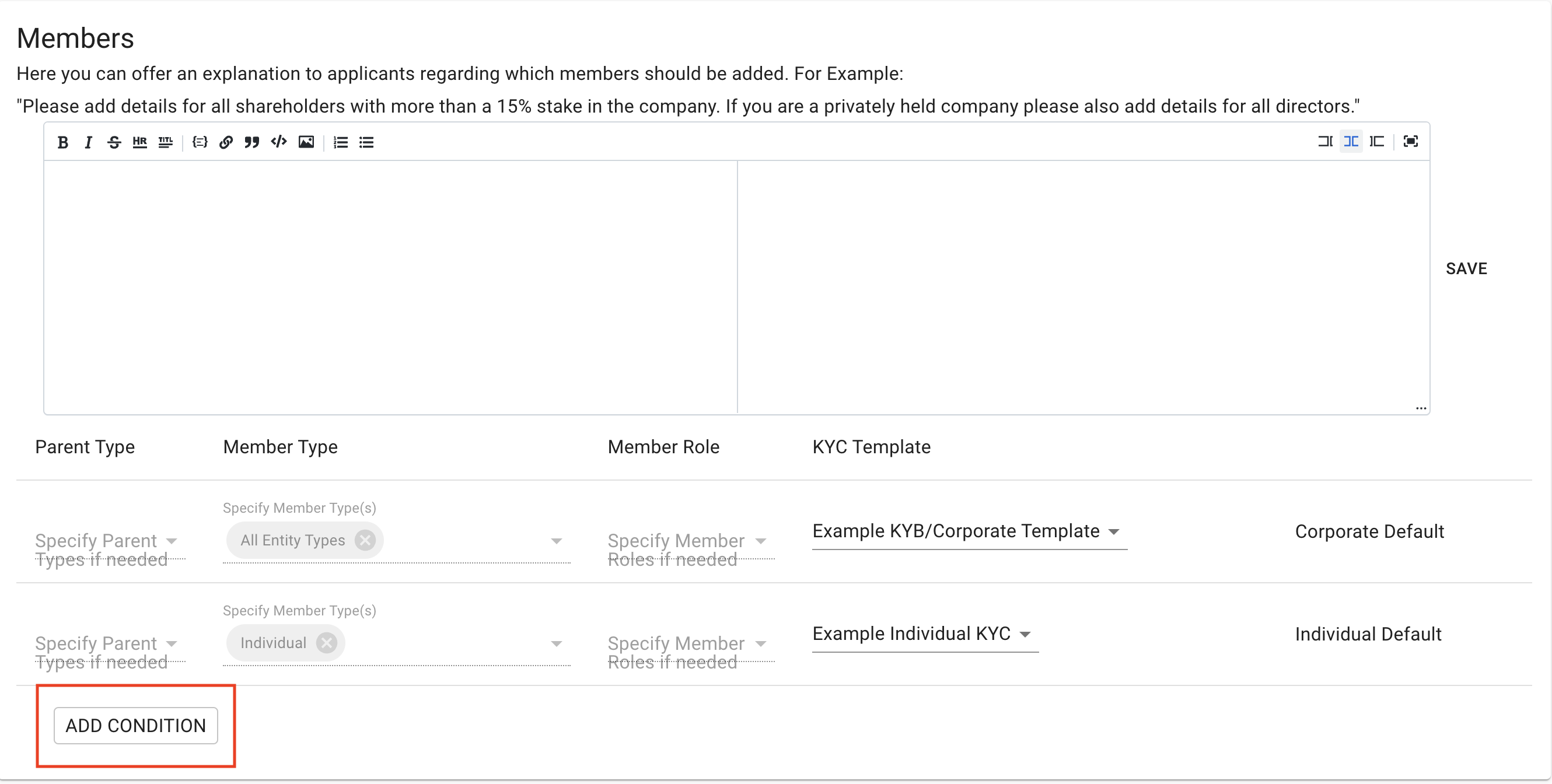

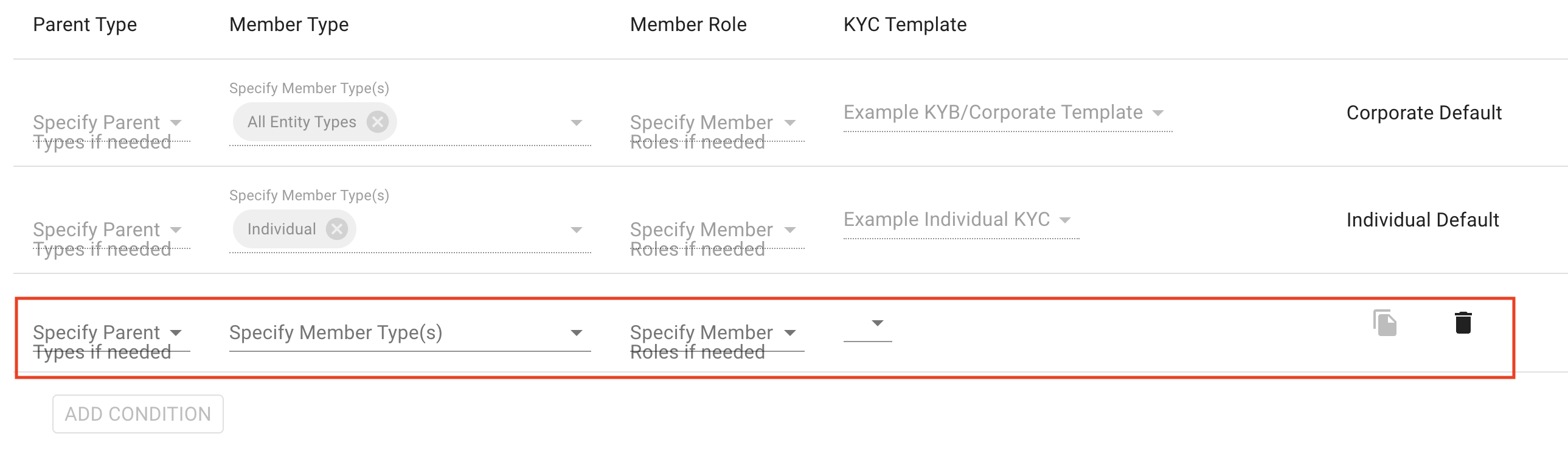

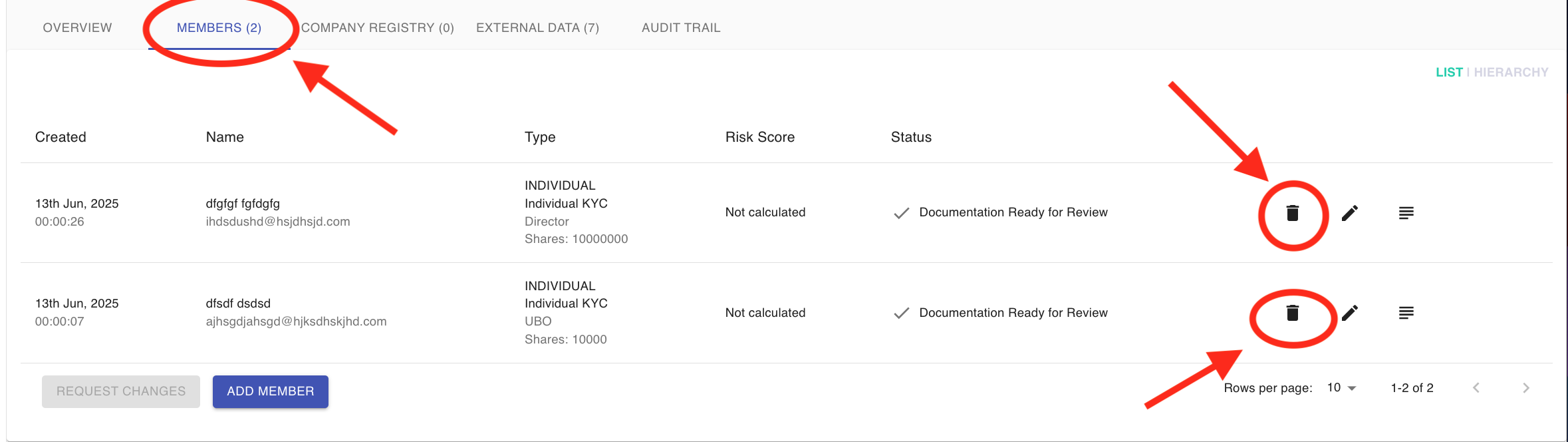

How to customize KYC requirements for members of a KYC Process?

The KYC-Chain application allows for members to be added to applications, and you can specify different requirements for them using the Member Templates section at the bottom of the KYC Template edit page.

- Go to the KYC Templates tab (left-side main menu)

- Choose a "corporate" template, and click "edit".

- Check the "Enable" checkbox in the Members section and then click "save".

- Scroll to the "Member Templates" section and select your chosen default KYC templates for Individual and Corporate members.

Note: If you'd like to set up your template so that a member's assigned KYC Template depends on the member's role and the parent company's legal entity type, then you can add more member template conditions to accomplish this:

- (Optional) Add a new condition and select any number of Legal Entity Type(s) and Member Role(s), along with the KYC template that you would like KYC-Chain to assign to new members who fit these criteria. Please note that each member template condition only works for either individual or corporate members, and this is determined by the type of the KYC Template you select. For example, a condition with "Foundation," "UBO," "Individual Template," etc... can only assign that template to individual UBOs of the foundation. To assign a similar corporate template to corporate UBOs, you can create a similar condition: "Foundation," "UBO," "Corporate Template," etc....

(Image reference to Image1UD3.0.png seems like a duplicate or placeholder from original doc, using Image19UD4.1.png as primary)

(Image reference to Image1UD3.0.png seems like a duplicate or placeholder from original doc, using Image19UD4.1.png as primary)

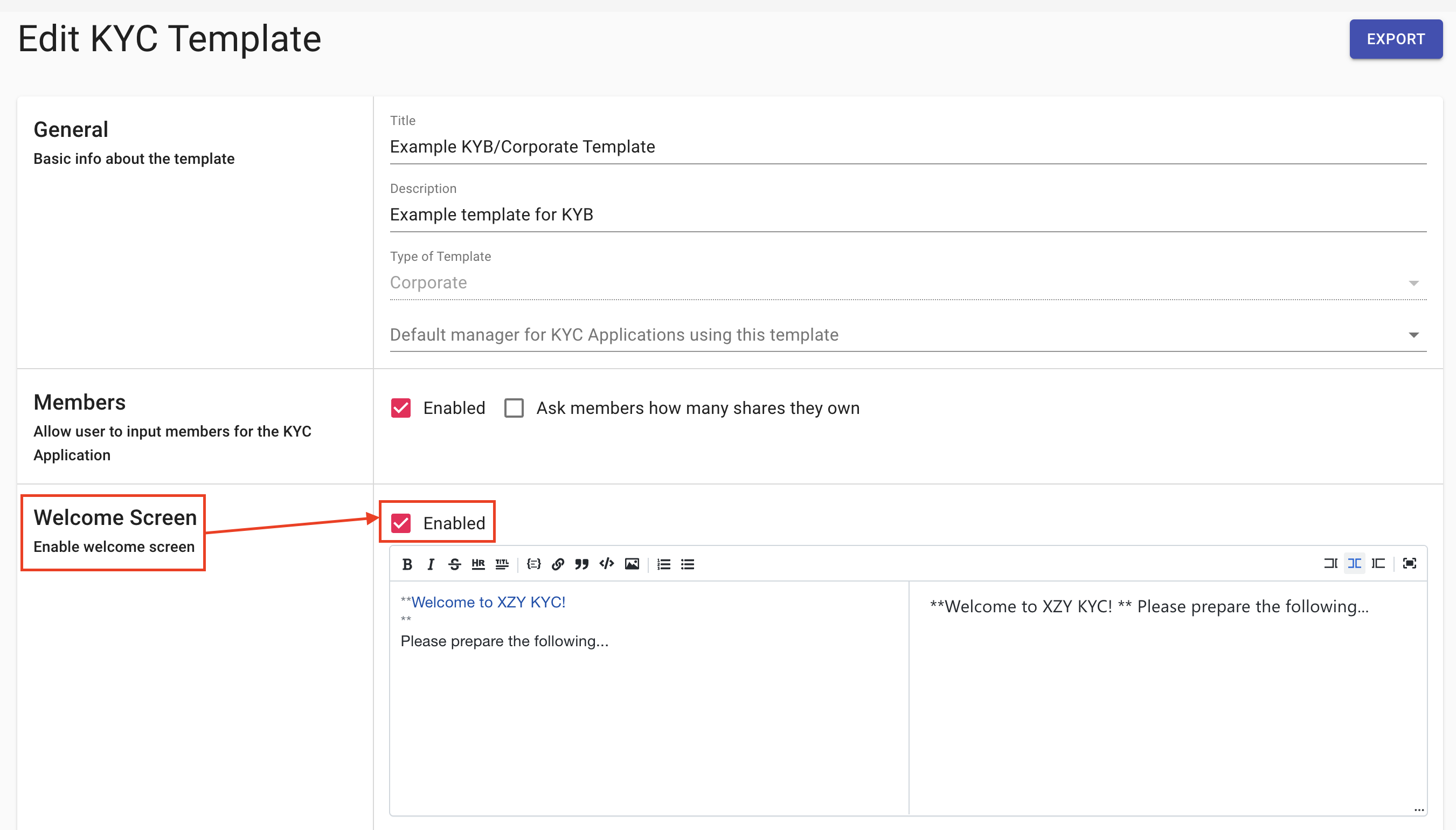

How to add and customize a welcome message?

If you add one, the welcome screen is the first screen your users will see when they start the on-boarding process. You can describe what information applicants will need to provide during the process, as well as your notarization/translation rules, and any other information you'd like to provide.

- Open a KYC template

- Scroll to the Welcome Screen section

- Check the Enable checkbox

- Add the text of the welcome screen and check the preview to confirm the styling

- Scroll down and click the Save button

How to set a default manager for new KYC Processes?

You can add a default manager to KYC templates so that all new processes with this template will be automatically assigned to a specific manager as soon as they are initiated.

- Open a KYC template

- In the General section, select a default manager from the drop-down list

- Scroll down and click the Save button

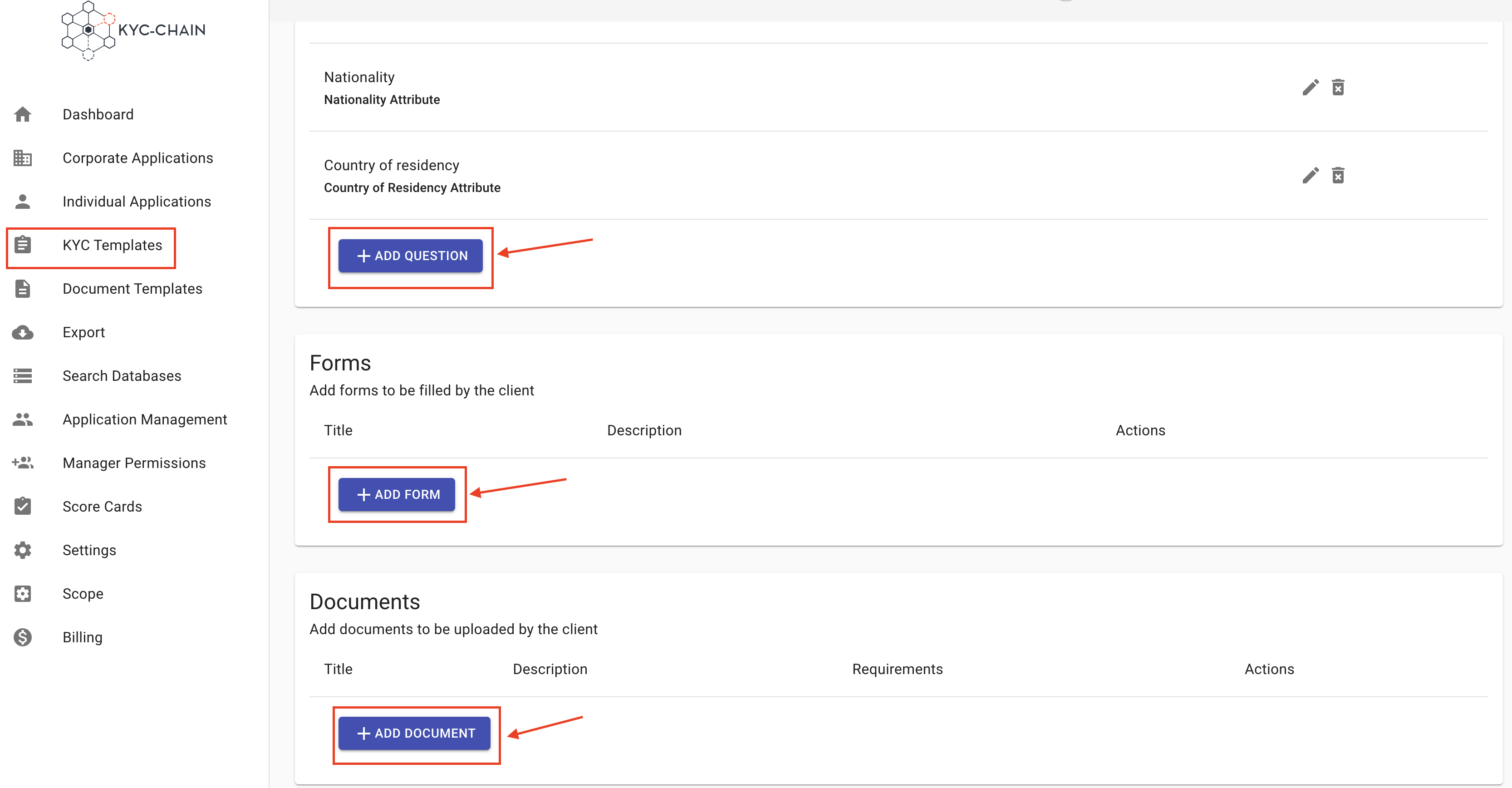

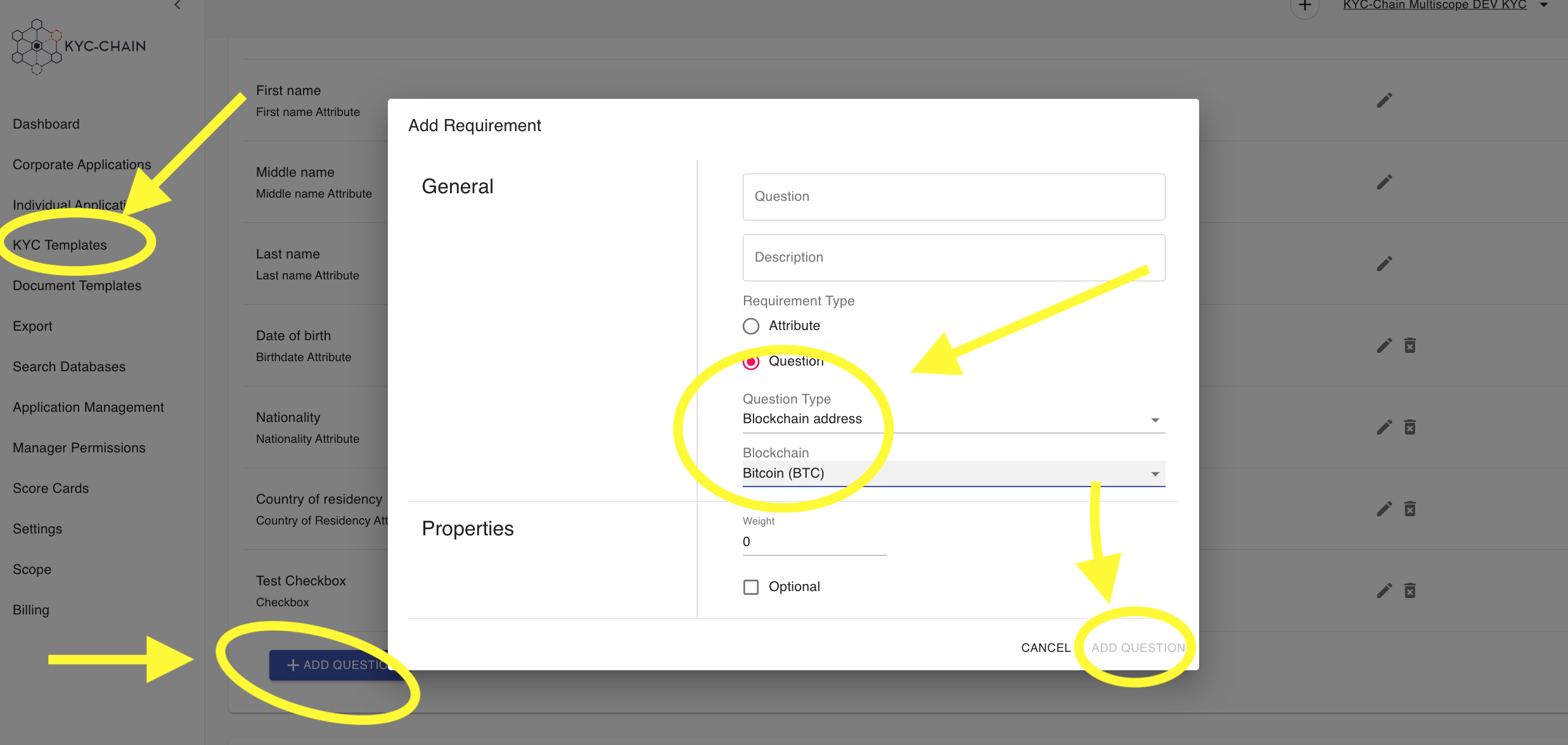

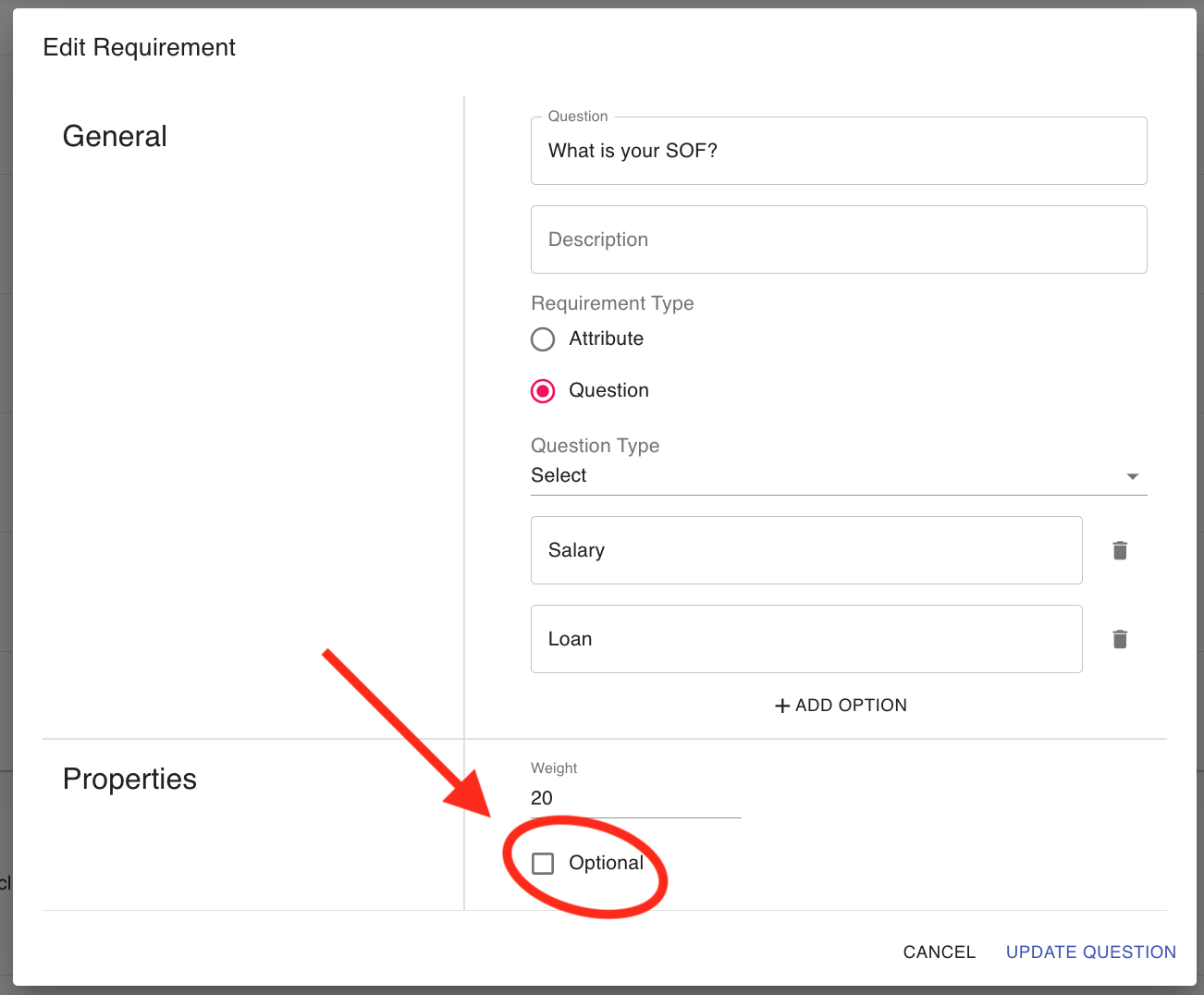

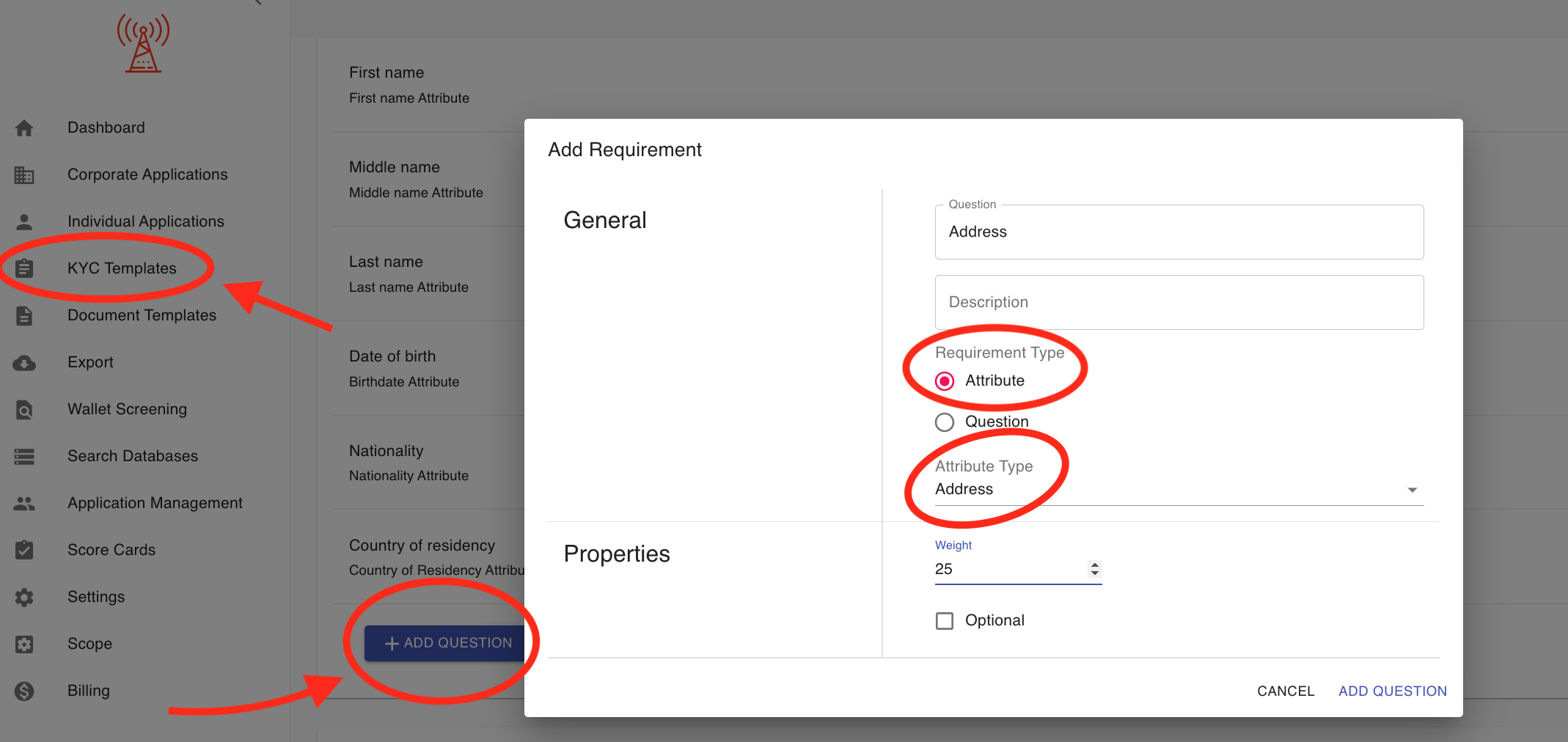

How to add KYC requirements (documents, forms, and questions)?

You can fully customize a KYC Template's requirements to your needs. KYC-Chain provides three types of requirements: Documents, Forms, and Questions.

- Documents: Documents are requirements which the applicant will upload from their computer. They are most often used to request scans or photos of official documents (e.g. Passport, Utility Bill, Company Registry, etc.).

- Forms: Forms are requirements which come in the form of a PDF file that the applicant needs to add information to. The applicant will be prompted to download the pdf form, fill it out on their device, and then upload the filled copy. Forms can be created and configured in the Document Templates section of KYC-Chain.

- Questions: Questions are requirements that require text input from the applicant. They are used to request details in text format (e.g. Date of birth, Taxpayer Identification Number, Residence Address, etc.).

After you've created a KYC Template, you can add documents, forms, and questions by clicking on the respective buttons.

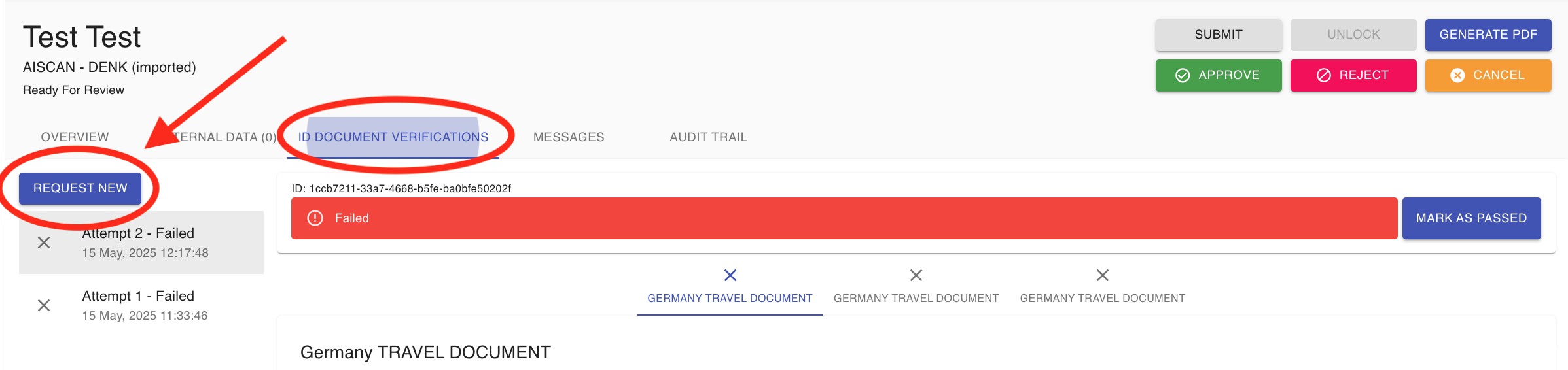

How do I troubleshoot issues with ID document verification, such as failures or delays?

1. Request a Re-upload

If an applicant’s ID document verification fails or returns an ‘Unknown’ status:

- Request Re-upload: You can ask the applicant to re-upload their ID document. To do so, navigate to the application’s ID document verification section and click the ‘Request New’ button.

2. Assisted Upload (Easy Fill)

- As a manager, you can re-upload a document on the applicant’s behalf using the Easy Fill feature. Simply click the ‘FILL’ button within the application, upload the new document, and then click ‘SUBMIT’ to initiate the verification checks. This feature is especially useful for Member KYC scenarios—such as when an applicant submits an ID document for a corporate member that fails validation. In such cases, the manager has the option to upload a new image and complete the process on the member’s behalf.

Common Reasons for Document Scan Failure and How to Address Them

- Expired Document: The ID document is no longer valid.

- Manipulated Document: The ID document appears to have been altered or tampered with.

- Poor Quality Copy: This is a frequent cause of failure. Advise the applicant to provide a high-resolution, uncropped, and clear photo of the physical ID document. Avoid using scanned copies, images with noticeable enhancements (such as altered brightness), or low-quality submissions.

Tips for Taking the Perfect Photo:

-

Capture the entire document; partial images are not sufficient.

-

Ensure the image is in focus. Using a mobile camera with at least 5 megapixels is recommended.

-

Only the ID should be visible in the image—remove any background clutter.

-

Avoid glare, shadows, or using the flash, which can obscure details.

-

For passports, only upload the data page; other sides or pages will not be accepted.

-

Data Extraction Issues: If the system cannot properly extract data from the ID document, a clearer or alternative document may be required.

-

Alternative Document: If quality issues persist, ask the applicant to provide a different form of ID if available.

For Delays or If Verification Is Not Progressing

- Application Submission: Ensure the applicant has fully completed and submitted their application. Verification checks, including ID document verification, are automatically triggered once the application is submitted and the status is ‘Documentation Ready For Review.’

- Browser Optimization: For best performance, make sure your browser is up-to-date, clear your browser cache, and use Google Chrome.

If you have any questions or encounter issues, please contact our support team for further assistance.

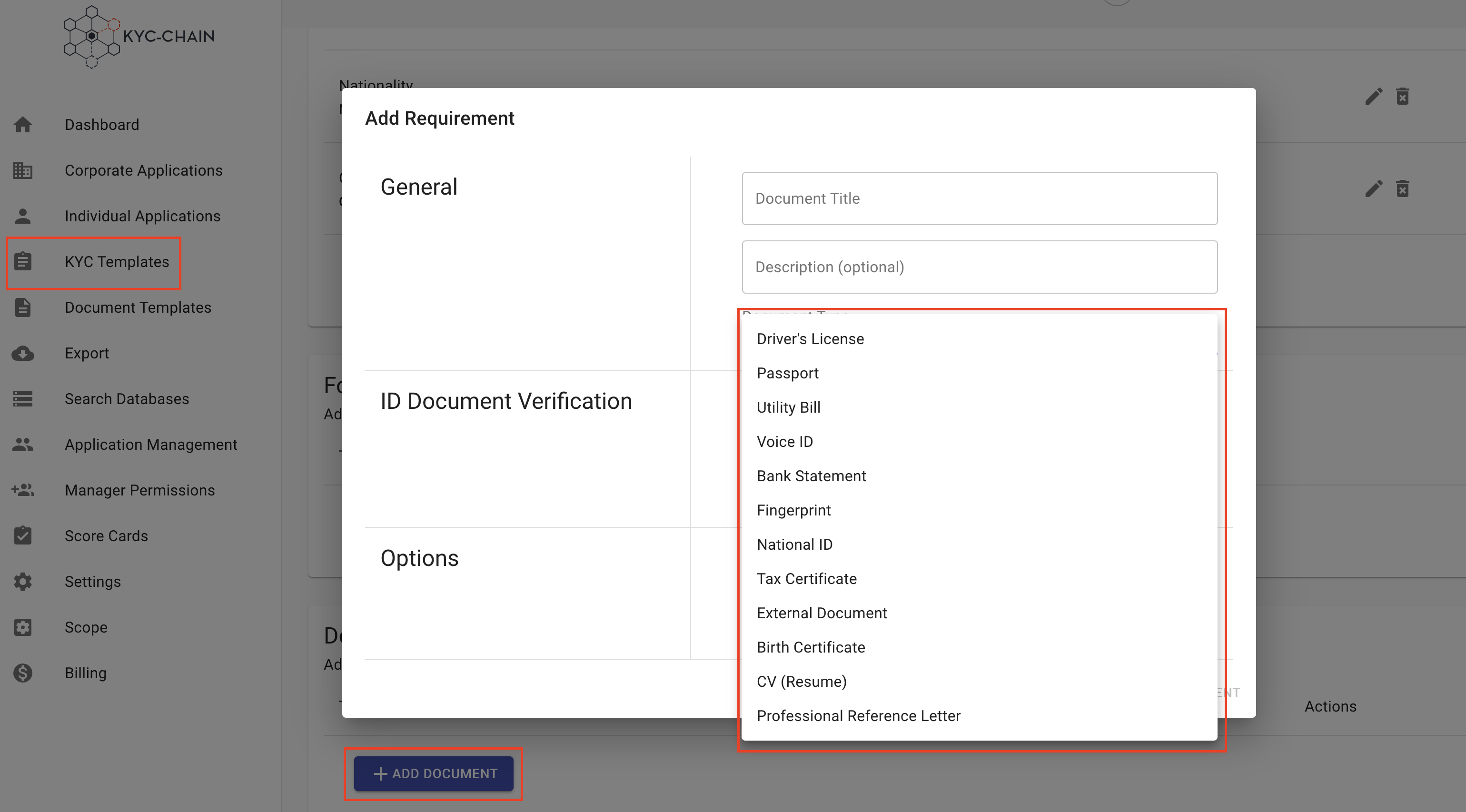

Add & Edit Documents:

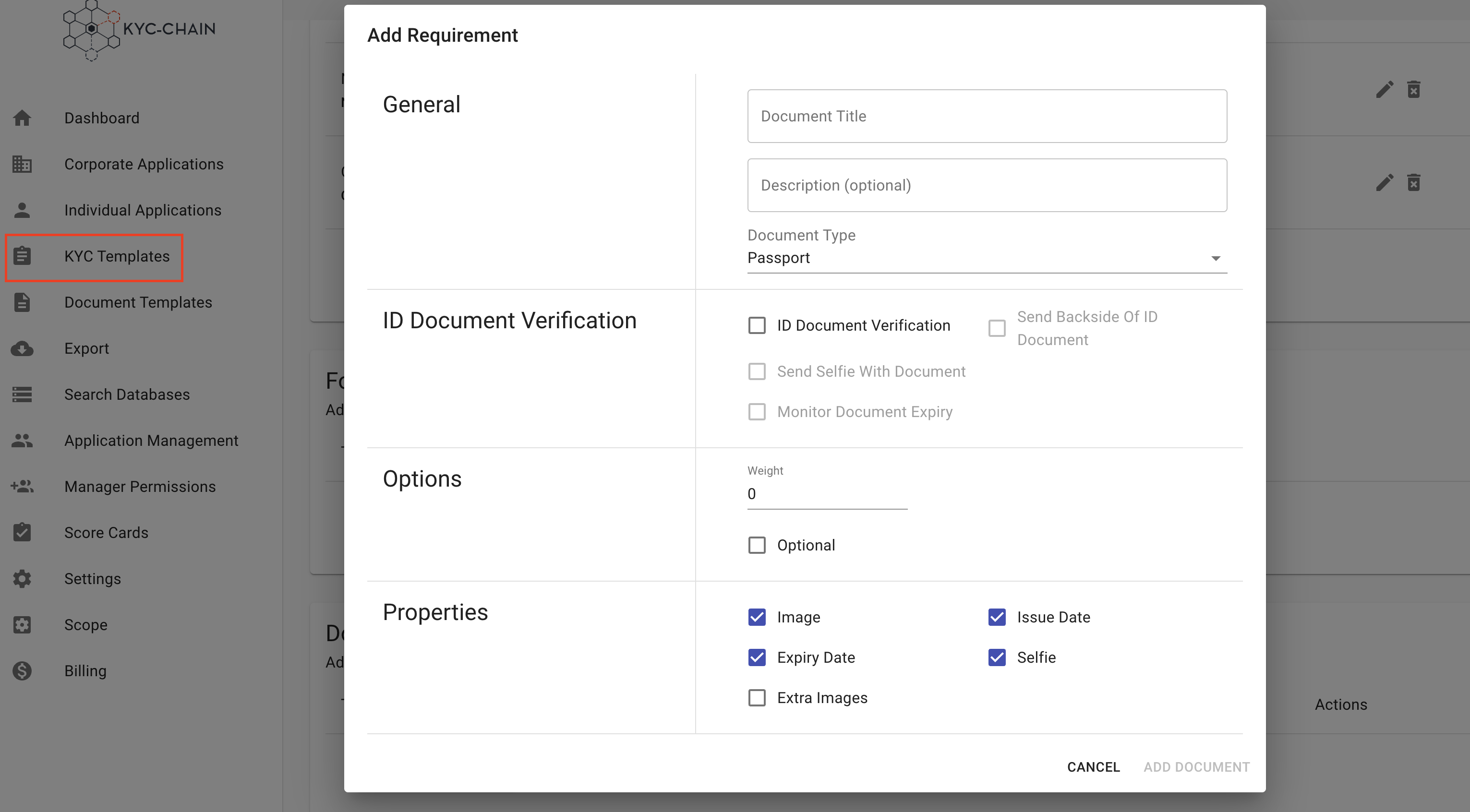

- General: In the "Document Title" and "Description (optional)" fields, enter general information about the document. The title and description will be visible in the customer portal.

- Select a document type: You can pick the appropriate type for the requirement, or select “External Document” type if none of the other options are appropriate. To be given the option of enabling ID Document Verification functionality, select the "Driver's License," "Passport," or "National ID" document type.

- ID Document Verification: If you have selected either "Driver's License," "Passport," or "National ID" document type, you will enable the following options:

- ID Document Verification - Select this option if you want to trigger ID Document Verification.

- Send Backside of ID document (for Driver's License and National ID) - Select this option if you want the end user to take a photo or send an upload of the backside of the Identification card for additional document verification purposes.

- Send Selfie with Document (for Passport and National ID) - Select this option if you require the end user to send a selfie for additional verification.

- Monitor Document Expiry - If this feature is enabled in your KYC-Chain package, you can select this option to have the system send an alert when the client ID documents are set to expire.

- Options: If you'd like to change the ordering of your documents, you can add a numeric weight to the document. The customer portal will display documents in weighted order (from lowest to highest weight).

- If you want the applicant to be able to skip the upload of this document, you can check the "Optional" box.

- Properties: Select the properties you'd like the user to provide. Each document type has specific properties that pertain to it. At least one property must be selected.

- For Passport Documents you can enable up to 2 Identity Verification checks

- ID Document Verification: Perform a verification check on the passport image

- Compare selfie with Passport image: If the selfie property is enabled, you can compare this image with the applicant's picture in their passport.

- Click the Save button.

Add & Edit Forms:

- General: Enter general information about the form. The title and description will be visible in the customer portal.

- Select a document form from the dropdown. This list shows all of the active KYC Document Templates in your instance.

- Options: If you'd like to change the ordering of your forms, you can add a weight. The customer portal will display forms in weighted order (from lowest to highest weight).

- If you want the applicant to be able to skip the upload of this form, you can check the "Optional" box.

- Click the Save button.

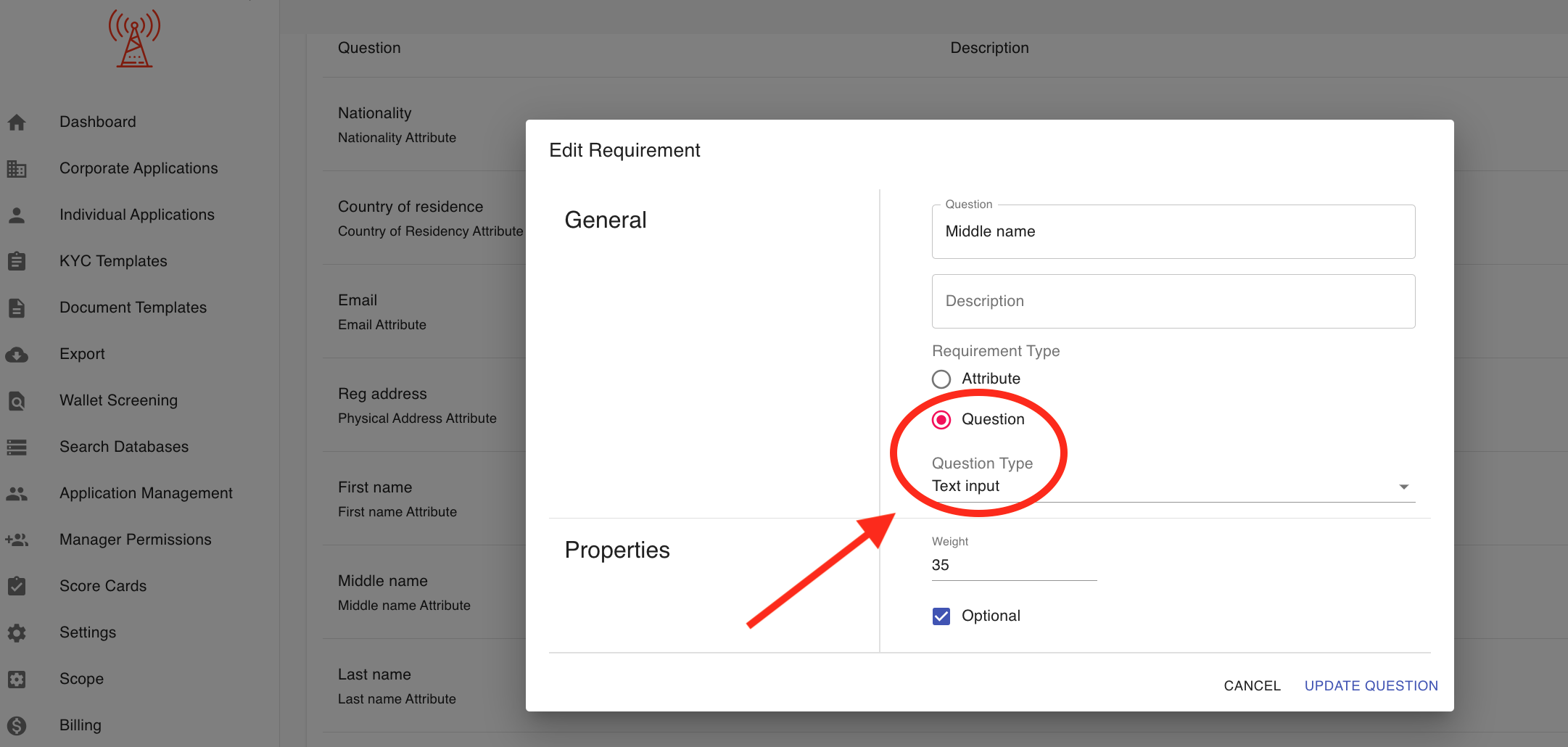

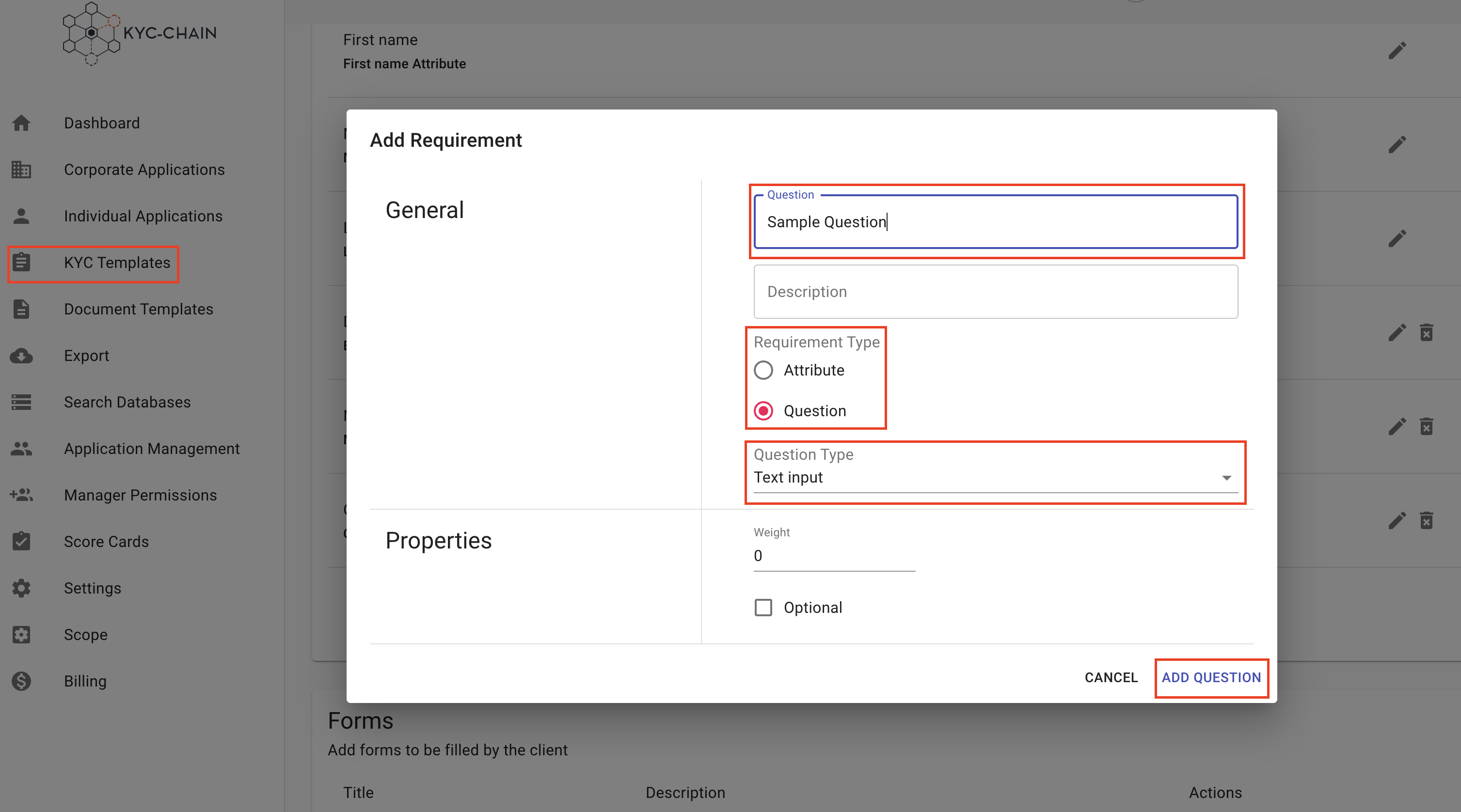

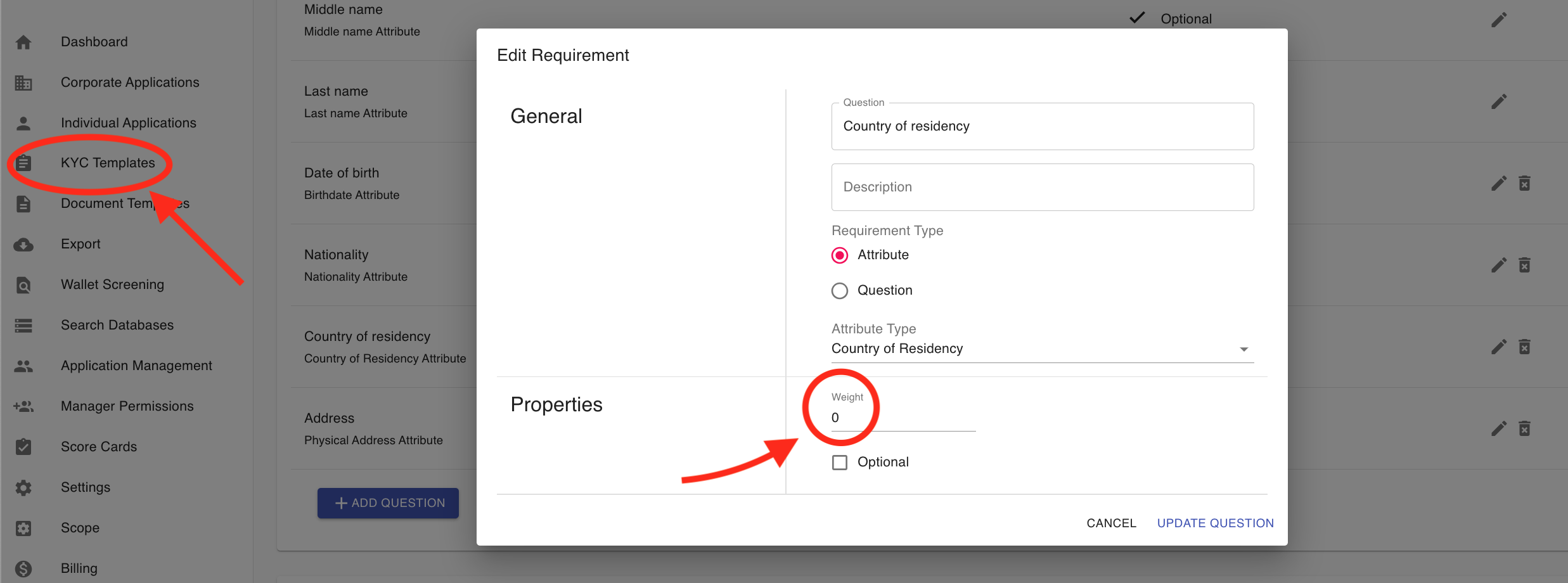

Add & Edit Questions:

- General: Enter general information about the question. The question and description will be visible in the customer portal.

- Select either a question type, or an attribute type. Please see more about the difference between these choices below this list.

- Properties: If you'd like to change the ordering of your questions, you can edit the numeric weight of the question. The customer portal will display questions in weighted order (from lowest to highest weight).

- If you want the applicant to be able to skip this question, you can check the "Optional" box.

- Click the Save button.

- Question types allow you to enforce a format for the applicant's answer, even if the question is not a common one in our list of attribute types. For example, the question "What is your favorite color?" can be left as a text input, whereas the question "What is your favorite country" can be given the "Country" question type so that the applicant will be given a list of countries to pick from.

- Attributes are specific, common pieces of information that you might require from an applicant. Not only do these attributes sometimes enforce the format of an answer (phone number, BTC address, Date of Birth, etc.), but they also allow our software to take actions with the answer that's provided. For example, the response given to a Nationality attribute can be used automatically for sanctions checks or risk scoring because our system knows that the answer is the applicant's nationality. If the "country" question type had been used instead, our system would not know that the response is the user's nationality.

- With this in mind, it is often best to use an attribute unless your question doesn't appear on the list of attributes, or if you have already used that specific attribute in this KYC Template. For example, if you need the primary and secondary address of an applicant, you can add the "Address" attribute for the primary address, and add a question with the "Address" type for the secondary address. This will avoid confusion about which value should be treated as the applicant's address by our system when cross-referencing it.

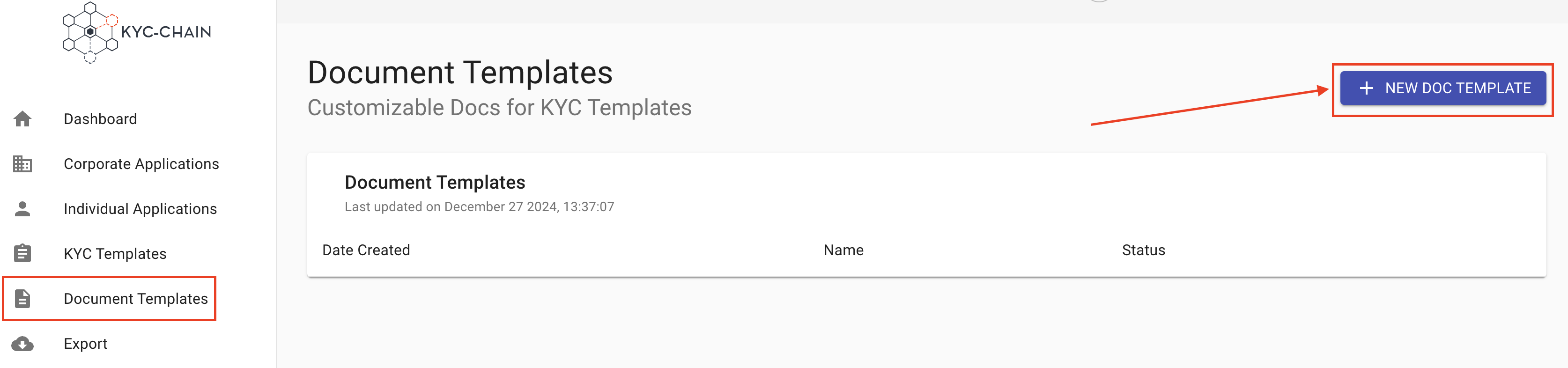

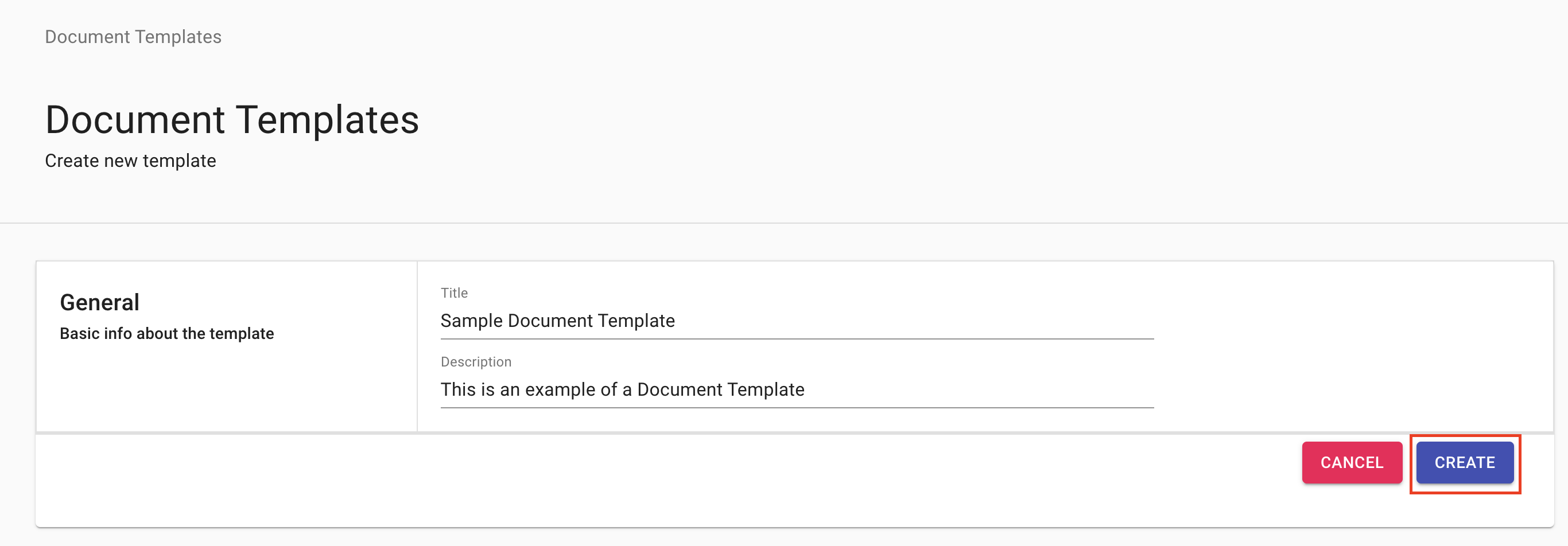

4.2 How To Create a Document Template:

Managers can customize the documents used in the KYC-Chain templates and create a form to fill out online, fully adapted to a specific process:

- Click on "+ New Doc Template".

- Fill out the basic information and click "Create".

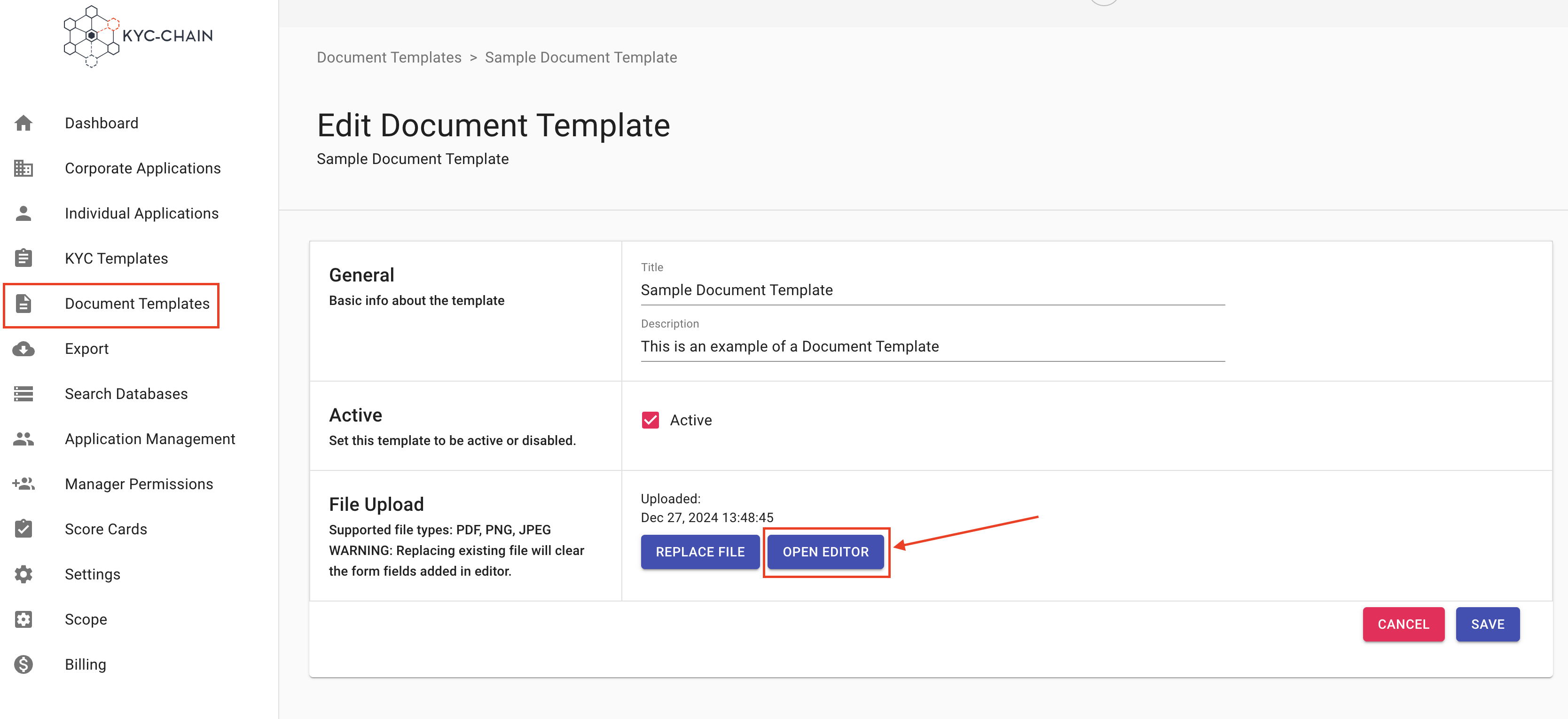

- Choose the PDF file you'd like to upload.

- Activate the document template so that it can be added to KYC Templates as the Legal Document or as a form.

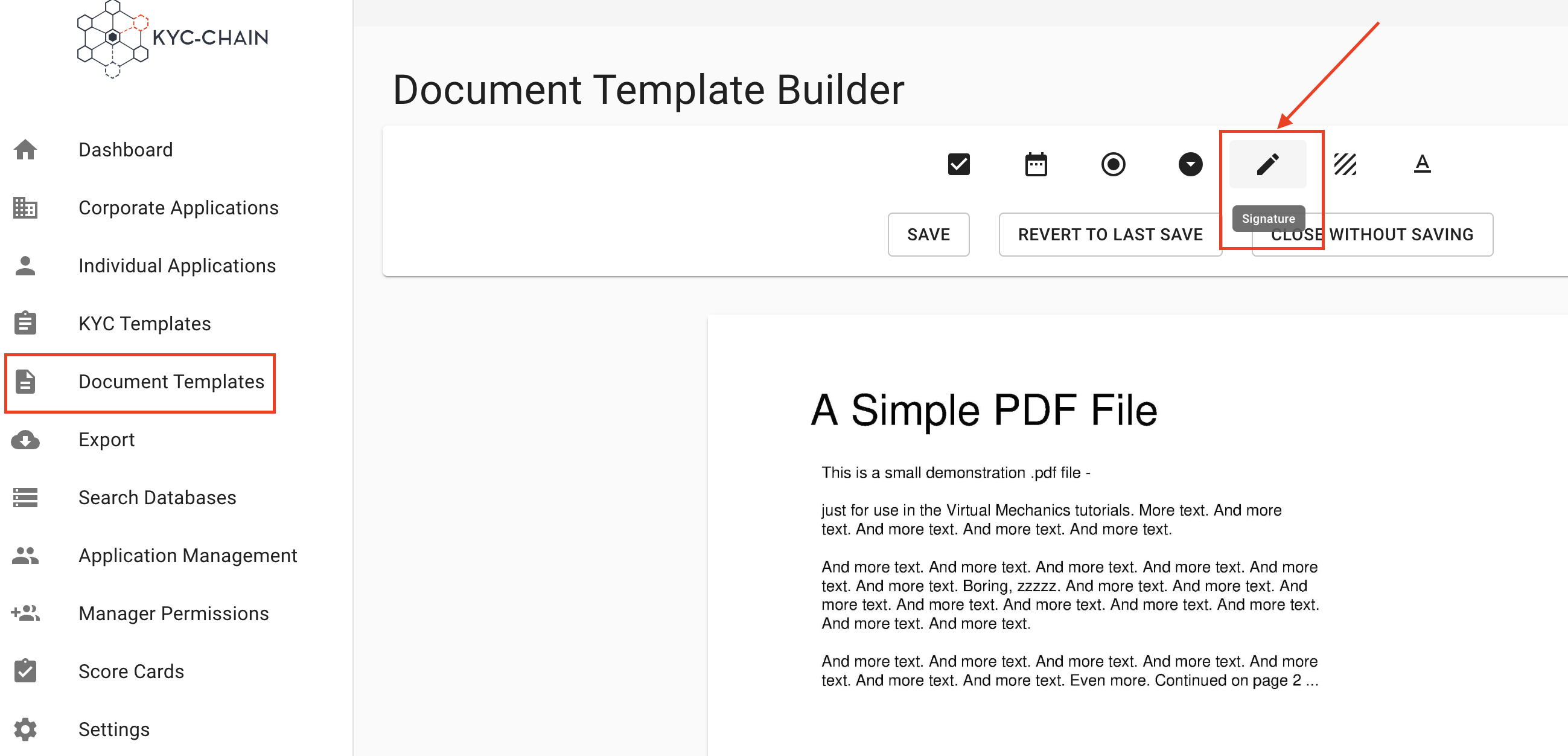

How to add a signature field to the document using KYC-Chain’s online form editor?

The manager can add a signature field to the document which the applicant will be able to sign if the document template is added as the Legal Document for a KYC Template. If this doc template will be added as a form then the user will download it as a PDF and the signature field will not be visible.

After you've uploaded a Document Template, you can open the editor and add a signature field by following these steps:

- Click on the Open Editor button.

- Drag and drop the signature box into the desired location in the document.

- Click on the preview button at the top of the page to see a live preview of the document.

- Click on the save button to save your changes or cancel to cancel all changes.

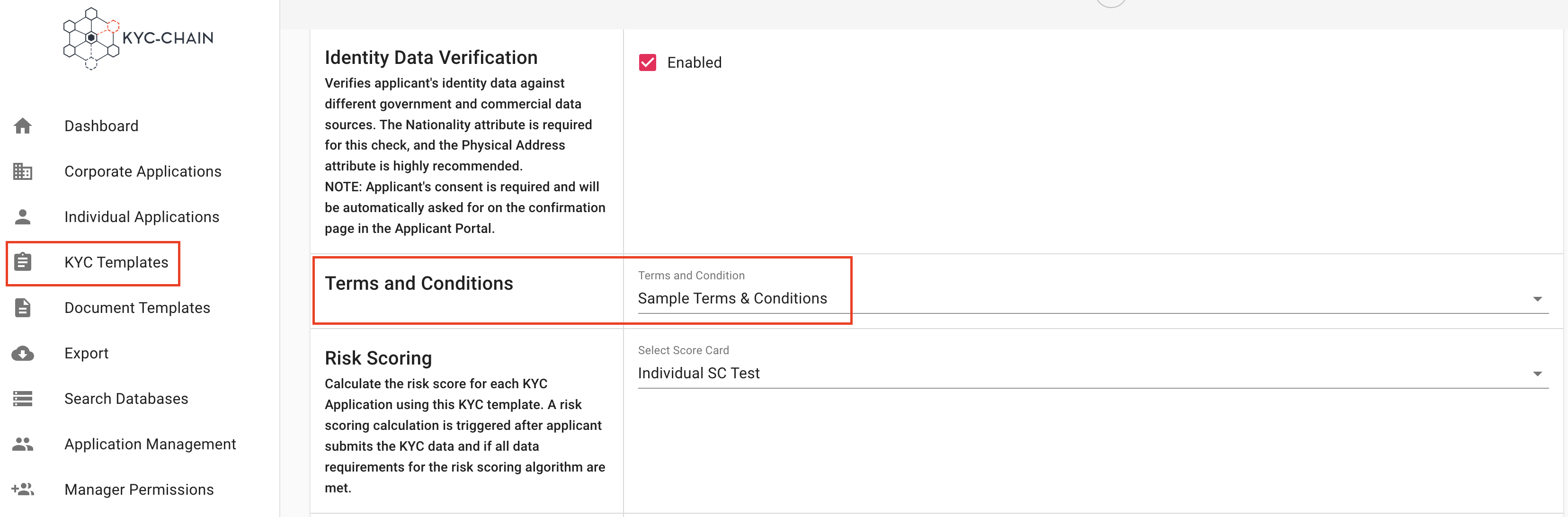

How to add the Terms & Conditions (create a Document Template)?

Management Users can upload the Terms & Conditions to which applicants must agree to start the KYC process. These Terms & Conditions are displayed on the dashboard throughout the process. To do that, the manager has to create a new Document Template and add it to the correct KYC template:

- Once you have created the Terms and Conditions in Document Templates, go to KYC Templates on the left side menu. Choose the Template where you want to add the Terms & Conditions and click on the View & Modify button (format text icon). (Original doc mentions [INSERT IMAGE 32], placeholder kept if needed)

- Once in the correct “KYC Template”, all that is required is to add the document template that contains the Terms & Conditions. For that, scroll down to the Legal Document and select the Terms and Conditions under Select Legal Document then click on Save:

Important when uploading the Terms & Conditions documentation:

- It must be a PDF File.

- If your Terms & Conditions are composed of several documents, you will have to combine them into a single PDF file (not exceeding 42 pages regardless of the file size).

- When you have added your Terms & Conditions, please double check how they are displayed on the user interface. Make sure that the title of the document is displayed correctly in the customer portal. If not, don’t hesitate to edit your document and upload it again:

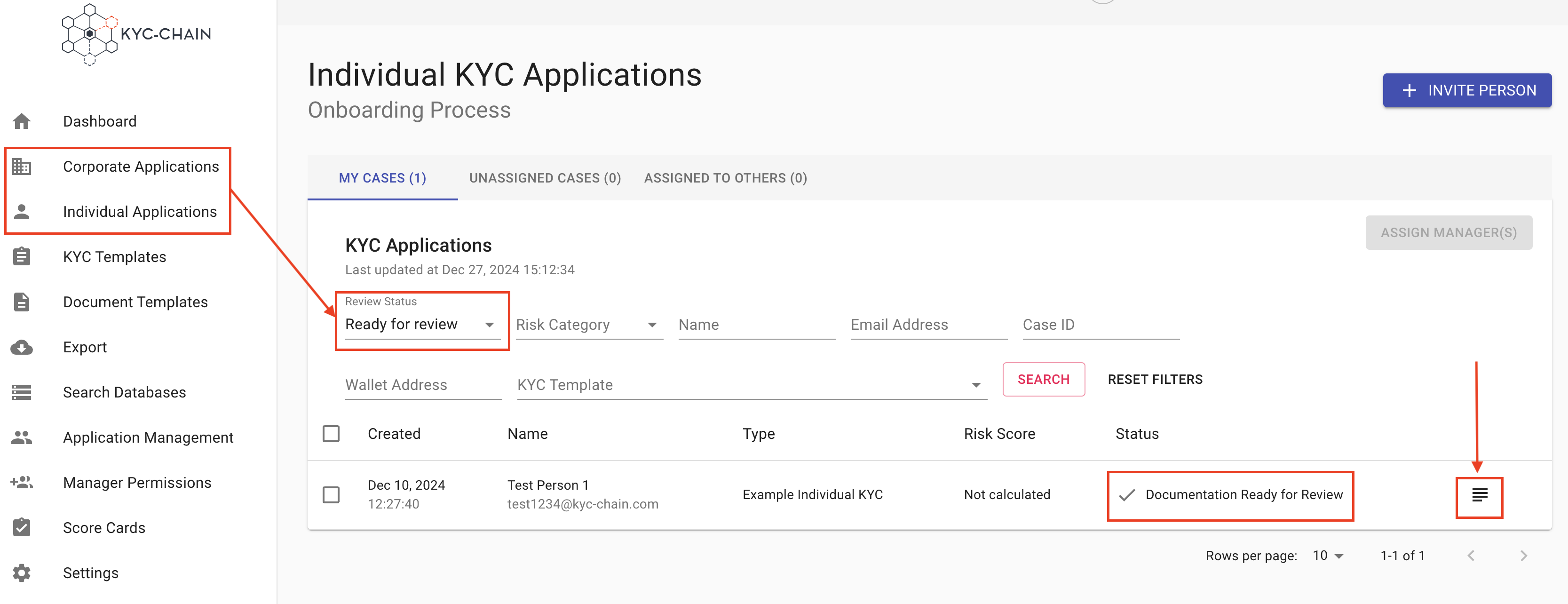

4.3 How To Check if a KYC Application is Ready for Approval?

Management Users can see indicators when cases are ready for approval. They can filter all cases specifically for those that are approved.

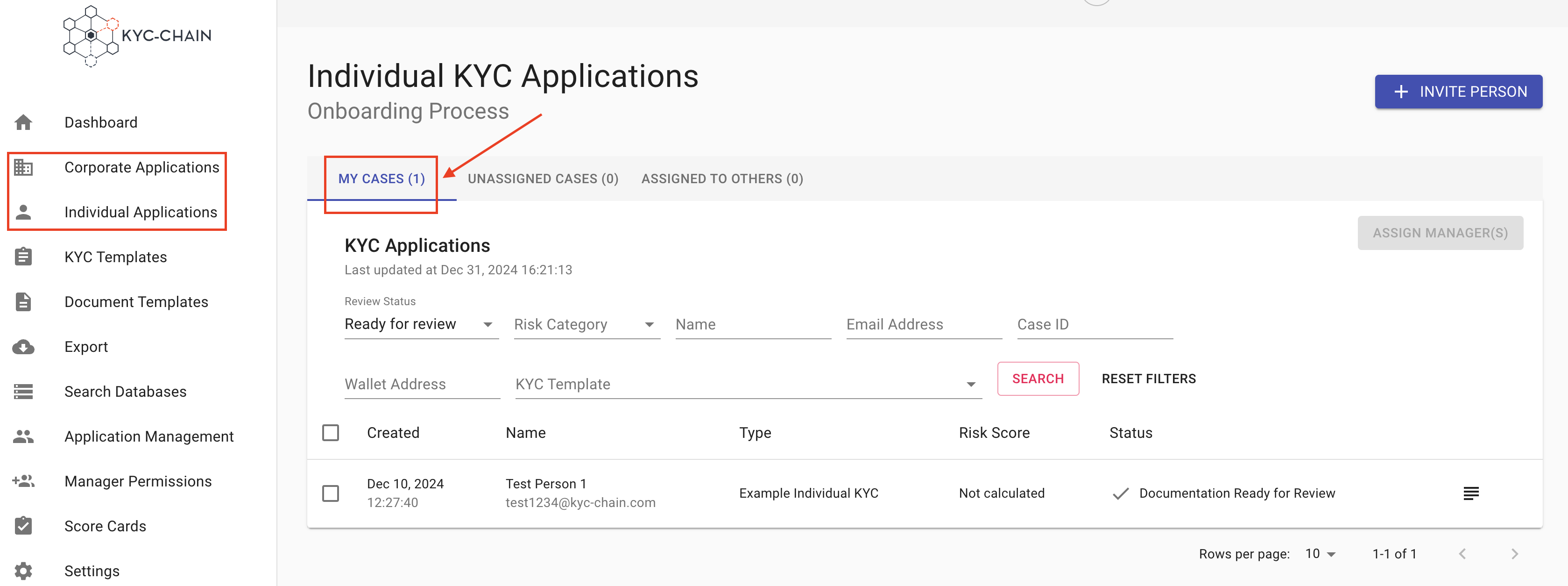

- Select the Corporate or Individual Processes tab on the left side menu. An overview of all the cases will show.

- Cases ready for review display the status "Documentation Ready for Review”.

- Click on the View button to open the case and review details that the user has provided.

To only display processes that are ready for review, managers can enable the "Ready For Review" slider.

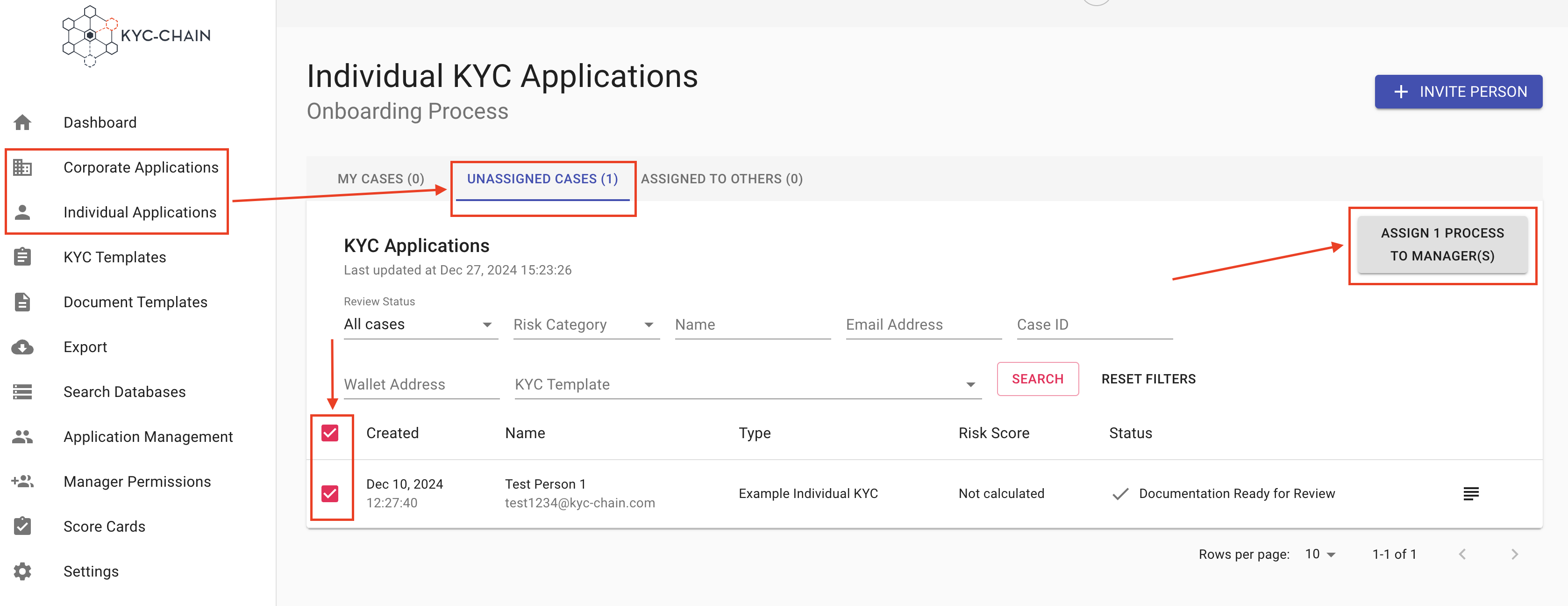

4.4 How To Assign Managers to Review KYC Applications?

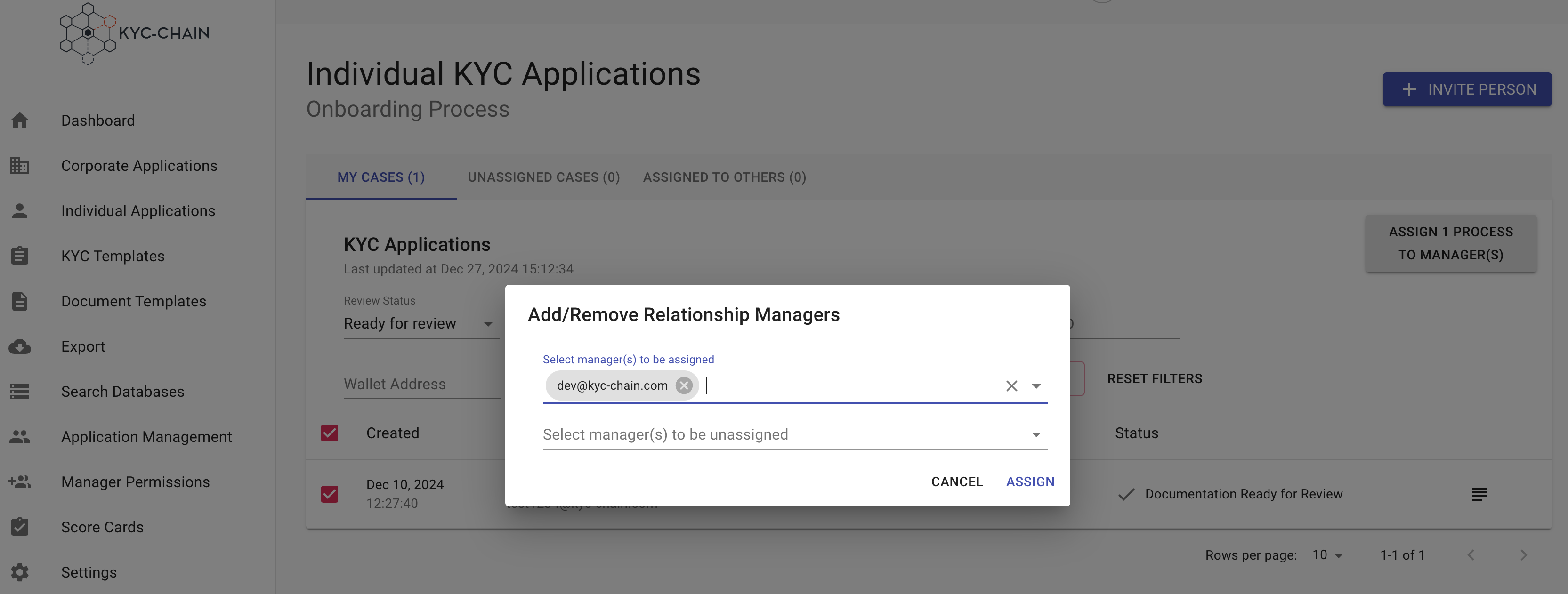

Management Users can select multiple cases for assignment to other KYC reviewers, or they can review and assign cases on a one-by-one basis. To bulk assign managers:

- Select the Corporate or Individual Processes tab on the left side menu. An overview of all the cases will show.

- Navigate to the Unassigned cases tab.

- Select cases you wish to assign and click on the Assign Manager button.

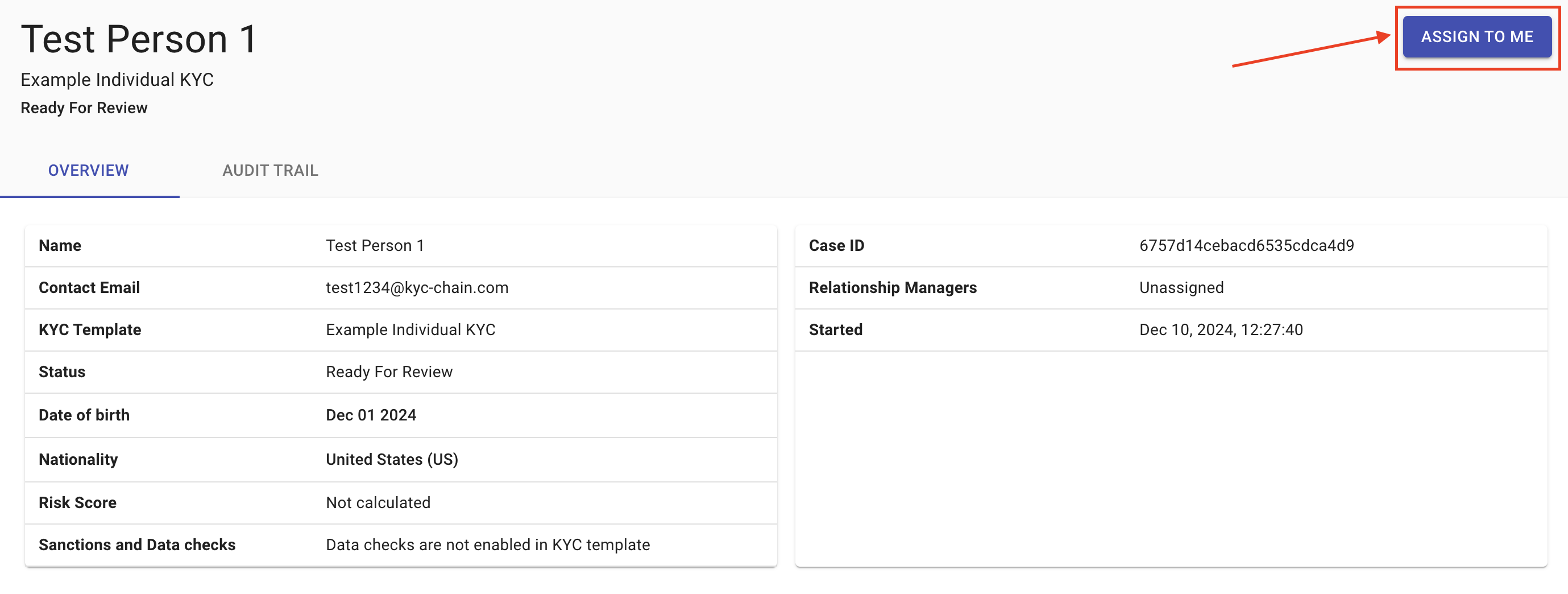

To assign yourself as manager to one process, simply view that process and then click the "assign to me" button in the top-right-hand corner of the screen.

You can set up KYC templates to be automatically assigned to a specific manager by default. Check the “How to set default Manager for new KYC processes” article in section 4.1.

4.5 How To Check Cases Assigned to Me?

When in the Corporate or Individual Processes tabs, management users can quickly see the cases that are assigned to them in the "My Cases" tab, and determine which cases are ready for their review.

Checking The Risk Score:

When the application is submitted, and the risk score is calculated, managers can check the risk score details under the Overview section of the application by clicking the risk category: LOW, MEDIUM or HIGH:

Overriding The Risk Category:

Please note that you can override the risk category manually and also include an internal note:

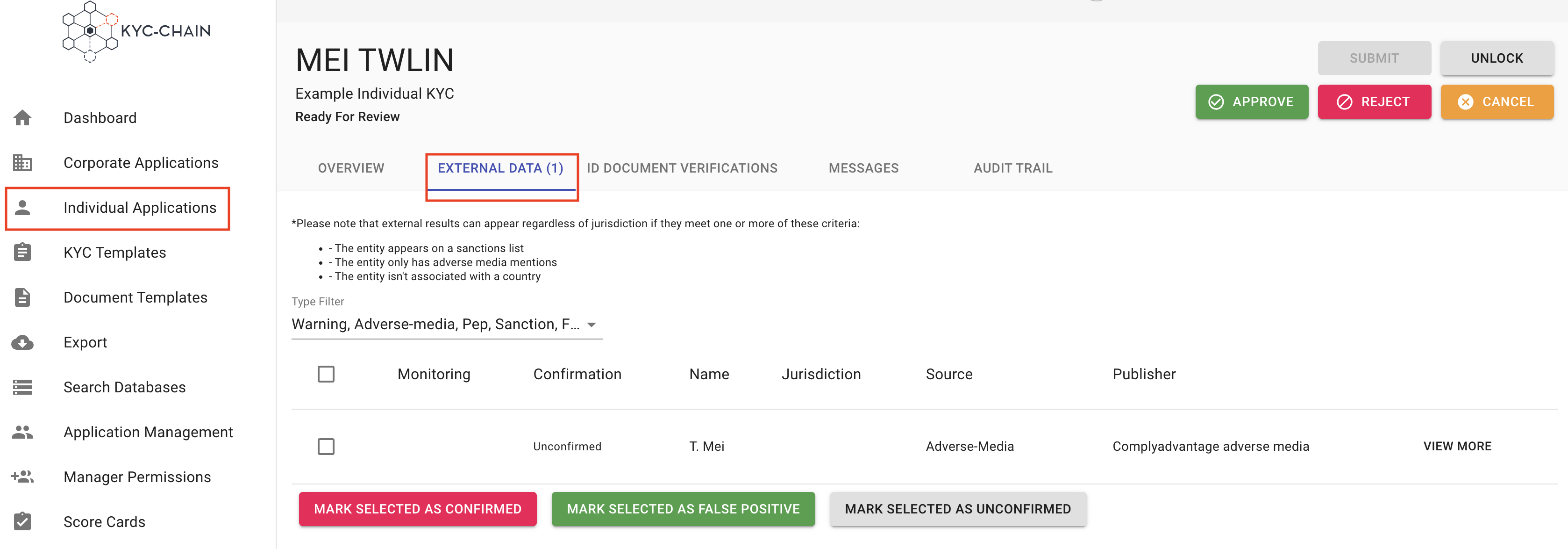

4.6 How To Check External Data Results

When reviewing a KYC process, one of the most important points is the External Data tab. The KYC-Chain app runs automatic sanctions checks on individuals and corporations. Our feature covers global and national sanctions lists: OFAC, US BIS, CIA, FBI, EEAS, SECO, HMT, MOD, World Bank and more. Additionally, we provide Adverse Media and PEP checks. Ask your account manager to provide more details about KYC-Chain Advanced Sanctions Screening or contact us at help@kyc-chain.com.

Individual Processes: Managers can see positive matches of individuals who are prohibited from certain activities or industries in the External Data tab:

- Navigate to a KYC case you want to review.

- Open the External Data tab. The list of positive matches for this individual will show up. If no matches were found, the "No Results" message will appear.

- Confirm the positive match(es) by checking the box near it/them, scrolling to the bottom of the list and clicking the Confirm Selected Results button.

Managers can filter false positive matches by clicking the “View More” button and verifying the ‘Date of Birth’, ‘Country’ and other data fields.

Corporate Processes: Managers can see positive matches for the entity and its members that are prohibited from certain activities or industries in the External Data and Members tabs.

- Navigate to a KYC case you want to review.

- Open the External Data tab.

- Then open the Members tab and click on the Member you want to check.

- Scroll down to the end of the Member details to External Data.

- The list of positive matches will show up. If no matches were found, there will be a "No Results" message.

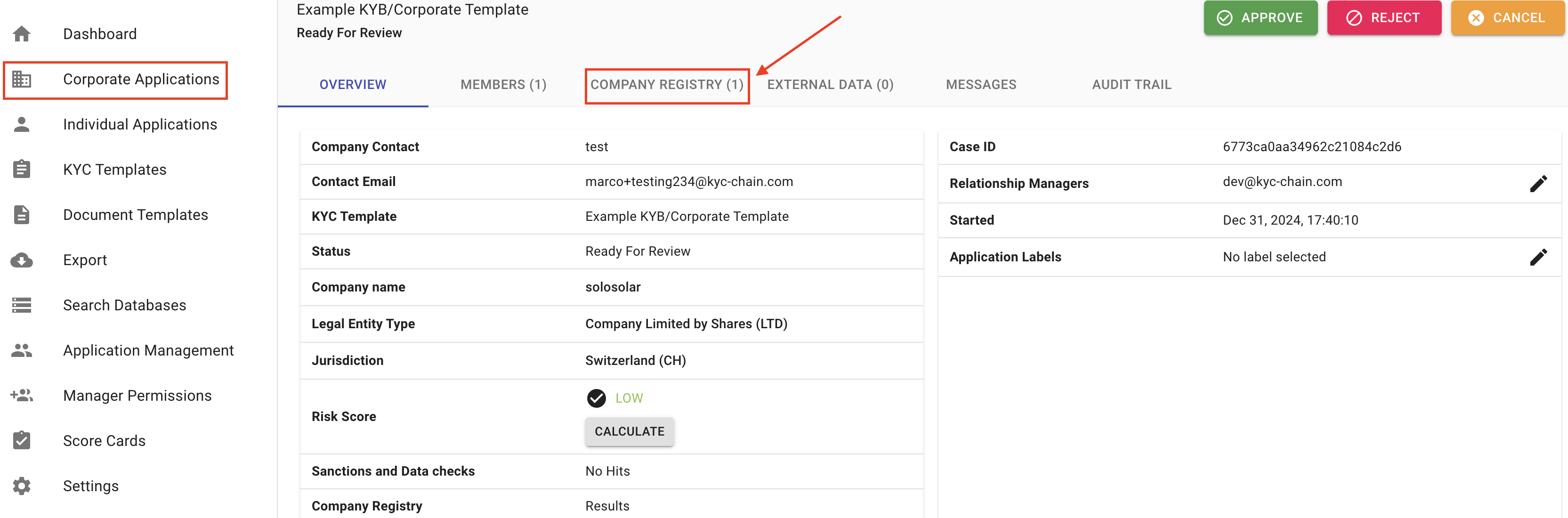

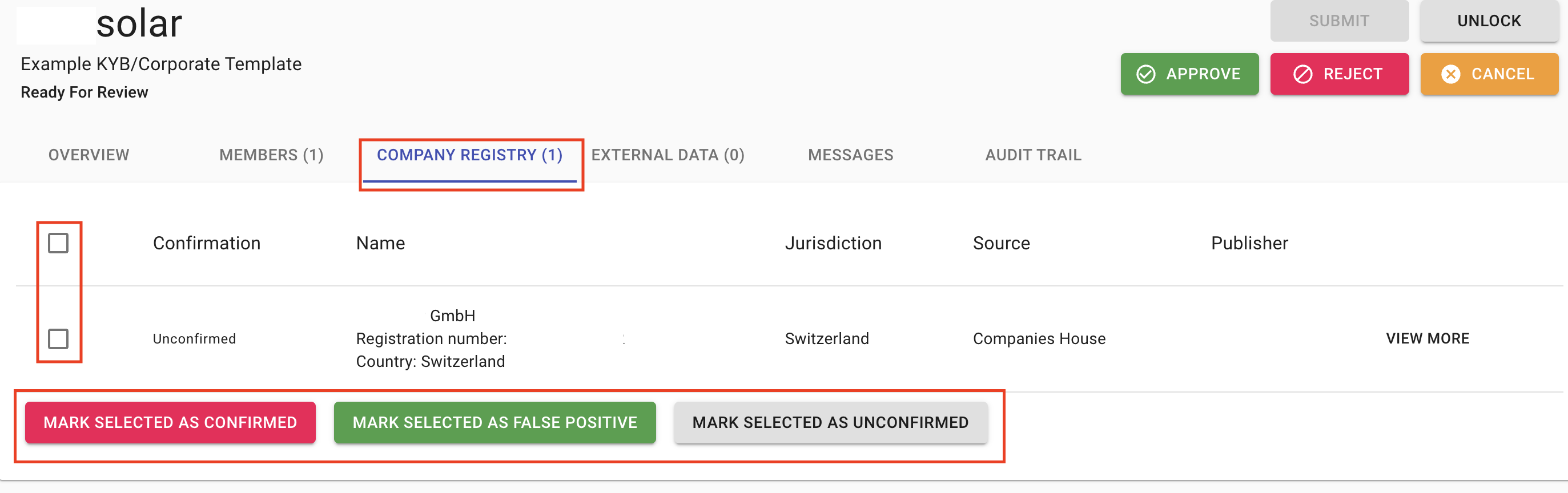

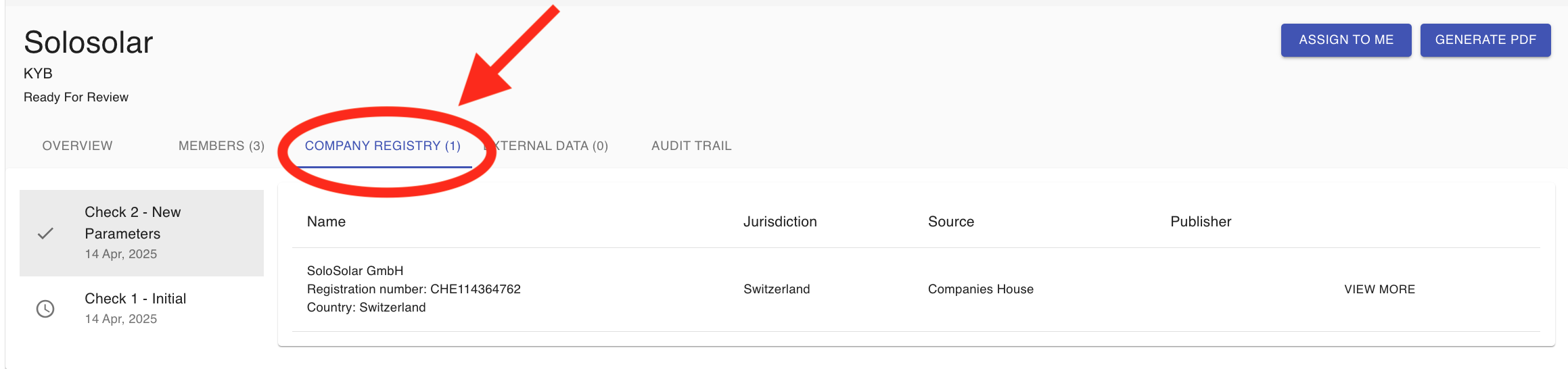

4.7 How To Check Company Registry Results?

Our system allows you to access business registration information from official and authoritative commercial register databases. Some of the data categories available are business registration number, address, incorporation date, activity status and list of directors and secretary. The data available depends on the jurisdictions. Ask your account manager to provide more details about the KYC-Chain company registry check or contact us at help@kyc-chain.com. As part of the Corporate Processes, management users can see company details in the Company Registry tab:

- Navigate to a KYC case you want to review.

- Open the Company Registry tab. The list will show the matching company profile. If we couldn't find the company or the jurisdiction is not supported, you will see a respective message.

- Confirm the company profile by checking the box on the left and scrolling to the bottom of the list and clicking the Confirm Selected Results button.

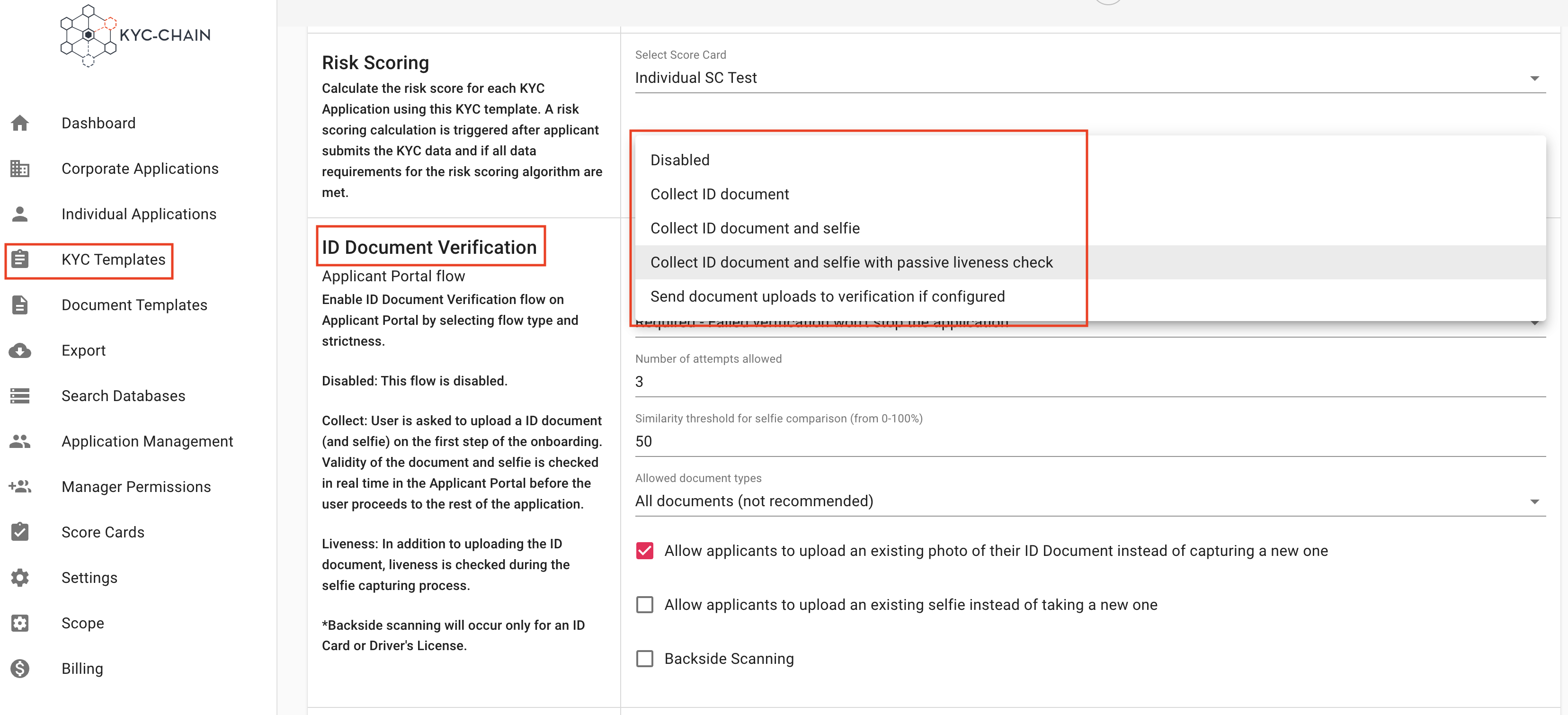

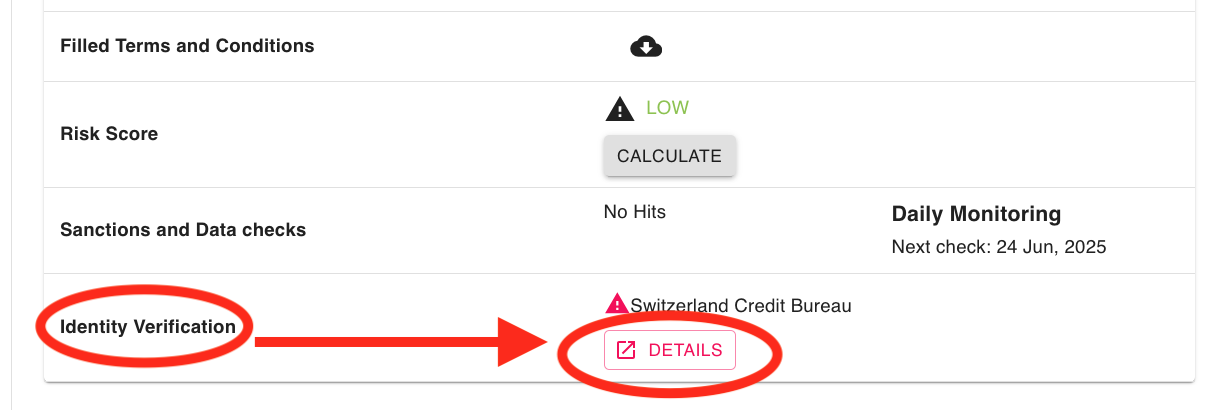

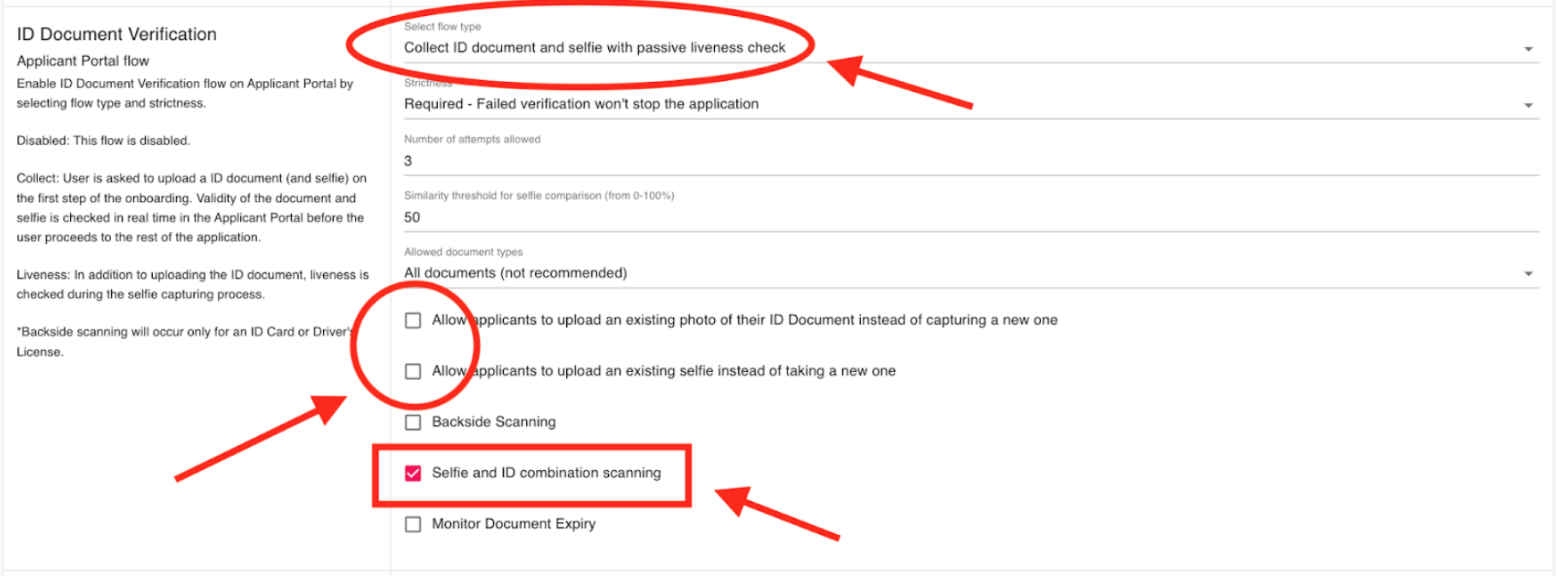

4.8 How To Enable ID Document and selfie verification with or without the LIVENESS check?

You can enable ID document and selfie verification with or without the liveness check.

ID document verification will check whether the uploaded (Passport, Driver License, National ID card or Foreigner card) is legitimate. The system will capture, extract, and analyze ID data in order to authenticate government-issued identity documents.

Selfie check is an identity verification method that will ask a user to take a photo of themselves that can then be used to compare against other photos, such as the photo on a government-issued ID, to confirm it's the same person.

Liveness check detects that there is a genuine presence on the other end of the device, and that they match the image in the presented ID document.

Strictness allows the manager to set level of strictness, there are 3 levels:

- Optional requirement - Applicant may choose to skip ID document and selfie verification.

- Required - Failed verification won't stop the application

- Strict requirement - Failed verification will stop the application

Number of attempts allowed can also adjust the number of tries allowed to successfully capture the client document (and selfie) using the device camera.

Similarity Threshold for selfie comparison (from 0-100%) will set the minimum comparison threshold by which the system will reject or accept the selfie when compared to the original ID document (50% is the standard).

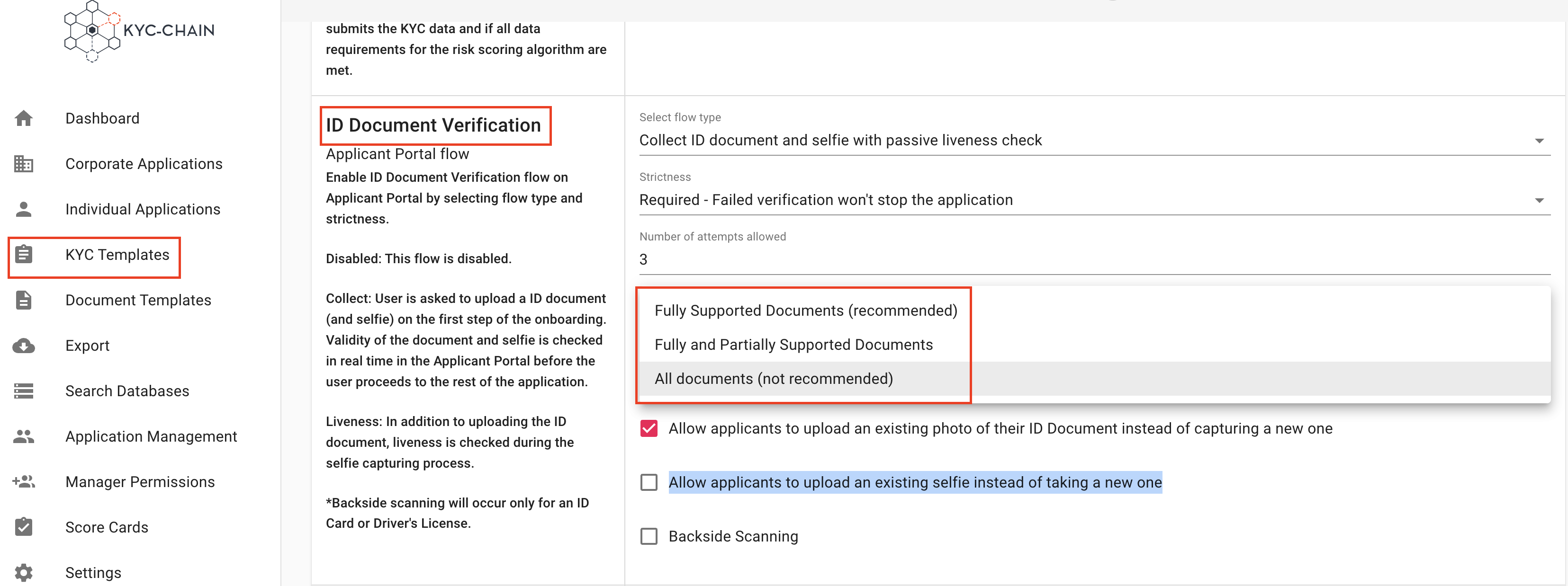

Allow Document Types determines which types of documents and jurisdictions/geographic areas are allowable as official identification.

- Fully Supported Documents (Recommended) - The system will only accept ID documents that it can fully verify.

- Fully and Partially Supported Documents - The system will also allow for some document types that it can partially analyze and verify.

- All Documents (Not Recommended) - The system will accept any ID document as ID verification, even those that the system is unable to fully verify for authenticity.

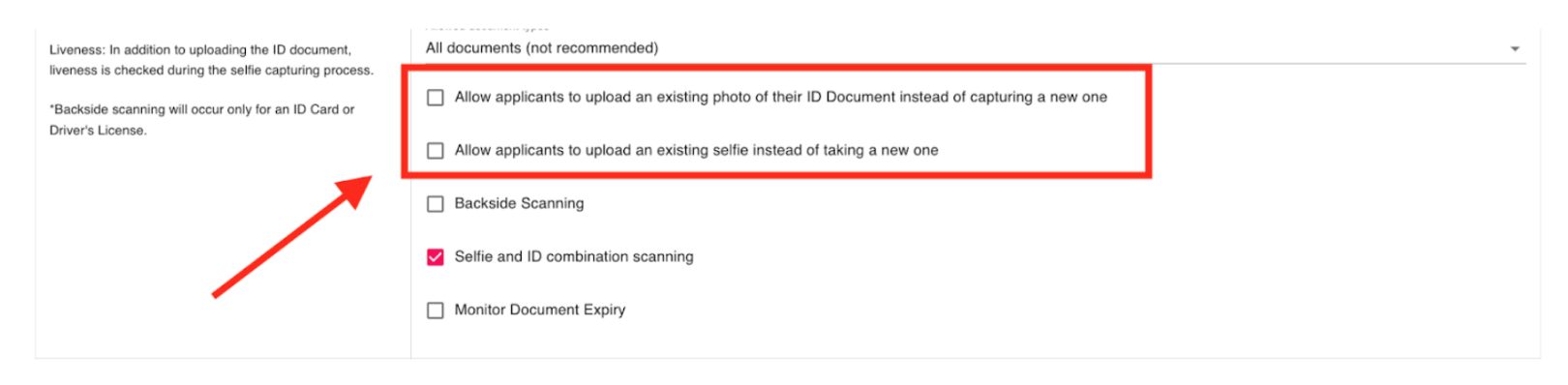

Options:

- Allow applicants to upload an existing photo of their ID Document instead of capturing a new one

- Allow applicants to upload an existing selfie instead of taking a new one

- Allow Backside Scanning: The system will also scan the backside of the ID document (for National ID cards and Driver's Licenses)

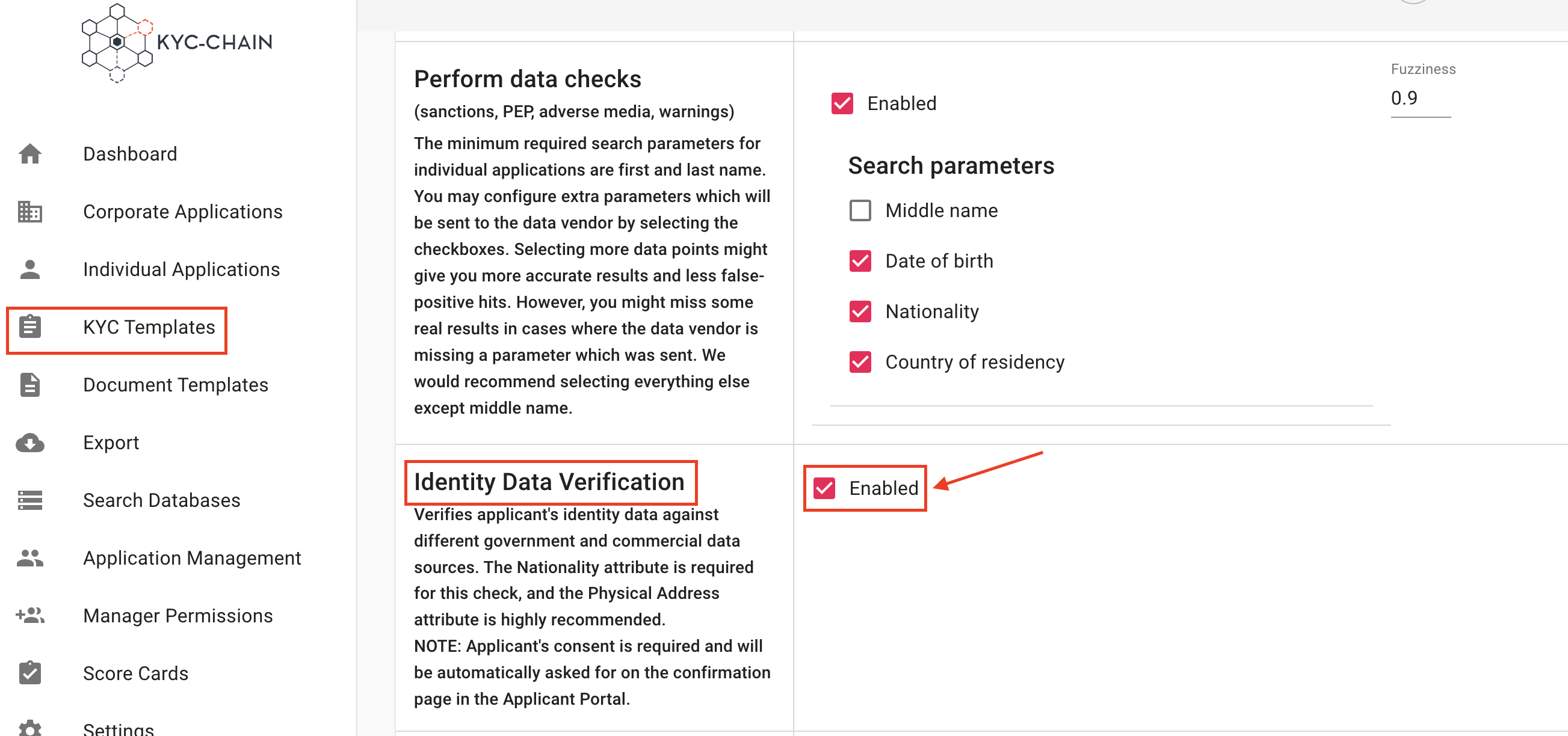

4.9 How To Enable ID Data Verification?

This feature verifies the applicant's identity data against different government and commercial data sources. The following attributes are required: first and last name and national id number. It is also recommended to include the physical address attribute:

- Go to: "KYC Templates"

- Select and Open Template

- Scroll to "Identity Data Verification", and click "enable"

- Save the template

4.10 How To Check ID Data Verification results?

The results will show if the provided name, date of birth and address exist in government databases. The system will also display a match score:

If not enough data was provided, or if the data was not formatted correctly and could not be verified, an error message will explain this to the manager. The data can then be modified, and a new check will be triggered if/when the application is re-submitted.

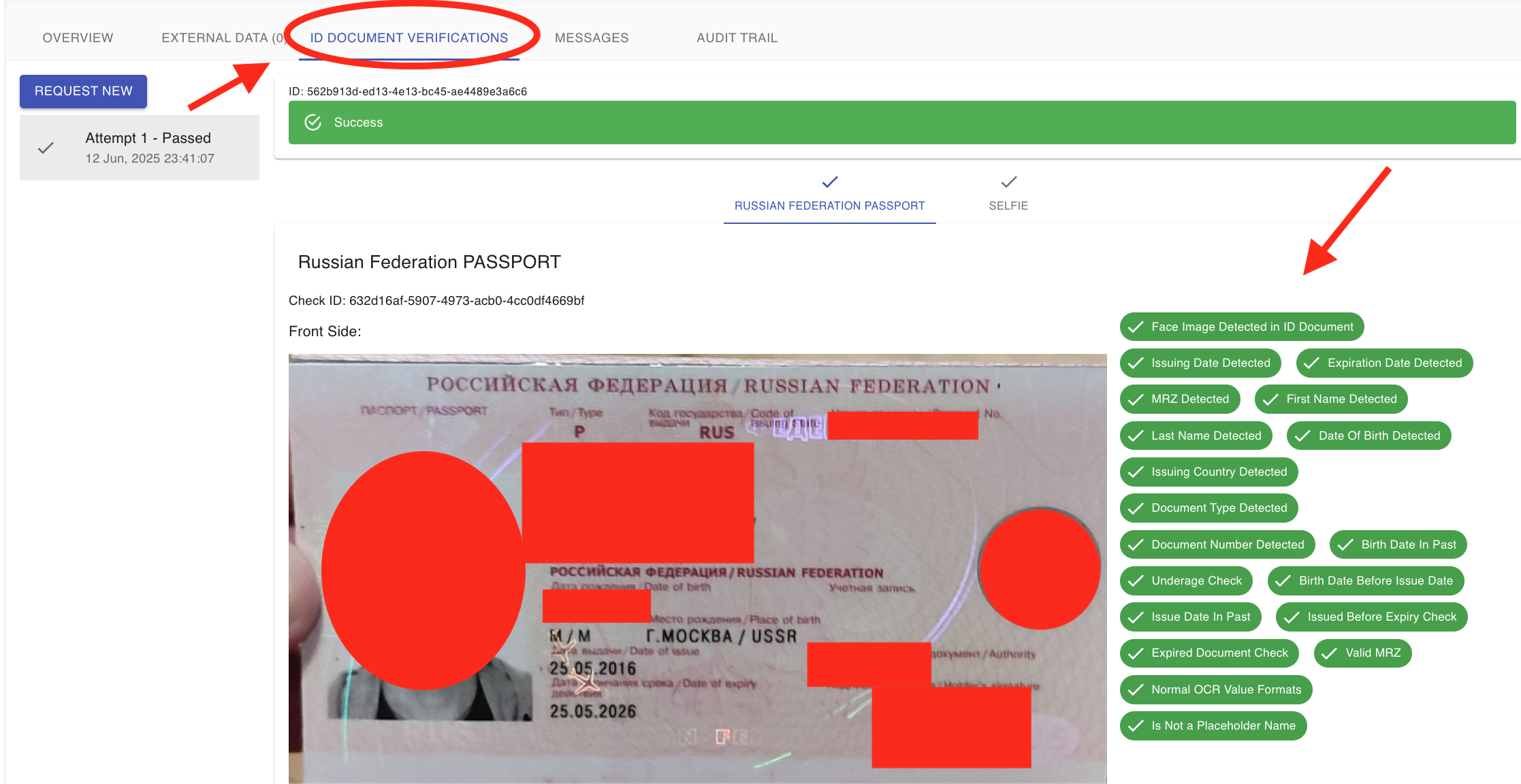

4.11 How To Check ID Document Verification Results?

Management Users can see a validation check of facial biometrics between ID document and photo, as well as extracted data from the document in the ID Document Verification tab.

- Select the Individual Processes tab on the left side menu

- Navigate to a KYC case you want to review

- Open the ID Document Verification tab

If ID document verification or selfie check failed, you can request upload again (screenshot) or the system can request upload again automatically if on the risk scoring card it is set to "Request".

Taking the perfect photo: If you or an applicant of yours is taking a photo of your ID with your smartphone, try to follow these simple tips:

- Capture the entire document, partial images will not be enough.

- Ensure that the entire image is in focus, using a 5+ megapixel mobile camera is ideal.

- Only your ID should be in the image, remove any background clutter.

- Do your best to avoid glare from your flash or lighting.

- Avoid glares, shadows or using flash.

- Ensure capture the data page only, as any other sides or pages will not be used.

4.12 How To Check The Audit Trail?

The Audit Trail allows managers to view the full status history of an application along with various metaData such as:

- The status of the application.

- The applicant's IP address, Country, City, Browser, and OS.

- Any notes associated with a status.

- Any changes to a specific requirement value, such as the old and new value.

4.13 How To enable wallet screening in the KYC process?

To enable blockchain wallet screening in your KYC process:

- Navigate to the KYC Templates section of the dashboard and select Add Question.

- In the "Add Requirement" dialog: Set the Requirement Type to Question. Choose Blockchain address as the Question Type.

- Select the relevant blockchain (e.g., Bitcoin (BTC)) from the dropdown menu. Save the configuration and ensure it is included in the KYC flow.

When the user submits a blockchain wallet address, the system will validate and screen it against leading blockchain analytics databases to identify potential risks. A comprehensive report will be generated, highlighting any red flags associated with the wallet.

4.13.1 How To Check Crypto Wallet Screening Results?

Our system is able to screen crypto wallet addresses. Management Users can easily review screening results for Bitcoin, Ethereum and Dash wallet addresses and review the following details in the WalletScreening tab:

- Risk score

- Balance

- Records of crime and fraud offenses: money laundering, bribery and corruption, financing of terrorism, and sanctions.

- Navigate to a KYC case you want to review

- Open the Wallet Screening tab

- Check the box next to the address(es) you would like to see a report for, and then click the button to generate either a standard or an enhanced report.

Managers can download the full report as a PDF file by clicking the “Download Report as PDF” button and requesting to generate an updated report by clicking the "Refresh" button.

4.13.2 How To Run a quick wallet check without initiating a KYC process?

- Click Wallet Screening in the left sidebar menu

- Complete the required fields:

- Select "Blockchain" from dropdown

- Enter "Wallet Address"

- Choose "Report Type" (Standard or Enhanced)

- Click SUBMIT SCREENING REQUEST button

That's it! Your wallet screening will be processed according to your selected report type. You can view the results and download the wallet report in the Wallet Screenings section.

4.14 How To Help Applicants during KYC process?

Managers can exchange messages to help applicants during the KYC process using the MESSAGE box. Please note that this will only work as long as manager is logged into the management app and applicant is on their application.

4.15 How To Request Additional Documents or Questions?

Management Users can request additional documents / questions from a user at any point during the KYC application process. This allows for a quick email communication with the user through the KYC-Chain interface. Management Users can add a customized External Note which users will see when they receive the email notification to add additional documents / questions.

- Navigate to a KYC case you want to review.

- Scroll down to the "Documents" or "Questions" section and click on the Request Additional Documents or Request Additional Questions button.

- In the pop-up window that opens, enter the necessary details and click the Save button. Add an External Note which will be included in the email notification to the user.

- The email will be sent to the user asking them to provide the additional details you have requested.

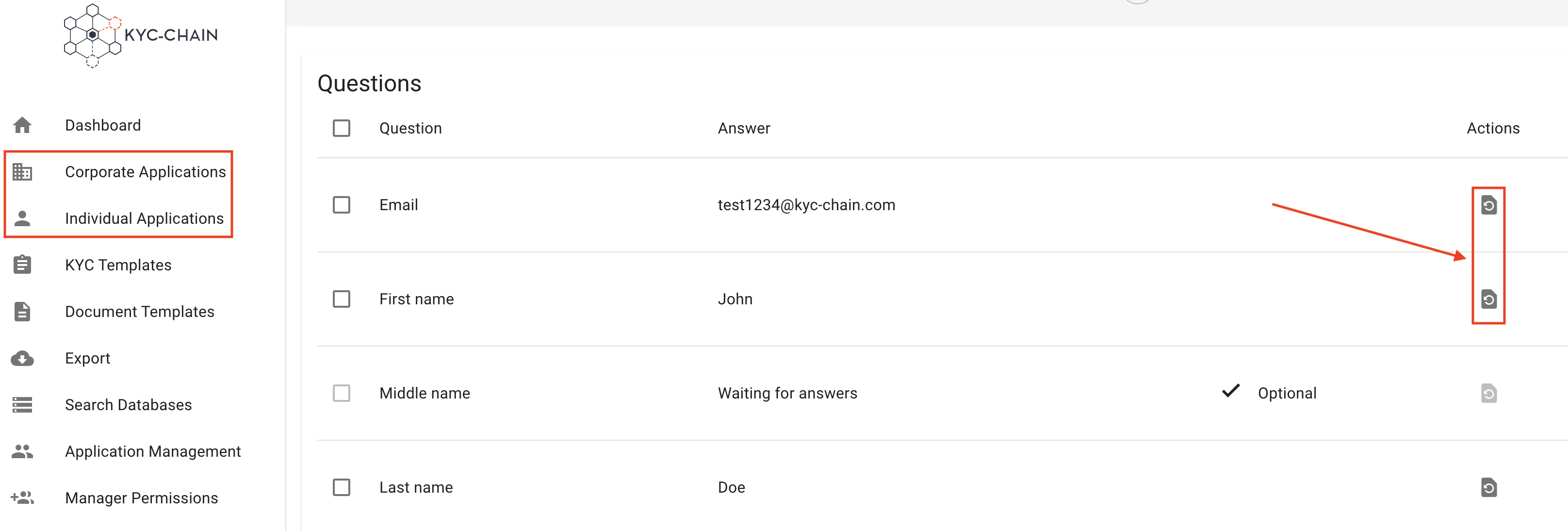

4.16 Request to Re-upload Documents or Answer questions?

Management Users can request a reupload of documents / questions from a user at any point during the KYC application process. This allows for a quick email communication with the user through the KYC-Chain interface.

- Navigate to a KYC case you want to review.

- Scroll down to the "Documents" or "Questions" section.

- Click on the Request Upload Again button (refresh icon on the right side of the screen). If you need to make multiple requests, check the box near the documents/questions, and then click on the "Request Re-upload/answer for (X)" button.

- The email will be sent to the user asking them to re-upload the details you requested.

4.17: Scope Settings:

This section allows app administrators to configure and customize portal settings efficiently. It provides essential options for branding, authentication, integration, and formatting. Administrators can ensure the system aligns with their organization's requirements while maintaining a professional and user-friendly interface for end users.

5: FAQs:

When is the applicant sent email communications by the KYC-Chain software? The applicant will only receive automated email notifications related to their KYC process after one of the following actions is taken:

- When the applicant is invited to start the KYC process

- When the applicant is requested to submit additional details

- When the applicant is requested to re-submit details

- When the KYC process is reviewed by a manager and is approved, rejected or canceled.

- When the applicant has started, but not submitted the KYC process, they will receive a reminder

Please note that if risk scoring is enabled and any Pre-Checks are set to "Request" then the system may automatically request a re-upload of this requirement without any direct input from the manager.

Where can product documentation be found? https://docs.kyc-chain.com/

What steps should be taken if a user cannot access expected features after a permission update?

If this occurs, please open a ticket and provide the user's email address along with the list of permissions that have been updated. This will allow us to investigate the issue on our end.

What are the options for maintaining an account during a temporary decrease or halt in KYC activity?

Please send an email to help@kyc-chain.com and include your project name. Our team will get back to you as soon as possible.

Can customer support modify KYC template settings on my behalf?

Yes, our customer support team can assist you with modifying your KYC template settings. Simply send a request with your project name to help@kyc-chain.com, and our team will be happy to help.

Can the system be deployed on both cloud and physical servers?

KYC-Chain is offered as a managed SaaS (Software as a Service) solution and is deployed on the cloud servers.

Where can I find documentation, demo videos, or a demo environment for the system?

You can consult our application documentation via the following link: https://docs.kyc-chain.com/

Why are applications not appearing on the main dashboard view, and where can all open applications be found?

Applications may not appear due to:

Misconfigured filters – The "All cases" filter may exclude in-progress applications, or "Review Status" filters hide open cases.

How can I view all open applications in the system? All open applications can be easily filtered and viewed directly from the dashboard:

-

Using the Status Filters

- Locate the "Review Status" column in the KYC Applications table

- Filter for:

- "Ready for Review"

- "In Progress"

- "Open"

-

Quick Access via Sidebar

- Go to: Individual KYC or Corporate KYB Processes → Use the same status filters

The dashboard interface (as shown) is designed to let you quickly filter and access all open applications with just a few clicks. If applications still don't appear, check that no other filters (like Labels or Risk Category) are accidentally hiding them.

What is the optimal process for coordinating a system reset and switch-over to production?

"Key Considerations and Steps for Moving from Test to Production in KYC-Chain:

Key Considerations:

- Data Isolation: Keep test and real applicant data completely separate.

- Configuration Review: Double-check all production settings, KYC templates, integrations, and notifications.

- Integration Updates: Use production API keys and endpoints for all external services.

- User Access: Grant live system access only to authorized personnel.

- Compliance: Ensure all regulatory and data retention settings are correct.

Steps to Go Live:

- Request Production Access: Switching to live mode requires action from the support team. Contact support to enable live mode for your instance.

- Finalize Settings: Confirm all templates, branding, and user permissions are set up as needed for production.

- Update Integrations: Swap test credentials for live ones and update webhooks.

- Test in Production: Run a few internal test applications to confirm workflows.

- Go Live: Invite real applicants and monitor for any issues.

It is also recommended to document differences between test and production setups for your team.

What automatic screenings are performed for companies and their members upon application submission?

Upon application submission, the system automatically performs sanctions checks, adverse media checks, and PEP (Politically Exposed Persons) checks for companies. It also accesses business registration information from official company registry databases.

For members of corporations (such as directors, UBOs, and shareholders), the system automatically runs sanctions screening, adverse media checks, and PEP checks. If configured, ID document verification, ID data verification, selfie checks, including a passive liveness check, are also triggered.

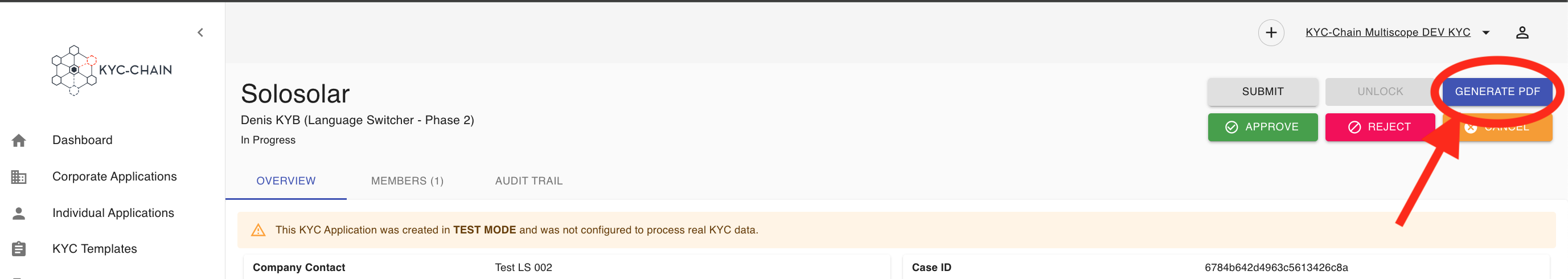

What are the available methods for accessing or printing reports?

To generate a comprehensive PDF report of all screening results:

-

Navigate to your management portal.

-

Click the Generate Report button in the top-right corner.

Note: If the button is unavailable, please contact our Help Desk for assistance.

Are there charges for CA reports or search certificates?

No, CA search certificates are free and available for download upon request.

Can the minimum password length requirement for user accounts be customized?

No, password length requirement cannot be customized.

How does the risk score icon provide information on application issues?

To view detailed information about application issues, click the warning icon ⚠️ for error notifications:

Under what circumstances are automated checks charged?

Automated KYC/AML checks incur charges in these scenarios:

-

Submission Triggers

- Fees apply immediately upon: ✓ Initial application submission ✓ Re-submission after edits

-

Check Types

- Identity Verification (e.g., document authenticity, biometric matching)

- Sanctions/PEP Screening (global watchlist checks)

- Wallet Checks (blochain walet screening)

- Company checks (company registry check)

-

Cost Controls

- Disable auto-processing to: ▶ Manually review applications pre-submission

- View real-time estimates in Billing Dashboard

Example: A failed ID check requiring re-upload = 1 additional charge.

Why are face match verifications failing?

Face match verification compares the applicant's live selfie with the photo in their passport/ID document and fails when:

-

Low Similarity Score

- The system detects insufficient facial match between the selfie and the ID photo.

-

Unprocessable ID Photo

- The passport/ID photo is: • Blurry, low-resolution, or obscured • Affected by glare, shadows, or poor lighting • Digitally altered or damaged

For successful face matching:

| Selfie Tips | Passport/ID Photo Tips |

|---|---|

| • Face centered with neutral expression | • Ensure the ID photo is fully visible |

| • Even lighting without shadows | • Avoid reflections on the photo area |

| • No hats/masks/obscuring objects | • Capture the data page flat and in focus |

Does exiting or refreshing the page remove an application from the risk score calculation queue?

No. Exiting or refreshing the page does not remove an application from the risk calculation queue because risk scoring is only triggered upon formal submission of a completed application.

Key details:

-

Draft applications

- Incomplete applications (not submitted) are saved but never enter the risk scoring queue.

- Refreshing/exiting preserves draft data based on your session settings, but does not trigger processing.

-

Submitted applications

- Once fully submitted with all required information, risk scoring is initiated immediately.

- This process is server-side and irreversible – page actions won’t affect already-queued submissions.

-

System integrity

- Risk scoring depends on locked, post-submission data snapshots.

- Partial/interim data is never scored to ensure accuracy and compliance.

Example: If you refresh during form entry, your application remains saved. Only after clicking "Submit" would the system queue it for scoring – and that queue persists regardless of browser activity.

What is the timeline for the platform's full launch or feature availability?

Thank you for your question. In order to provide an accurate response, could you please specify which platform or feature you are referring to? Once we have more details, we will be happy to share the relevant timeline or update.

Can a shared email address be used for account management or notifications?

Yes, shared email address can be used for accessing the account or receiving notifications.

Where can I find information about API integration and its technical requirements?

All API information and documentation is available at: https://apidocs.kyc-chain.com/#/

To obtain login credentials for accessing the API documentation, please submit a support ticket.

Is the platform compatible with cloud hosting platforms other than AWS, such as Digital Ocean?

No, our platform is compatible with AWS, Google Cloud and Minio.

Are additional credits required to generate a PDF wallet screening report?

Generating a PDF report does not incur additional credit charges. Please just be aware that Enhanced reports are priced slightly higher than Standard reports.

What should I do if document uploads are taking an unusually long time or appear unresponsive?

If your internet connection is stable and your upload speed is sufficient, please open a support ticket including your project name and any relevant details. This will help our team troubleshoot the issue effectively and provide prompt assistance.

How can I ensure that attachments or linked documents are properly displayed and accessible on the welcome page?

To ensure that links and documents are displayed correctly, run a quick test by inviting yourself to complete the KYC process. If anything appears incorrectly, you can edit the document template or open a support ticket for further assistance.

How can I access the public-facing portal?

The Customer/Applicant Portal is available at your unique instance URL: https://your-scope-name.app.kyc-chain.com

(Replace your-scope-name with your designated project identifier)

How do I configure a question as optional in a template?

"To configure a question as optional in a template:

- Go to the KYC Templates tab.

- Select the template you wish to edit and click the View & Modify button.